Third Quarter | September 27, 2023

special questions

Data was collected September 13-21. 142 oil and gas companies responded to the special questionnaire survey.

all companies

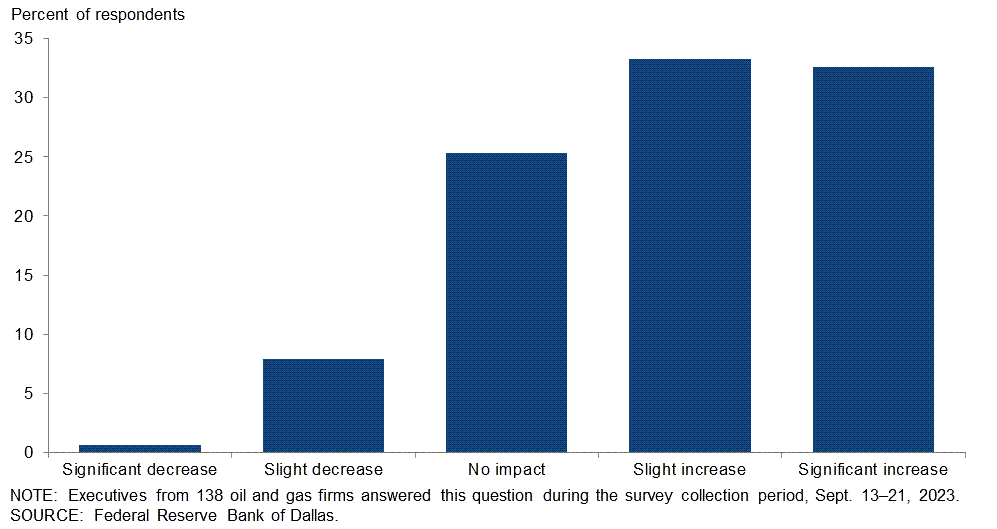

Looking ahead five years, how do you expect the energy transition to impact oil prices?

The largest percentage of executives surveyed, 33.3%, said they expected oil prices to rise slightly over the next five years due to the energy transition. A similar number of respondents (32.6%) expect a significant increase. 25% expect no impact. Only 9% expect the energy transition to lower oil prices.

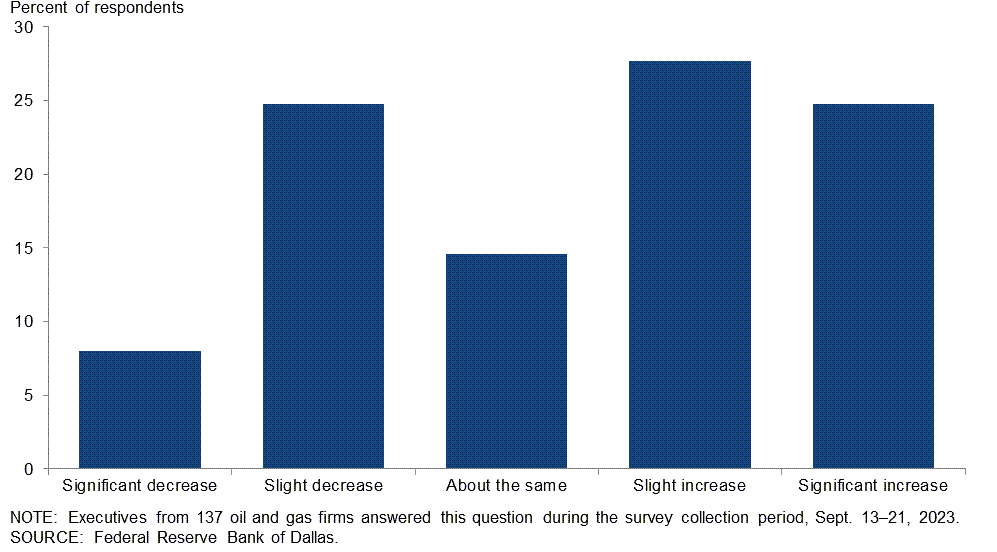

What do you expect world oil consumption to be in 2050 compared to current levels?

More executives expect global oil consumption to increase in 2050 compared to current levels than expect it to decrease. Among executives surveyed, 28% expect global oil consumption to increase slightly in 2050 compared to current levels, and a further 25% expect it to increase significantly. Meanwhile, his 25 percent of executives expect consumption to fall slightly in 2050 compared to current levels, and a further 8 percent expect consumption to fall significantly. 15% expect global oil consumption in 2050 to be close to current levels.

