Darren 415

This article was inspired by a discussion about our services about the value of priorities in income investing. Member suggested that, on the face of it, the income options are not particularly attractive.After all, unlike common stocks, preferred stocks Benefit your business. And compared to other options such as high-yield bonds and bank loans, senior debt trades at lower yields for the sector despite its lower capital structure.

So should investors avoid preferred assets and stick to other income-producing assets? As we explain in this article, our answer is a resounding “no.” Preferreds are a very attractive income asset class and much of the criticism is misplaced.

Upside and yield optics

Let's address two criticisms first.The fact that preferred stocks don't have the same upside as stocks is neither here nor there – no one considers preferred stock to be a share in a business (with the rare exception of so-called participating preferred stock, which is not available to individual investors).

Preferred stock replaces dividends and good news about the business ahead of bankruptcy than common stock – that's literally true. No one can abuse bonds because they are not a share of the business either.

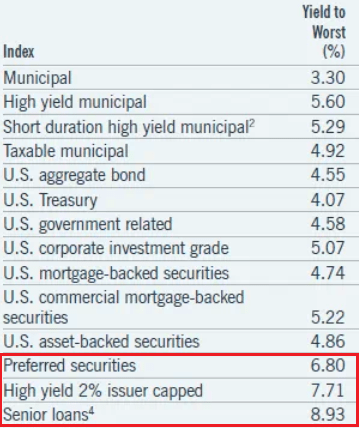

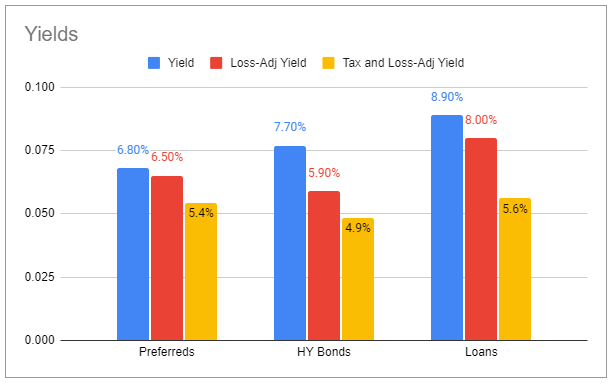

As long as the preferred yield is lower than the yield on the HY bond or loan, that is true overall, as the following table shows.

Nuveen

However, I don't know where to start here. In a big-picture sense, senior bonds are a higher quality asset class than his HY bonds and loans, which explains their lower total yields. The overall preferred stock market is dominated by blue-chip financial issuers such as banks and insurance companies, and as a result, the average preferred stock is barely investment grade.

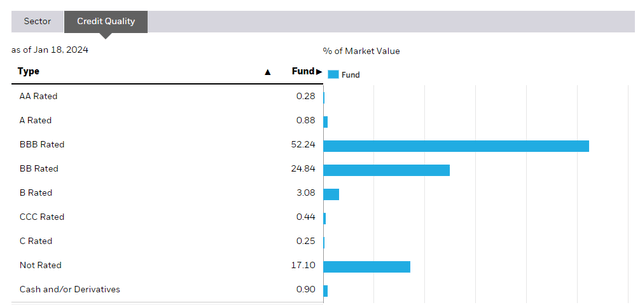

This can be seen in the credit breakdown of the largest preferred ETF, PFF.

state street

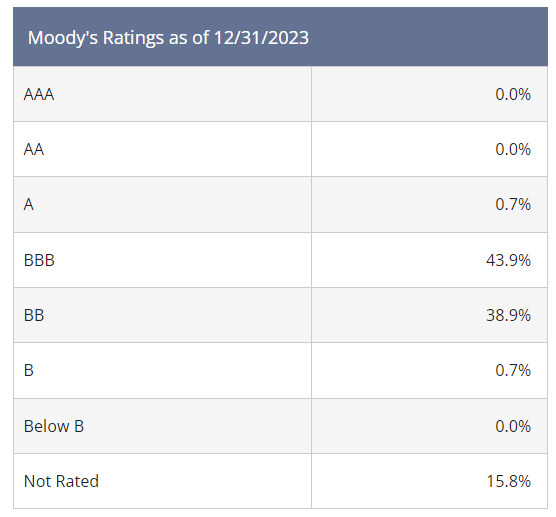

Perhaps a better indicator is the following snapshot of the Cohen Preferred CEF, which captures both the retail and institutional preferred markets.

cohen

By comparison, the average rating for bank loans is a single B, and the average rating for HY bonds is around BB-. However, even here the yields do not change much. The preferred yield is 6.8%, compared to 7.7% for HY bonds and 8.9% for loans. The rise in loan yields is favored by an inverted yield curve that is expected to resolve within the next 18 months and a method of calculating discount margins that assumes calls several years from now.

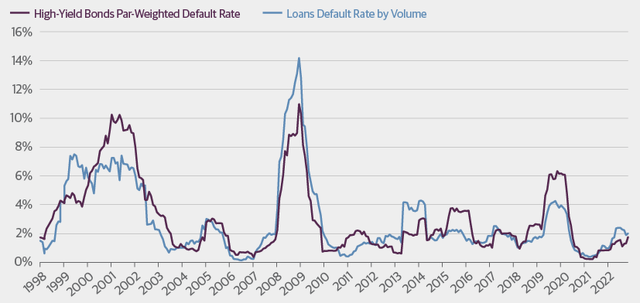

Another important point is that these yields are not without risk. In other words, you cannot take these numbers as “money in the bank.” As many investors know, the higher the yield on a security, the greater the potential for loss of principal. The annual default rate for high-yield corporate bonds and loans is about 3%, and the loss rate is closer to 2% for bonds and 1% for loans. However, in contrast, according to Moody's, the senior debt default rate is much lower at 0.3%.

guggenheim

To figure out the loss-adjusted yield, you need to subtract the expected losses from each asset class using their respective historical default and recovery rates (conservatively set a recovery rate of 70% for loans and 70% for bonds). Assume a recovery rate of 40% and a priority recovery rate of 0%). When he does this, the difference in the “true” yields decreases significantly, and on this basis the preferred yield actually exceeds the yield on his HY bond.

Another important point is that preferred dividends are mostly eligible, whereas loans are taxed as interest. This is a big difference in taxable accounts. On this basis, preferred stocks offer significantly higher yields to investors in the higher tax brackets of taxable accounts. Of course, many investors hold bond and loan assets in tax-sheltered accounts. However, what often makes this possible is that same investor holding more tax-efficient income sectors such as Munis or Preferreds in her taxable account.

Adjusting the nominal yield by the expected loss and tax rate (yellow bar) shows that priorities do more than work alone.

systematic income

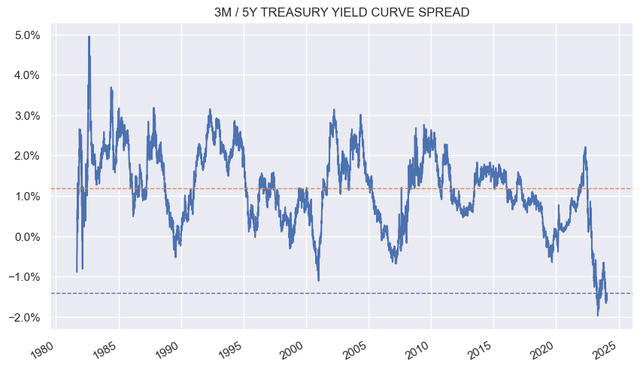

And remember, the only reason loan yields remain high is because of the highly unusual slope of the yield curve. This tilt is expected to resolve within the next 18 months as the Fed begins lowering short-term interest rates. In other words, the loan yield advantage we see today will dissipate over time.

systematic income

In short, the nominal yield advantage of high-yield bonds and loans is more or less visual. Adjusting for the higher quality of the preferred sectors, significantly lower historical loss rates, and favorable tax treatment largely eliminates the difference in yields.

Performance overview

As explained above, what is often lost in discussions of yield is the fact that yield provides a misleading picture of wealth creation. Many investors chase eye-popping yields, only to realize after some time that their assets aren't actually increasing to the level of the yield.

Let's use 2023 as a good example. There was a banking crisis that year, and the corporate background was quite strong. In other words, it was a bad year for preferred stocks and a good year for corporate assets such as bonds and loans. This year should hit the preferred line especially hard, given that the financial position is about two-thirds of the preferred line.

In what has been a bad year for banks, five of the 4,700 FDIC-insured banks in the U.S. failed last year, for a default rate of about 0.1%. In contrast, the default rate for bank loans was 3.04% and the default rate for high-yield corporate bonds was 2.99%. Sure, Silicon Valley Bank, the biggest bank failure, is a big problem, ranking 16th in the bank before its failure, but the overall numbers speak for themselves.

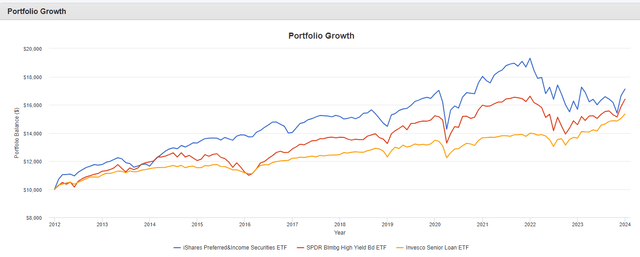

Something else worth checking is the actual performance of the three asset classes. Investors who focus only on yield may be surprised to find that the returns over 10 years are actually in the reverse order of yield, first for senior bonds, then for HY bonds, then for loans. The ETF we use is the one with the longest track record.

portfolio visualizer

However, the Preferred ETFs we used are primarily focused on retail/exchange-traded preferreds, and the Institutional Preferred ETFs are more likely to have a shorter duration and less exposure to long-term upside. You may be significantly underestimating the performance of the broad preferred ETF. -Term interest rate from 2022 onwards.

