Warren Buffett is considered one of the greatest investors of all time. Since 1965, he berkshire hathaway (NYSE: BRK.A)(NYSE: BRK.B) The investment company's value increased by an astonishing 4,384,748%.benchmark S&P500 The index rose just 31,223% over the same period.

Buffett's investment strategy is simple. He likes companies with steady growth, high profitability, and good management teams. He particularly likes companies that return money to shareholders through dividends and stock buybacks. This rigorous standard is why there are so few technology stocks in Berkshire's portfolio.

Over the past year, a group of companies known as the Magnificent Seven have captivated investors with their strong performance and massive valuations totaling $13.5 trillion. The seven stocks include:

-

apple (NASDAQ:AAPL)

-

Amazon (NASDAQ:AMZN)

-

Nvidia

-

microsoft

-

alphabet (Google's parent company)

-

meta platform

-

tesla

Although Berkshire owns only two of the stocks listed above, they represent 43.5% of the conglomerate's $372 billion publicly traded stock and securities portfolio.

1. Amazon: 0.5% of Berkshire's portfolio

Amazon, the world's largest e-commerce company, dominates the cloud computing industry with its Amazon Web Services (AWS) platform and is rapidly expanding its presence in both streaming and digital advertising. Berkshire bought Amazon stock in 2019, a small portion of the conglomerate's portfolio, but Buffett has expressed regret in the past for not buying more.

Investors are now firmly focused on artificial intelligence (AI), and Amazon is quickly becoming a leader in the space. As the largest cloud platform, AWS is well-positioned to distribute every layer of AI to thousands of companies around the world.

Amazon has developed its own data center chips called Trainium and Inferentia. This helps differentiate its AI infrastructure from many other operators that rely solely on Nvidia's graphics processing units (GPUs). The company has also created its own large-scale language models (LLMs) under the Titan program that developers can use to build their own AI applications.

Finally, AWS provides enterprises with several off-the-shelf AI applications. These include CodeWhisperer, which helps programmers write code faster, and Amazon Q, a virtual assistant powered by generative AI. Businesses can feed data into Q, at which point they can answer complex questions, create content, and help employees solve problems.

