In reality, Charlie was the current “architect” of Berkshire, and I served as the “general contractor” who carried out the day-to-day construction of his vision. – Warren Buffett

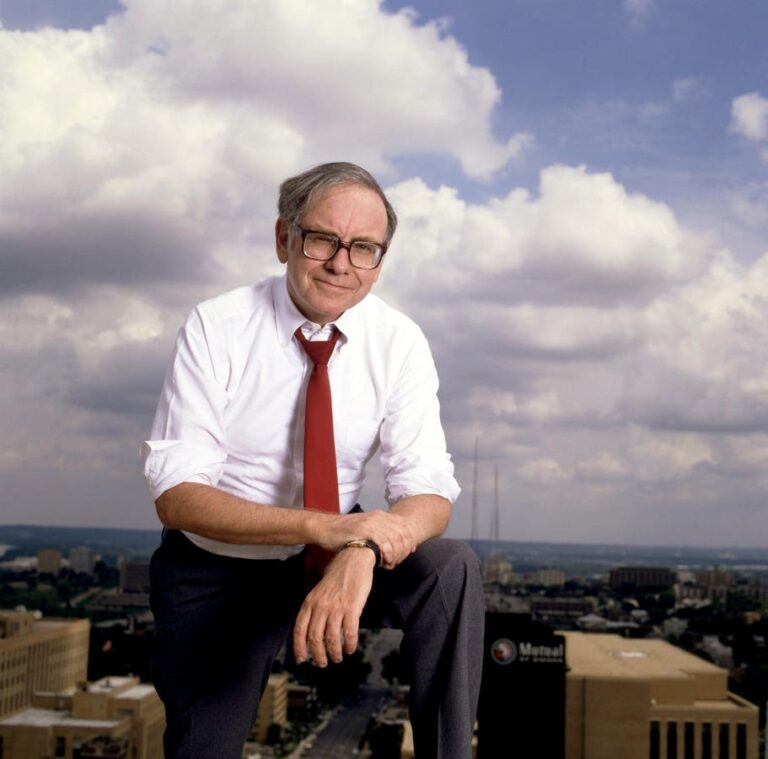

Warren Buffett, CEO and Chairman of Berkshire Hathaway, has a talent for explaining complex topics in an easy-to-understand format, and he always includes great insights in his annual letters. Charlie Munger, who served as vice chairman until his death, just before his 100th birthday in late November 2023, opened his letter with a moving tribute. Their partnership in running Berkshire produced arguably the most remarkable long-term performance ever recorded for investors. Since Berkshire began operations in 1965, its stock price has risen at an annual rate of 19.8%. The S&P 500's annualized return over the same period was 10.2%. Even over a shorter period of time, Berkshire has significantly outperformed his S&P 500. As a rough indicator of growth in a company's intrinsic value, book value growth has also far outpaced his S&P 500 growth rate.

Berkshire Hathaway's performance

Glenview Trust, Bloomberg

There are countless lessons that can be learned from Buffett's letters, but this article summarizes his annual letters into three timeless insights.

Lesson 1: Focus on what matters and evaluate your business.

In the short term, the market acts as a voting machine. In the long run, it will weigh you down. – Benjamin Graham

Berkshire Hathaway reported significant losses in 2022 as its stock price plummeted due to accounting rules that force it to record gains and losses on its investment portfolio as part of earnings. In 2023, the opposite happened as the stock market soared and his reported earnings per share also rose. Operating income per share, which removes distortions from short-term market changes and better reflects the company's earning power, increased by 23% in 2023 compared to 2022. Over the long term, the investment results from Berkshire's large portfolio of publicly traded stocks are significant. Still, it would be unwise to base Berkshire's valuation on short-term, volatile stock returns.

Berkshire Hathaway's earnings

Glenview Trust, Berkshire Hathaway

Buffett's mentor, Benjamin Graham, taught him a lot about value investing, but one important truth is to analyze stocks as a business and not react to short-term fluctuations in stock prices. is. With Munger's help, Buffett evolved from Graham's specialty of “buying fair companies at great prices” to “buying fair companies at fair prices.”

Despite the evolution, Chapters 8 and 20 of Benjamin Graham's book The Intelligent Investor remain the cornerstone of Buffett's investment process. Mr. Graham believed that investors should view stock ownership as a “silent partner” in a private company, owning parts of various businesses. Therefore, stocks should be valued as part of a company's intrinsic value, rather than as constantly changing prices in the stock market. Investors should take advantage of the stock market's volatile view of companies rather than being told what to do. By valuing stocks as a business and buying them with a “margin of safety,” investors can ignore market fluctuations. For Graham, a “margin of safety” means buying below the “listed or appraised price” so that even if the analysis is wrong, the investment should still give you a reasonable return.

Lesson 2: Effective risk management is essential not only to avoid downside risk but also to achieve superior long-term returns.