A key factor in this long-term preferred stock's outperformance is, unsurprisingly, its high-quality profile. We can see how this played out in the 2015 energy crisis. Both HY bonds and loans suffered losses, creating a wedge between their performance relative to senior bonds. These fluctuations are not obvious from looking at yields alone, but they are also likely to repeat over time.

some important benefits

Let's now move from the apparent disadvantages of preferential sectors to their actual advantages.

Preferred interest rates make it easier for investors to express their views on interest rates. For example, you can lean toward floating rates versus fixed/floating rates during a Fed rate hike cycle, or vice versa. Preferred investors can also do this by holding shares in the exact same issuer, as many issuers have preferred stock with different interest rate profiles.

Second, investors can choose their favorite stocks. This is very easy to do with retail preferred stocks that are traded on an exchange, but it can also be done with institutional preferred stocks. This is not possible with loans because there is no over-the-counter secondary market available to non-institutional investors. While it is possible for investors to trade individual corporate bonds (the same way they trade institutional bonds, or OTC preferred bonds), given its complexity, this process is clearly not for everyone. The ripple effect here is that by holding individual preferred stock, investors can avoid the high management fees associated with holding bonds and loans through a fund.

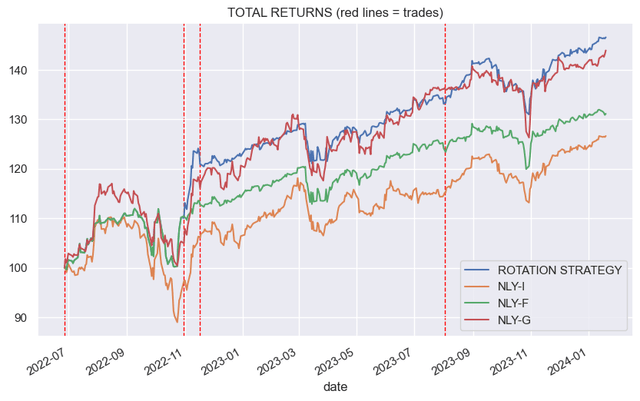

The third, personal preferences, provides rich relative value opportunities. To take advantage of this phenomenon, we used a rotation strategy to allocate between different series from the same publisher. For example, the chart below shows how this performed for our high-income portfolio Agency Mortgage REIT NLY Preferred.

systematic income

This is because over-the-counter institutional securities are more difficult to trade, and given the fact that these markets are dominated by institutional investors, which means they are more efficient and have fewer relative value opportunities than bonds and loans. That's not an easy thing to do.

Take-out

Our main conclusion is that the disappearance of preferred assets as valuable income assets has been greatly exaggerated. Much of the decline in senior debt yields is due to their higher quality than high-yield corporate bonds and bank loans, and much of this is eliminated on a loss-adjusted tax equivalent basis. In any case, lower yields do not prevent preferred stocks from producing stronger long-term total returns than any other two assets. And even though most of the preferred stocks are high-value/low-yield options, there are plenty of high-yield opportunities that don't require a dumpster dive.

Aside from these spurious “downsides,” this asset class offers many investment benefits, including the ability to express interest rate views, the ease of selecting personal preferred stocks, and the pursuit of relative value opportunities that generate additional alpha. It has many benefits for your home.

Regarding our own views in this area, from an interest rate positioning perspective, we still prefer to maintain a floating rate-first policy, given the highly inverted yield and still strong macro conditions. The three-month and five-year inverted yield curves are 2.5% higher than average, so even if the Fed starts lowering rates, floating-rate preferred stocks will continue to provide excess yield over fixed-rate stocks for several years. At the same time, we are comfortable adding longer-term preferred rates, especially if we see long-term rates continuing to rise this year.

In terms of quality, we like the following:

- Floating rate US Bancorp Series A (USB.PR.A), strip yield 8.24%

- Loan / CLO CEF XFLT Series A (XFLT.PR.A), strip yield 7.7%

- Fixed/Variable Insurance Company Sirius Point Series B (SPNT.PR.B) delivers 8.1% strip yield and double-digit reset yield in 2026 (but likely to be redeemed)

In terms of high yield, I also like the following:

- Floating Rate Agency Mortgage REIT Annaly Series F (NLY.PR.F), Strip Yield 10.7%

- Fixed/Floating Synovus Financial Series E (SNV.PR.E) has a strip yield of 6.2% and a July reset yield of 8.7%.

- CLO Equity CEF Priority Income Fund Series F (PRIF.PR.F) has a yield to maturity of 9.6%.