In this article, we'll discuss the 11 best income growth stocks to invest in. If you want to read more about such stocks, please go directly to: 5 Best Earnings Growth Stocks to Invest in.

Looking ahead to 2024, the outlook for the stock and bond markets will fluctuate regularly based on a myriad of factors, including the release of economic data, Federal Reserve Board communications, and changes in interest rate forecasts. Investors initially expected the Fed to cut rates multiple times this year, with the first expected to occur in March. However, given a series of positive economic indicators, the Fed indicated that a rate cut in March is unlikely. As a result, investors are recalibrating their valuations of stocks and bonds and are expecting fewer interest rate cuts to begin later than previously expected.

According to a report on economic growth from the Department of Commerce, it is clear that the economy is expected to grow by 3.1% year-on-year in the fourth quarter of 2023, supported by solid consumer spending in fields such as healthcare, food and beverages, and automobiles. Became. This strong performance and the possibility of future rate cuts strengthen market sentiment, with bulls expressing optimism and setting higher targets for the S&P 500 index. Katie Stockton, founder and managing partner of Fairlead Strategies, suggested that the S&P 500 index could reach 6,100 in the long term if it reaches new highs. Even though certain stocks are overbought, Stockton highlighted signs of market strength and suggested the beginning of a bull market.

In contrast, analysts with a long-term view expect the Federal Reserve to eventually start cutting rates. At the same time, solid earnings growth and economic resilience should push the S&P 500 index higher toward the end of 2024. Goldman Sachs recently revised its year-end target for the S&P 500 index to 5,200, up from its previous expectation of 5,100. Goldman Sachs' David Kostin expects strong performance within mega-cap stocks, particularly within the Magnificent Seven group, to play a key role in boosting S&P 500 profits in 2024. There is.

Considering the above situation, well-known companies such as Alphabet Inc. (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT), and Amazon.com, Inc. (NASDAQ:AMZN) remain top contenders as potential players. No wonder it continues. Income stocks to invest in, as seen by both analysts and investors.

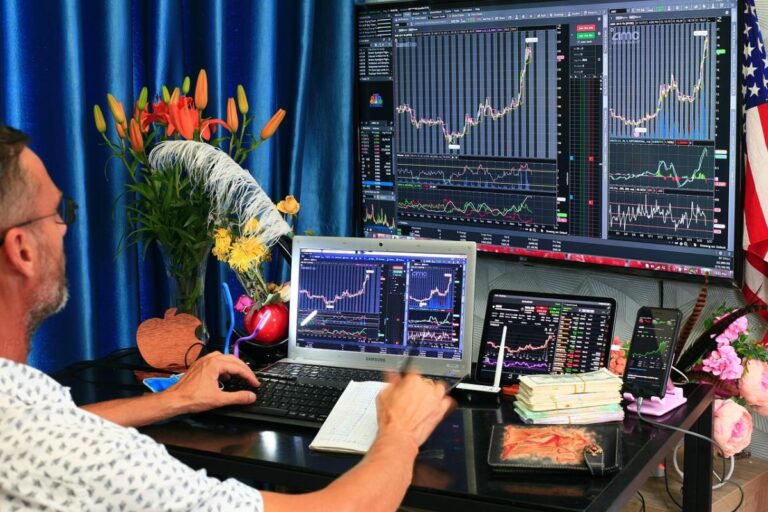

Source: Pixabay

our methodology

For this list, we utilized a stock screener to identify stable companies with earnings growth greater than 10%. Our methodology focuses on identifying the best revenue growth stocks while considering hedge fund sentiment as of Q4 2023. The list is ordered in ascending order based on the number of hedge fund holders. It's worth noting that hedge funds' consensus top 10 stocks have outperformed the S&P 500 index by more than 140 percentage points over the past decade (Please see here for the detail). Therefore, we place great importance on this often overlooked metric.

11. JPMorgan Chase & Co. (NYSE:JPM)

Number of hedge fund holders: 109

Quarterly revenue growth rate: 74.00%

JPMorgan Chase & Co. (NYSE:JPM) is a prominent American multinational financial services company headquartered in New York City and incorporated in Delaware, and the largest bank in the United States.

On December 12, JPMorgan Chase & Co. (NYSE:JPM) announced a quarterly dividend of $1.05 per share on outstanding common stock. The dividend was scheduled to be paid on January 31 to shareholders of record as of January 5, 2024.

A total of 109 hedge funds tracked by Insider Monkey had JPMorgan Chase & Co. (NYSE:JPM) stock in their portfolios heading into the final quarter of 2023. The biggest stakeholder in JPMorgan Chase & Co. (NYSE:JPM) was Ken Fisher's Fisher Assets. The management team owns $1.7 billion in stock in JPMorgan Chase & Co. (NYSE:JPM).

Madison Sustainable Equity Fund stated the following regarding JPMorgan Chase & Co. (NYSE:JPM) in its fourth quarter 2023 investor letter:

“We have updated our sustainability scorecard. JPMorgan Chase & Co. (NYSE:JPM). JPMorgan maintains average ratings on governance, social, and environmental factors. JPMorgan is using its business to fight climate change. JPMorgan aims to raise $2.5 trillion from 2021 to 2030 to advance long-term solutions to address climate change and sustainable development. The Board of Directors oversees corporate responsibility and ESG issues, but ESG and sustainability are addressed company-wide. JPM listens to shareholder opinions. Since the 31% vote in favor of executive compensation in 2022, the Board will not award special awards to Jamie Dimon and Daniel Pinto, and will not award special awards to other named executive officers in connection with such awards. direct performance conditions will be imposed. The compensation committee limited the percentage of Dimon and Pinto's compensation that was cash. ”

Along with Alphabet Inc. (NASDAQ:GOOG), Microsoft Inc. (NASDAQ:MSFT), and Amazon.com Inc. (NASDAQ:AMZN), JPMorgan Chase & Co. (NYSE:JPM) is one of the best-earning stocks. operated as one. invest in

Ten. Adobe Inc. (NASDAQ:ADBE)

Number of hedge fund holders: 105

Quarterly revenue growth: 13.22%

Adobe Inc. (NASDAQ:ADBE), headquartered in California, is a versatile software company that offers a wide range of products and solutions that enable individuals, teams, and businesses to create, publish, and promote content. Known as a top choice for content creators, students, professionals, and consumers alike, Adobe Inc. (NASDAQ:ADBE) also operates a Digital Experiences division that provides customer experience management, implementation, and revenue. We provide services to brands and companies in the field of development.

On December 13, Adobe, Inc. (NASDAQ:ADBE) reported fourth-quarter non-GAAP EPS of $4.27 and revenue of $5.05 billion, beating Wall Street expectations of $0.13 and $30 million, respectively. It exceeded the dollar amount. This strong performance confirms Adobe's continued strength in the market. Additionally, the company demonstrated confidence in its future by repurchasing approximately 1.8 million shares during the quarter.

Insider Monkey researched 933 hedge fund holdings in the December quarter of last year and found 105 Adobe Inc. (NASDAQ:ADBE) shareholders. Ken Fisher's Fisher Asset Management became the company's biggest investor with a $2.7 billion stake.

9. UnitedHealth Group Incorporated (NYSE:UNH)

Number of hedge fund holders: 113

Quarterly revenue growth rate: 14.06%

UnitedHealth Group Incorporated (NYSE:UNH), headquartered in Minnetonka, Minnesota, is a leading American multinational corporation operating as a for-profit corporation specializing in managed health care and insurance services. The company consists of four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. Recognized as one of the best earnings growth stocks to buy, United Health Group Incorporated (NYSE: UNH) offers a quarterly dividend of $1.88 per share as of February 16th. Masu.