One of Berkshire's investment rules has always remained the same. It's about never risking permanent loss of capital. Thanks to America's tailwinds and the power of compound interest, the arena in which we operate has been, and will continue to be, rewarding if we can make some good decisions and avoid some serious mistakes in our lifetimes. I can feel it. – Warren Buffett

In addition to their investment results, one of the things that sets Buffett and Munger apart is their ability to generate incredible returns over such a long period of time. Investment management is littered with shooting stars with outstanding track records, but sometimes falling apart in spectacular fashion. Risk management continues to be a hallmark of the Berkshire model. Berkshire has a Fort Knox balance sheet of more than $163 billion in cash and equivalents at the end of 2023, with a very low probability of catastrophe and the flexibility to take advantage of opportunities such as stock repurchases. It offers sex. Most of the company's cash pile is held as debt with the U.S. Treasury, so there is no risk of default. Berkshire has said it will not buy back stock if its cash levels fall below $30 billion.

Mr. Buffett says: “In most years, in fact in most decades, our vigilance is likely to prove to be an unnecessary action, akin to insuring a fortress-like building.” thought This level of vigilance leads to improved long-term profitability. Counterparties can trust Berkshire to complete agreed-upon transactions. This stance has allowed Berkshire to make some investments even during severe market stress, such as the global financial crisis. Berkshire's sheer size makes it nearly impossible to make “truly groundbreaking” acquisitions in normal times, but “the ability to quickly respond to market grabs with both significant capital and performance certainty.” ” May Occasionally offer large-scale opportunities. ”

Lesson 3: Capital allocation is Berkshire's secret weapon.

Berkshire can withstand unexpected economic conditions, but it doesn't deliberately put good money after bad. – warren buffett

Perhaps Berkshire Hathaway would not have become a household name without important capital allocation decisions early in Buffett's leadership. In the mid-1960s, Buffett took control of Berkshire Hathaway, a New England textile company that made suit linings. Instead of reinvesting in his substandard textile business, he invested the cash he earned from it in better businesses such as GEICO. The textile business was closed in 1985. Buffett credits Munger with persuading him to allocate to “great businesses” rather than investing or reinvesting in difficult, even low-cost businesses. As Buffett now says, “Time is the friend of great business and the enemy of mediocre business.”.”

Buffett can also avoid following the crowd, even though mania drives rational people into unwise investments. The early days of the Internet ushered in a technology bubble that drove both great companies and scammers to huge valuations, even though many companies had no hope of making a profit in a reasonable time. Stock prices soared, and tech stocks represented by the Nasdaq NDAQ 100 also rose spectacularly. Meanwhile, Berkshire's stock price fell because it lacked exposure to the next big thing.

As the years passed, the massacres became large-scale. Berkshire rose nearly 30%, the S&P 500 fell nearly 40%, and tech stocks accounted for only a fraction of their peak valuations. The Internet has truly changed the world, and some of the companies of the time, like Amazon.com (AMZN), have become our new blue-chip companies, but at the end of the day, valuations and profits matter. When the time was right, Buffett bought shares in Apple AAPL (AAPL). The stock has grown to be worth $174 billion, roughly 50% of Berkshire's publicly traded stock portfolio.

In a letter earlier this year, Buffett noted that another major capital allocation decision could be on the horizon. Berkshire has long operated a power utility in the West through Berkshire Hathaway Energy (BHE). These investments were a good fit for Berkshire because they allowed the company to invest large amounts of capital at attractive after-tax rates of return. Buffett said, “For more than a century, power companies have poured out huge sums of money to fund growth through state-by-state promises of fixed returns on equity, sometimes with small bonuses for superior performance.'' “We have procured the following,” he explains.

2023 earnings were very disappointing as BHE had set aside large amounts of cash to cover potential debt from the western bushfires. “Due to the regulatory environment in some states, there is a possibility that profitability will drop to zero or even bankruptcy,” and there are concerns that this unfavorable environment will spread to other states. Buffett will likely determine whether this mutually beneficial relationship between utility owners and regulators has reached its end before deciding to invest further in power infrastructure. The drama may take years to conclude, but an update should be provided at the annual meeting in May.

Warren Buffett is a great teacher and investing genius, so his annual letter never disappoints. Although none of the concepts he discussed are new, Mr. Buffett has reinforced the current state of investing and insights related to Berkshire Hathaway. His next big update will be in early May, when many of us will be making our annual pilgrimage to Omaha to attend the annual convention known as Woodstock for Capitalists. It will be.

follow me twitter Or LinkedIn. check out my website.

Disclosure: Glenview Trust owns Berkshire Hathaway and other stocks mentioned in this article within its recommended investment strategy. I'm a longtime Berkshire Hathaway shareholder and worked at Salomon Brothers when Warren Buffett became chairman and CEO.