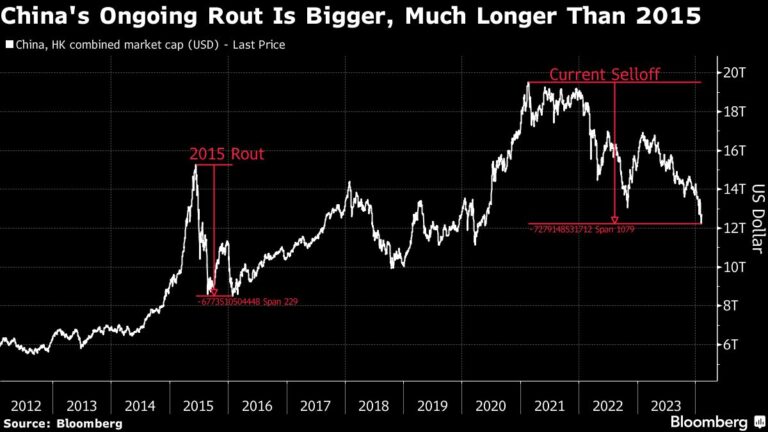

(Bloomberg) — China's efforts to halt a $7 trillion stock market crash are evoking memories of 2015, when the Chinese government took drastic steps to stem the collapse. Investors say the problem is even deeper this time.

Most Read Articles on Bloomberg

Authorities have gone into crisis mode to support China's plummeting markets, targeting short sellers and securing funding in banks, while state funds ramp up purchases. Signaling growing alarm, China abruptly removed market chief Yi Huiman on Wednesday, marking another hallmark of a nearly decade-long blueprint to boost stock prices.

“The changes show that the political impulse remains to tighten administrative control rather than address the fundamental problems facing the economy,” said Eurasia Group Analyst. List and others wrote in a memo after the sudden reorganization. Instead of helping, they write, it “entrenches discomfort and weighs on confidence.”

The move came as President Xi Jinping was scheduled to receive a briefing from regulators on financial markets, which he announced earlier this week in a bid to stem a collapse that exceeded the $6.8 trillion collapse that began in mid-2015. , sparking a mean rally to bet on stronger measures. .

At the time, Mr. Xi personally ordered an unprecedented campaign to protect the interests of small and medium-sized investors. While some of the measures taken this year mirror those taken during the previous rout, authorities in Beijing have yet to respond with the same force overall. The People's Bank of China has refrained from making large-scale liquidity commitments, and President Xi's economic team has not pulled the trigger on a proposed 2 trillion yuan ($278 billion) rescue package.

Even as policymakers ramp up relief efforts, investors say old strategies are not enough to satisfy questions about the long-term health of China's slowing economy, plagued by a real estate crisis, deflation and population decline. claims.

“The real reason this time is different is that the economic growth story has changed,” said Huang Rui, a fund manager at Shanghai Wusheng Investment Management Association. “We are now at a tipping point not seen in decades.”

The market turmoil has also generated hidden criticism of Xi's government among the public and investors, after years of policy repression and inflexible coronavirus curbs soured business confidence. As the country's 200 million mother-and-son investors prepare to unite with their families due to the impending Lunar New Year holiday, pressure is mounting to halt the selloff and gloom could spread.

While the 2015 crash coincided with an economic slowdown and housing market downturn, China today faces a changing policy environment. Leaders have signaled they will not rely on large-scale economic stimulus as Mr. Xi seeks to reorient the economy away from a debt-fueled real estate market and toward high-quality growth.

Last time, the most prominent figure who led the response was then-Premier Li Keqiang. When he returned from a trip to Europe in July of the same year, the government introduced a stabilization fund, the People's Bank of China promised to fully fund state-backed investors, and various sectors of the financial world supported the market. mobilized to do so. President Xi did not make any public comments until September, several months after the defeat.

This time, supportive statements from Premier Li Qiang, Vice Premier He Lifeng, Central Bank Governor Ban Gongsheng and others failed to have a lasting impact. The People's Bank of China said in its quarterly monetary policy implementation report released on Thursday that consumer prices are expected to recover moderately as demand recovers and will strengthen monitoring of banking system liquidity and changes in financial markets. Then he added.

Some investors are now waiting for information from Mr. Xi. Mr. Xi has consolidated his power in recent years, increasing his influence over economic policy and weakening the influence of China's second-largest official.

“The fact that a special meeting may have been called is an important warning that things could be very dire,” said Xu Dawei, a fund manager at Jintong Private Fund Management in Beijing. It is necessary to report to the He added that once the briefing with regulators is confirmed, “we can say with confidence that this is a key point.”

Alicia García Herrero, chief Asia-Pacific economist at Natixis SA, said the situation calls for Mr. Xi to make fiscal reforms, noting that central banks are not playing the leading role they were in 2015. He pointed out that Mr. Xi has recently weakened the People's Bank of China. Over the years, some of its powers have been transferred to a revamped financial regulator.

He said if the central bank implements easy monetary policy, it will also need to tighten capital controls. “Otherwise, all the renminbi they put into circulation will flow out. So we expect to see very strict capital controls in China, where investors are locked in. So this is very bad news for investors.”

The problem nearly 10 years ago was also largely caused by credit trading through shadow finance. As a result, leveraged investors were forced to sell, resulting in a rapid and severe decline. The slump extends to three years as the disappointing reopening after the pandemic has compounded losses from coronavirus disruptions.

“Unless you address the underlying factors, market interventions will not be effective over time,” said Brock Silvers, managing director at private equity firm Kaiyuan Capital. “All recent policies seem to be treating the symptoms, not the disease.”

Overall Chinese stocks ended the week with strong gains, but some analysts still want stronger policies to ensure a turnaround.

Xin Yao Ng, director of Asian equities investment at abrdn, cited a “perception gap” between top leaders and market participants' view of the Chinese economy, saying that without a major stimulus package, sentiment will continue to decline. He said he was skeptical that it would rise.

“Investors think the economy is really weak and don't even believe the GDP statistics,” he said. “Mr. Xi and his cabinet may still be relatively comfortable about the pace of economic growth.”

–With assistance from Colum Murphy, Rebecca Choong Wilkins, John Cheng, April Ma, Ishika Mookerjee, and Charlotte Yang.

(Updated to add People's Bank of China report in paragraph 11)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP