Laila Athany, Amy Chappell, Lorenzo Garza, Emily Greenwald, Sam Schulhofer-Wall

Construction cranes building new office space continue to dot the Texas skyline, even as remote work arrangements persist and existing office buildings remain largely vacant.

In fact, new office projects are on the rise in Texas. So why aren't developers slowing down? Office space isn't all the same, and the incentives to complete new projects can be very different from the overall market drivers.

Office construction continues to be active

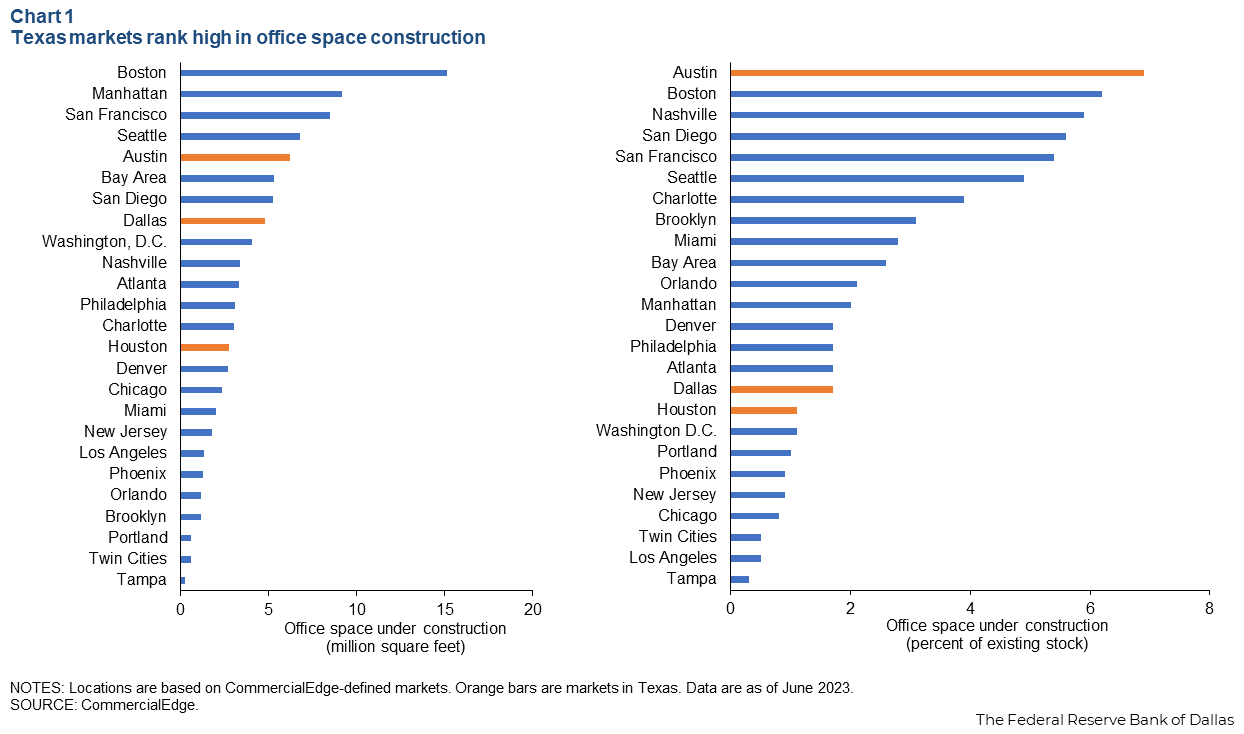

As of June, about 115.8 million square feet of office property was under construction nationwide, representing 1.7% of existing inventory, according to commercial real estate software company Commercial Edge. New construction is occurring primarily in markets with a high concentration of technology, financial and professional services firms, and these sectors are facing challenges in getting employees back to the office.

Texas includes three of the top 20 markets in the United States based on the amount of office space under construction. Austin is fifth;Austin is fifth. Dallas is in 8th place. Houston ranked 14th (chart 1).

Expectations for continued economic growth and people to move to Texas are accelerating construction in the state. Austin ranks No. 1 in construction as a share of existing stock among the nation's largest office markets, with 6.2 million square feet of office space under development, representing 6.9 percent of existing stock. I am.

Developers building more office space are predicting enough demand to absorb the new supply. Large office projects typically take two to four years from groundbreaking to completion. However, market conditions for office real estate have changed dramatically since construction of these projects began.

Additionally, ongoing construction typically does not respond quickly to changes in market conditions. Once construction begins, it is often most economical to complete the project.

The office sector, once the center of white-collar work, was hit hard by the 2020 pandemic and continues to suffer as remote work takes hold and companies continue to redefine traditional work environments. ing. Even after pandemic-induced lockdowns and capacity limits are eased and economic activity picks up, the return to offices has been slow. A study by economists José María Valero, Nicholas Bloom, and Stephen J. Davis found that telecommuting will account for 25% of workdays by 2023, up from 5% of workdays in 2019 before the pandemic. %.

These structural changes, combined with the typical cyclical effects of rising interest rates, can create challenges for property owners. Lack of tenant demand is a problem for all building owners, but the biggest challenge is for owners whose projects are nearing completion and who need to refinance from construction loans to mortgages, who need to prove to banks that they can repay their debts. Maybe for some people. Long-term commercial mortgage. Owners of existing properties who need to refinance their mortgages may face similar challenges.

Office performance faces headwinds

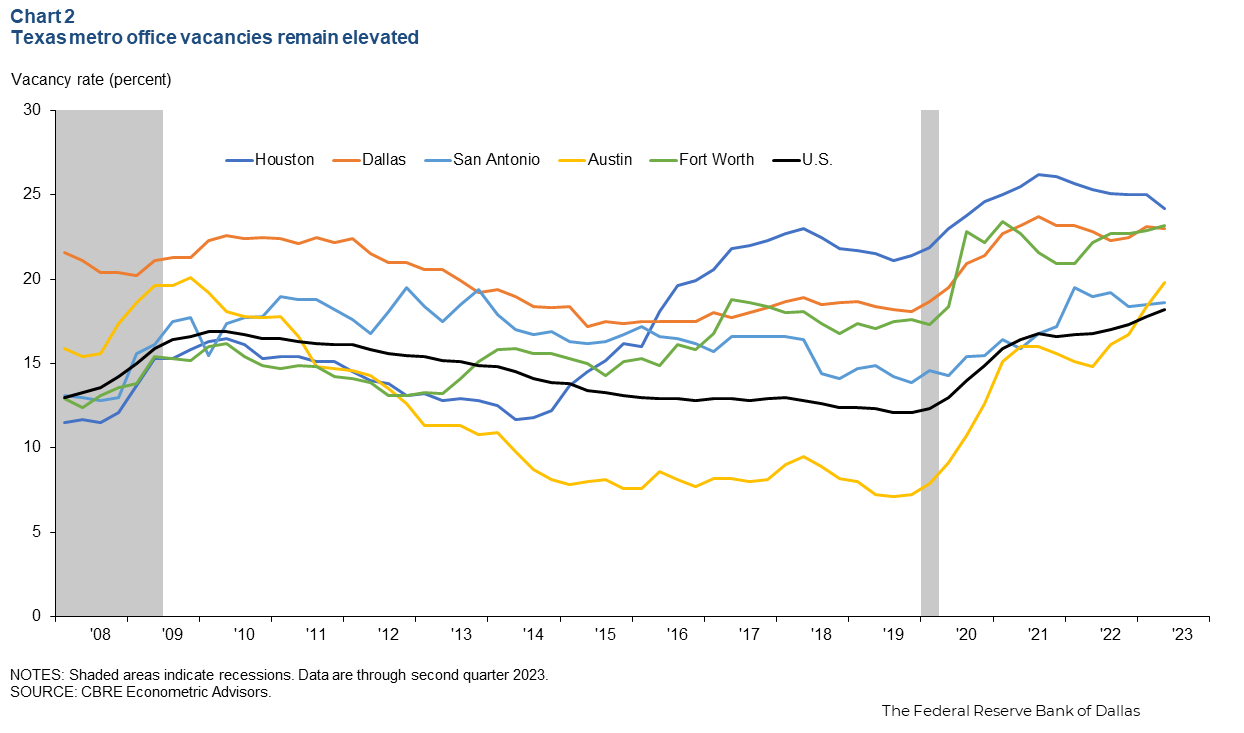

In the first half of 2022, the office market appeared to be stabilizing, with vacancy rates gradually decreasing in most major Texas cities. However, leasing demand has since failed to gain traction. Vacancy rates in major Texas cities as of the first quarter of 2023 exceeded the peak reached in 2010 after the Great Recession (chart 2).

The measured vacancy rate includes space available for sublease, i.e., tenants trying to find another party to take over unneeded space. Office sublease availability has also increased sharply since the start of the pandemic, with San Antonio increasing fivefold since the end of 2019, Austin fourfold and Dallas-Fort Worth 2.5fold, according to data from CBRE Economic Advisors. . . This is three times his number nationally. The increased availability of sublease space will put further pressure on rents.

Commercial real estate outside the office sector

Since the pandemic, office real estate has fared worse than other types of commercial real estate, including retail, hotels, industrial real estate, and multifamily housing. Texas' retail and hotel sectors have rebounded from pandemic shutdowns. Minimizing the construction of new retail space has helped reduce retail vacancies and accelerated rents for retail space in Texas. Hotel occupancy rates have recovered from the dramatic post-lockdown decline in 2020 and have stabilized in recent quarters, broadly in line with 2019 levels.

The boom in the industrial and multifamily sectors is beginning to subside. The demand for warehouse space within the industrial sector increased during the pandemic in line with the growth of e-commerce. But as builders complete construction projects, warehouse vacancy rates in major cities across the U.S. and Texas are inching up from near historic lows in the first quarter of 2023. Multifamily occupancy rates are roughly in line with historical levels, but have declined since their peak in 2021. They are near or below trend rates and are down from the all-time highs reached in 2021.

Office real estate factors remain important

Although the office sector as a whole underperforms other types of commercial real estate, demand for office space varies depending on the characteristics of individual properties. New buildings in Texas' major metropolitan areas will become more desirable as companies look to bring employees back to the office.

Newer buildings with modern decor and technology are classified as Class A and tend to have the highest rents. Building owners and brokers make classifications based on quality, such as age, upgrades, and amenities. Lower Class B buildings are generally better located, but tend to be older and don't have the same modern or high-end technology and finishes as Class A, so they command lower rents. Class C properties are typically older properties located in less desirable areas. These properties may require renovation and typically have lower lease costs than other classifications.

Location also drives demand. Geographic factors include proximity to major employers, major infrastructure, urban landscapes, and other environments. Properties are typically categorized into primary (most desirable), secondary, and tertiary locations. Features such as design and sustainability also differentiate office buildings. More desirable office buildings, such as Class A properties in prime locations, are seeing a stronger return to offices, higher occupancy rates, and higher demand.

Class A building top Texas office outlook

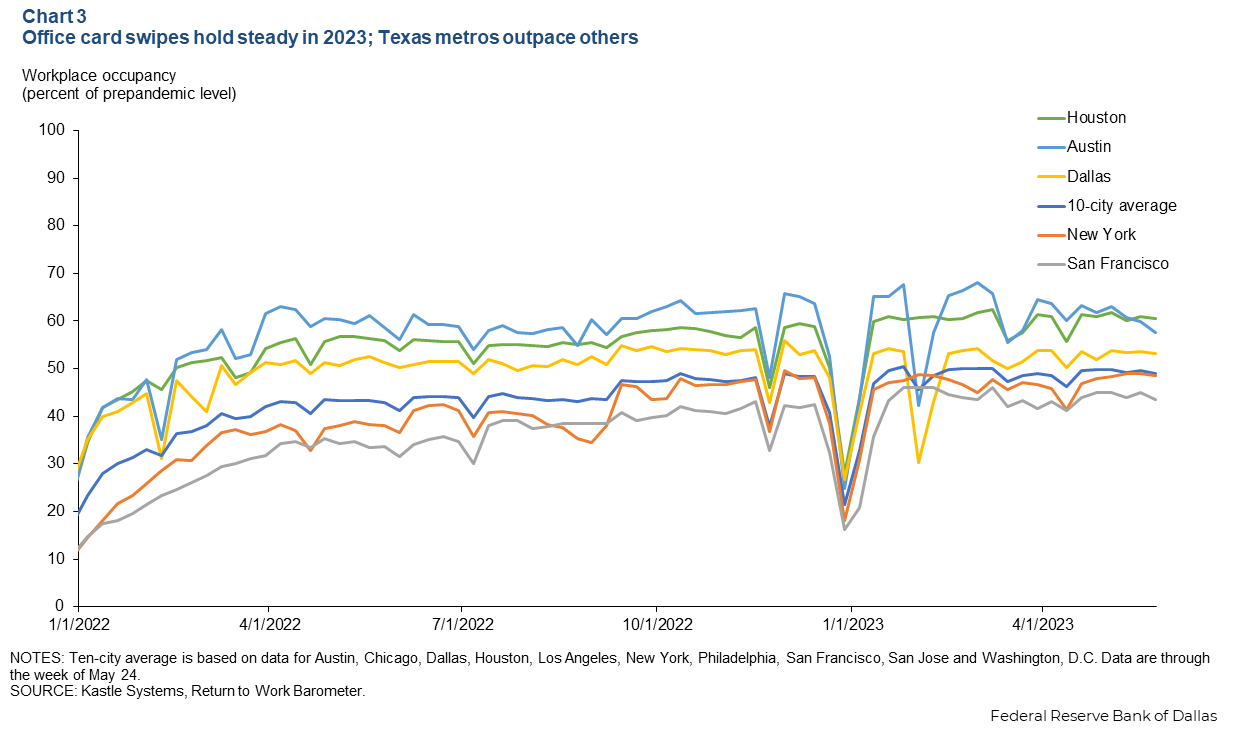

Demand for office space will depend on companies' plans to bring employees back to the office, the economic outlook, and migration patterns. Texas' major cities returned to offices earlier than other large cities across the country during the pandemic. But office occupancy remains well below pre-pandemic levels, according to badge swipe data from security management company Castle Systems.

Office occupancy has remained flat since the beginning of 2023, with card swipes averaging 60 percent of pre-pandemic levels in Austin and Houston and 51 percent in Dallas, Texas' three metros, Castle said. reported (chart 3). According to the data, assuming workers were in the office five days a week before 2020, workers in Austin and Houston are in the office an average of three days a week, while workers in Dallas are in the office an average of 2.5 days a week. I know that there is.

Office vacancy rates in Texas are expected to continue increasing into 2024. Sublease availability remains high and a significant amount of new office space is progressing towards completion. Despite the potential for higher overall vacancy rates, high demand for new Class A properties means buildings under construction are more likely to be successfully rented than the average property. means. Oversupply can cause even bigger problems in older buildings.

About the author

The views expressed are those of the author and are not attributable to the Federal Reserve Bank of Dallas or the Federal Reserve System.