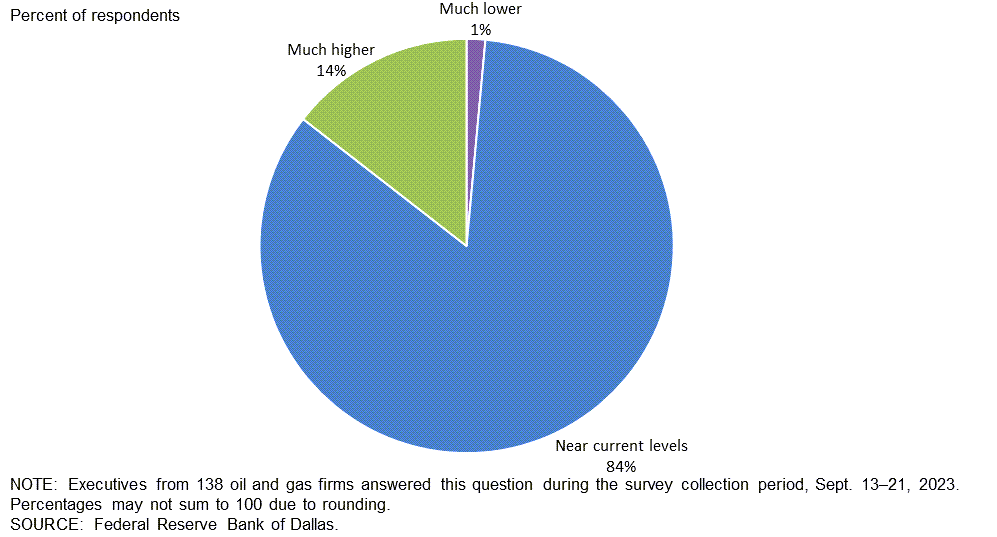

Do you expect the number of oil rigs in the U.S. to be much higher, much lower, or close to current levels six months from now?

Most executives (84%) said they expect the number of U.S. oil rigs to be close to current levels six months from now. 14% expect U.S. oil rigs to drill even more in the next six months, but just 1% of executives say they expect far fewer.

A much larger percentage of support service company executives expect there to be a much higher number of U.S. oil rigs six months from now compared to the percentage of E&P executives who agree. (See table for details.)

| response | Percentage of respondents (in each group) | ||

| all companies | Development & Manufacturing | service | |

| much lower | 1 | 1 | 2 |

| close to current level | 84 | 88 | 76 |

| much higher | 14 | 11 | twenty two |

Exploration and production (E&P) companies

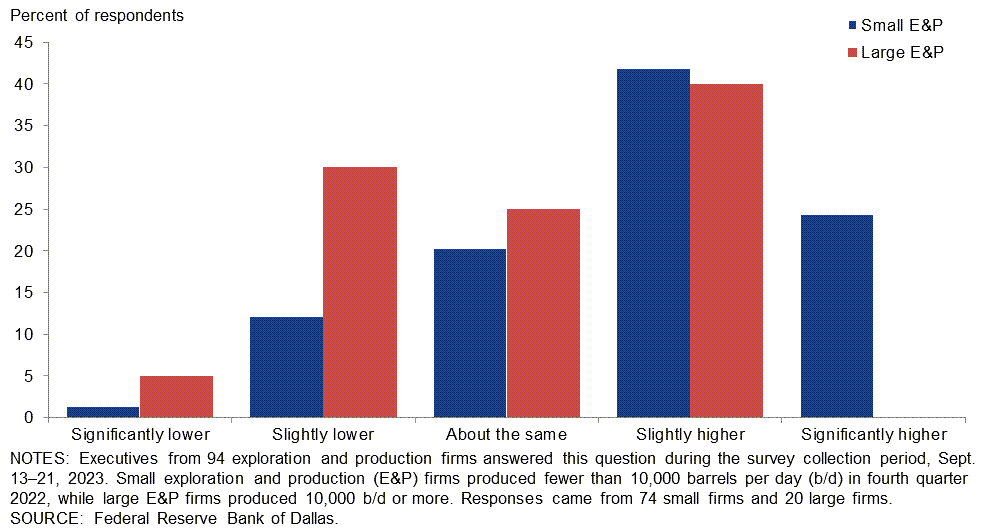

What are your company's expected drilling and completion costs per well in 2024 and 2023?

Companies were classified as “small” if they produced less than 10,000 barrels per day (b/d), and “large” if they produced more than 10,000 barrels per day (b/d). Although there are a large number of small E&P companies in the United States, large E&P companies account for the majority of production (more than 80%). The breakdown of the data is shown below.

Across all companies, 60% of executives expect the cost to drill and complete a well in 2024 to be higher than in 2023, while 18% expect costs to be lower. ing. 21% expect no change.

A breakdown of the data for small E&P companies compared to large E&P companies is shown in the table below. Executives at smaller His E&P companies were more likely to expect an increase in cost per well than executives at larger His E&P companies. On the other hand, executives at large E&P companies were more likely to expect lower costs per well than executives at smaller E&P companies.

| response | Percentage of respondents | ||

| all companies | Small-scale development/development | Large-scale development | |

| significantly reduced | 2 | 1 | Five |

| somewhat low | 16 | 12 | 30 |

| almost the same | twenty one | 20 | twenty five |

| somewhat expensive | 41 | 42 | 40 |

| significantly higher | 19 | twenty four | 0 |

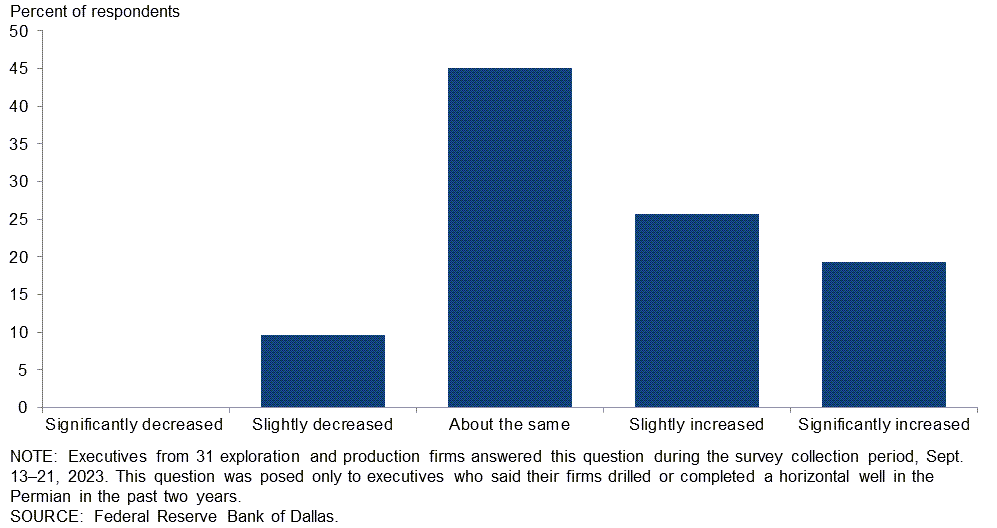

How has the lead time for interconnecting new well pads and power from the grid in the Permian Basin changed for your company compared to a year ago?

Among executives surveyed, 45% said the lead time to interconnect new well pads with power from the grid is about the same as a year ago. 26% of executives said lead times had increased slightly, and an additional 19% noted a significant increase. Only 10% said lead times have decreased compared to a year ago. This question was posed only to executives who said their company had drilled or completed a horizontal well in the Permian in the past two years.

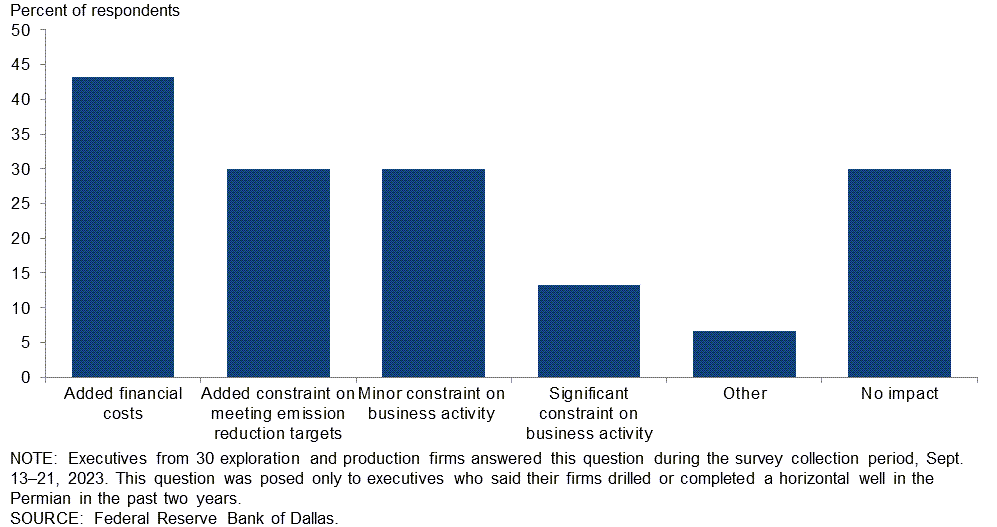

How will the current lead times for interconnecting new well pads and power from the Permian grid impact your company? (Check all that apply.)

43% of executives said current lead times are increasing their company's financial costs. “Additional constraints on meeting emissions reduction targets” and “mild constraints on business activities” were each selected as impacts by 30% of executives due to current lead times. His 30% of executives say there is no impact on current lead times. This question was posed only to executives who said their company had drilled or completed a horizontal well in the Permian in the past two years.