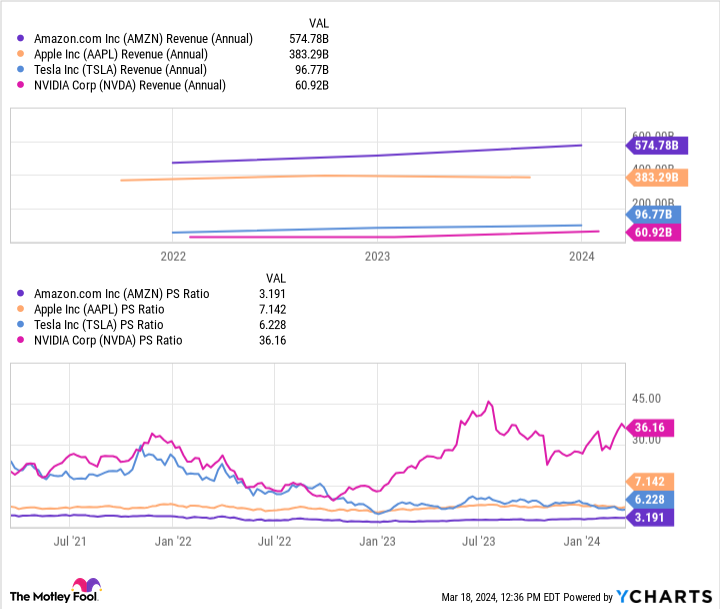

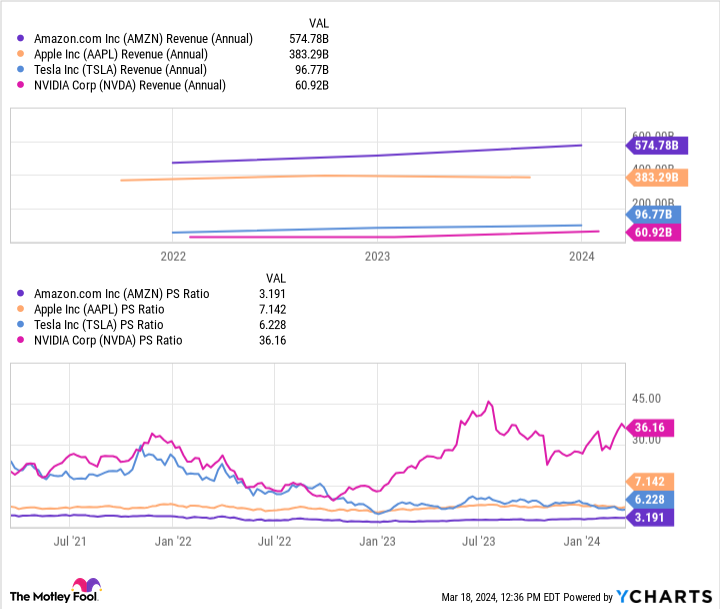

Amazon generated $574 billion in revenue in 2023.That's more than Apple, Nvidia, and Tesla. Combined During comparable reporting periods. But on a revenue basis, Amazon's stock is significantly cheaper than all three of his companies.

Amazon is a huge organization, so why have I focused primarily on AI? Even though e-commerce generated most of the company's value in the early days and still accounts for 41% of total revenue. , AI is likely to help Amazon close its valuation gap in the future thanks to the significant growth it can achieve.

Buffett may regret owning more Amazon stock, but Berkshire's position is worth $1.7 billion, which is still a significant amount.

2. Apple: 43% of Berkshire's portfolio

Apple makes some of the world's most popular consumer electronics, from iPhones to Mac computers. Berkshire began buying Apple stock in 2016 and has spent about $38 billion building its position since then. That's more than the conglomerate has invested in all but one stock.

Thanks to Apple's strong growth, Berkshire's position is now worth a whopping $160.2 billion, representing 43% of its $372 billion portfolio.

The iPhone is Apple's most successful product. This accounts for more than half of the company's total revenue and has led to multibillion-dollar derivative products such as the Apple Watch and AirPods. But with more than 2.2 billion iPhones currently in operation around the world, Apple is struggling to generate growth.Actual company total revenue shrunken The growth rate was high during fiscal year 2023 (ending September 30), and the recent first quarter of fiscal year 2024 (ending December 30) saw modest growth of 2.1% year over year.

However, Apple's services division remains bright. This includes services like Apple Pay, as well as subscription-based platforms like Apple Music, Apple News, and Apple TV. The Services segment delivered an 11.3% revenue increase in the first quarter, offsetting flat hardware sales.

Like Amazon, Apple is turning to AI to unlock its next phase of growth. The latest iPhone 15 Pro is equipped with the A17 Pro chip, which can efficiently handle AI workloads on the device. To leverage its computing power, Apple is developing its own LLM and AI applications in-house, but is also reportedly in talks with major developers such as OpenAI and Alphabet.

Advanced AI makes existing features like the Siri voice assistant much more capable and streamlines tasks like composing messages and emails. Additionally, virtual chatbots could reduce the time users spend searching the internet for information.

Given the iPhone's huge installed base, whichever AI platform Apple chooses, it could instantly become the most widely adopted platform in the world. I predict that companies like Alphabet will pay billions of dollars to have Apple use the Gemini AI model, similar to how they pay Apple to set Google as the default search engine on iPhones. do.

Buffett may have to be patient if AI is to reignite Apple's growth. But given that the company paid out $3.8 billion in dividends to shareholders in the most recent quarter alone and spent $20.1 billion on stock buybacks, he could be handsomely compensated while he waits. This means that

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool's board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool's board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool's board of directors. Anthony Di Pizio has no position in any stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

The article Warren Buffett's $372 billion portfolio has 43.5% invested in two 'Magnificent Seven' stocks was originally published by The Motley Fool.