UnitedHealth Group Incorporated (NYSE:UNH) saw a significant increase in hedge fund interest, with the number of hedge fund positions increasing to 113 by the end of the quarter. This represents an increase from 104 positions in the previous quarter. The consolidated value of these shares is more than $11.1 billion.

8. Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of hedge fund holders: 120

Quarterly revenue growth: 10.16%

Advanced Micro Devices, Inc. (NASDAQ:AMD), based in Santa Clara, California, is a global semiconductor company specializing in the development of computer processors and related technologies, serving both business and consumer markets. is.

On February 1, Citi analyst Christopher Daenley highlighted an upward revision to Advanced Micro Devices' (NASDAQ:AMD) artificial intelligence revenue guidance. The company expects sales for this fiscal year to be $3.5 billion, a significant increase from its previous forecast of $2 billion. Citi suggested that AMD may be intentionally underestimating the company, and the CEO expressed confidence in surpassing this year's $3.5 billion figure.

Of the 933 hedge funds surveyed by Insider Monkey, 120 had invested in the company by the end of the fourth quarter of 2023. Advanced Micro Devices, Inc. (NASDAQ: AMD)'s largest hedge fund shareholder is Ken Fisher's Fisher Asset Management with his 28 million shares worth $4.1 billion.

7. Uber Technologies, Inc. (NYSE:UBER)

Number of hedge fund holders: 129

Quarterly revenue growth: 15.44%

Uber Technologies, Inc. (NYSE:UBER), headquartered in San Francisco, California, operates a technology platform that connects consumers with independent ride-hailing service providers and offers a variety of transportation options, including public transit, bicycles, and scooters. It offers. In addition, Uber offers on-demand food delivery, freight services, business fleet solutions, and same-day delivery options, serving more than 142 million monthly active platform consumers in 70 countries.

In the fourth quarter of 2023, Uber Technologies (NYSE:UBER) saw gross bookings reach $37.6 billion, an impressive 22% year-over-year increase, and rides rose 24% year-over-year to 2.6 billion. reported that it has been reached. , which averages about 28 million rides per day. On February 7, Uber Technologies, Inc. (NYSE:UBER) announced fourth-quarter GAAP EPS of $0.66 and revenue of $9.9 billion, beating Wall Street's expectations of $0.49 and $140 million, respectively. It exceeded the dollar amount.

129 of the 933 hedge funds in Insider Monkey's Q4 2023 database bought and owned shares in the company. The largest hedge fund shareholder in Uber Technologies, Inc. (NYSE:UBER) is DE Shaw with his $886 million investment.

6. Salesforce, Inc. (NYSE:CRM)

Number of hedge fund holders: 131

Quarterly revenue growth: 11.27%

Salesforce, Inc. (NYSE:CRM) is a prominent American cloud-based software company specializing in customer relationship management. Salesforce, Inc. (NYSE:CRM) provides a suite of customized software and applications covering sales, customer service, marketing automation, e-commerce, analytics and application development to meet diverse business needs.

On January 30, BofA named Salesforce, Inc. (NYSE:CRM) one of its 2024 Top Picks. Analyst Brad Sills highlighted Salesforce's strategic positioning to further increase market share in a cumulative $200 billion market. In particular, Sills boasts a strong moat stemming from his 15% market share and a broad installed base of more than 150,000 customers in his core sales/front office categories. Emphasized competitive advantage.

At the end of the fourth quarter of 2023, 131 hedge funds tracked by Insider Monkey held shares in Salesforce, Inc. (NYSE:CRM), up from 122 at the previous quarter. This shows that hedge fund sentiment towards Salesforce, Inc. (NYSE:CRM) is surging.

Salesforce Inc. (NYSE:CRM) joins Alphabet Inc. (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT), and Amazon.com, Inc. (NASDAQ:AMZN) as one of the best income stocks to invest in. I can list it.

Click to continue reading 5 Best Earnings Growth Stocks to Invest in.

Recommended articles:

Disclosure. none. 11 Best income growth stocks to invest in Originally published on Insider Monkey.