Oil and gas support services

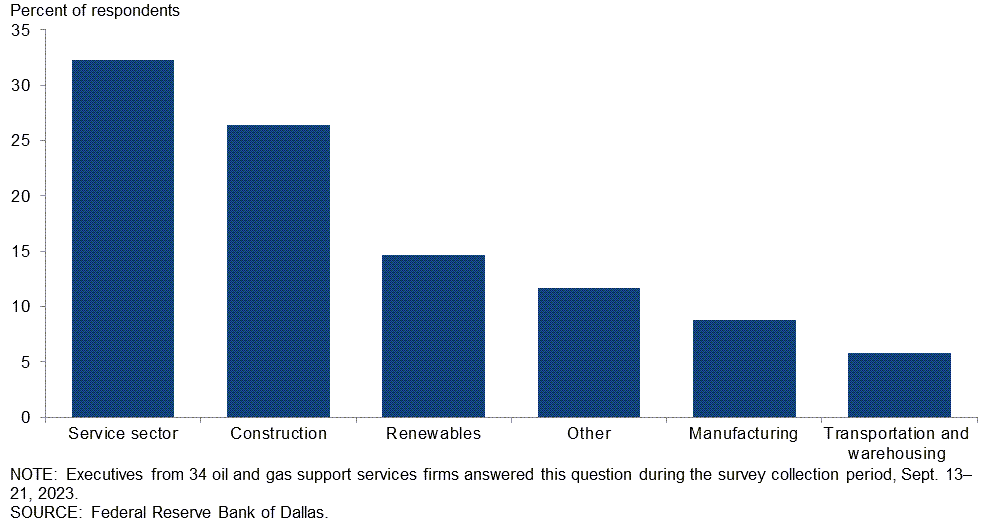

In what areas do you think your company will compete the most for employee recruitment and retention over the next five years?

Thirty-two percent of executives surveyed believe their company will compete most with the services sector for employee recruitment and retention over the next five years. A further 26 per cent believe their company will compete most with the construction sector for recruitment, followed by the renewable energy sector with 15 per cent.

Special Questions Comments

Exploration and production (E&P) companies

- While the development of alternative energy sources continues, I still believe that the need for various forms of hydrocarbons will increase over time.

- The impact of the energy transition on prices is difficult to quantify. At first glance, you would think that a decrease in demand would cause prices to fall. However, as the transition continues and U.S. oil production is likely to decline (depending on a variety of factors, including government regulations, investors, etc.), OPEC will continue to gain greater market share and We expect it to reach that level. higher than at any point in history. Therefore, I expect OPEC to continue to have more power to keep prices above a certain level.

- To reduce emissions, we need to solve power interconnection problems.

- Within 18 to 24 months, oil supplies from the United States will be severely disappointed, throwing global supply and demand out of balance. Considering the actual price per barrel, we believe the forward curve will be between $50 and $100. It will have a significant impact on the world economy.

- My company builds and manages much of our power distribution ourselves because we don't trust large power distribution providers to meet our business needs in a timely manner.

- The energy transition will cause a very large increase in overall energy costs for consumers, but will have a smaller impact on the price of oil, a global commodity manipulated by governments. Politicians are already trying to avoid the fact that rising electricity and gasoline prices are being passed on to individual consumers because of mandated taxes and subsidies funneled to political darlings. They're making fun of the price.

- Rising wages are having an impact on lifting and development costs. This has been offset somewhat by tube cost reductions over the past few months. Overall, our costs are flat to slightly down compared to last year, but we are seeing significant cost increases compared to three to five years ago.

- The “energy transition” narrative is completely false. Because this so-called transition does not exist. We are sitting on an ocean of oil and gas, and if we choose not to make the most of it, our economy in general and our people in particular will become even poorer. Living standards are declining and will continue to do so.

- It is returning to the Permian Basin. I was surprised to find that the price of natural gas, our secondary product, was extremely low.

oil and gas support services company

- Deep and long wells require large drilling rigs and a full crew. Automation and artificial intelligence aren't going to change that. To date, land-based excavators have not experienced a decline in excavator usage, and we do not expect that to change in the near future. Automation improves safety by moving people away from danger, but it does not reduce staffing to perform efficient operations.

- The risks to our industry are foreseeable. If the outlook remains uncertain or negative, there will be major headwinds for jobs, financing, wealth creation, and more.

- Seismic data is currently used by oil and gas companies for carbon capture, use, storage, and brine disposal wells. Many of our customers are also turning to exploration for the first time in years. I think this reflects the fact that the core of non-traditional areas is very mature and companies are actively exploring what's next.

- After a summer of energy usage warnings from ERCOT, it feels like Texas is nearing a tipping point. Can we continue to grow housing, energy, and industry without major upgrades to our power infrastructure?