After a year marked by a marked market slowdown, hopes were high that 2023 would bring about a turning point for both the economy and the housing market. Nevertheless, the economy faced additional challenges as the Federal Reserve implemented multiple interest rate hikes throughout 2023 despite a cooling inflation environment. These rate hikes amounted to a cumulative 1 percentage point, putting further pressure on all types of borrowing.

As a result, mortgage rates exceeded the 7.5% threshold for the first time in 23 years, pushing home affordability to record lows.

The housing market continued to slump for the second consecutive year in 2023 as many buyers were forced out of the market. Housing inventory exceeds 1.1 million units available for sale in 2023, but data shows that these additional homes were not enough to accommodate housing demand, although demand was down from the previous year.

But this is not a new problem. The current housing shortage has been building up for decades. Since the housing boom of the mid-2000s, the United States has consistently underbuilt homes compared to historical averages. Furthermore, with mortgage rates hovering around 7% for most of the year, fewer homeowners chose to list their homes in 2023. As a result, housing inventory remained at low levels throughout the year due to this long-standing underbuilding problem and interest rate lock-in effect.

The housing market is expected to grow in 2024 after two years of weakness. There are several signs that a market recovery is imminent.

Because all real estate is local, the National Association of REALTORS® has identified which markets will see increased activity in the new year. In identifying these markets, NAR considered a variety of metrics considered to impact metropolitan markets in this report.

There are more “repeat” buyers than at the national level

Lower mortgage rates will improve home affordability and bring more buyers back to the market in 2024. The influx of these 'returning' buyers is expected to stimulate housing market activity. NAR calculated and compared the number of households across 100 metropolitan areas that could afford a home with a 6.5% mortgage rate versus a median rate of 7.5%. The percentage of “returning” buyers was then calculated by comparing these “returning” buyers to the total number of households in each metro area. The fact that the percentage of “repeat” buyers exceeds the national level indicates that market activity is increasing. Therefore, regions with a higher proportion of “repeat” buyers than the national level are expected to outperform.

The rate of increase in house prices is lower than the national level

NAR calculated home price growth in the 100 largest metropolitan areas to determine which areas will be most affected by the slowdown in economic activity in 2023. While these regions appear to be more susceptible to market changes, pent-up demand is also likely to result in significant price increases. In 2024.

More renters can afford median-priced homes than nationally

Trends in homeownership rates depend on the ability of renters to become homeowners. NAR calculated how many renters would be able to purchase a typical home with a 10% down payment. Relative to the nation, regions with a higher percentage of renters who can afford median-priced homes indicate higher home-buying activity in those regions.

More potential sellers than national level

In anticipation of lower mortgage rates, many existing homeowners were reluctant to forgo their 3% interest rates and did not list their homes in 2023. However, lower mortgage rates are expected to increase market activity for these stuck sellers in 2024. NAR calculated the number of homeowners who lived in their homes for a period equal to or longer than the average tenure within each metropolitan area. Identify potential sellers. Therefore, in regions where there are many homeowners who have owned their homes for longer than the average number of years, economic activity is likely to increase in 2024 as mortgage interest rates decline.

The decline in remote workers is greater than the national level.

The surge in remote work has increased demand for housing and changed housing location preferences. Respectively, the decline in remote work is also expected to increase demand as more companies transition away from working from home and people need to return to the office. In regions where the decline in remote workers is greater than the national level, demand for housing may increase.

Listings more affordable for first-time buyers than national levels

After calculating the maximum price for a home that a first-time buyer can afford, NAR identified the neighborhoods with the most affordable properties.Regions with properties that are more affordable for first-time buyers than the national level are expected to outperform.

Employment growth stronger than the national level

A strong job market typically drives housing demand as household incomes increase. Therefore, regions with higher employment growth than the national level typically experience more homebuying activity than other regions.

Income growth rate faster than national level

Rising incomes allow people to afford housing, increasing demand for housing. Therefore, demand for housing is expected to rise more in regions where people's incomes rise faster than the national level. While the majority of high-income millennial renters move to the region and first-time buyers account for one-third of sales, the arrival of high-income renters from other states housing activity is expected to increase.

Violent crime rate lower than national level

Research shows that people buy homes in neighborhoods that provide a safe and stable environment for their families. Therefore, areas with lower violent crime rates are likely to be more attractive to buyers.

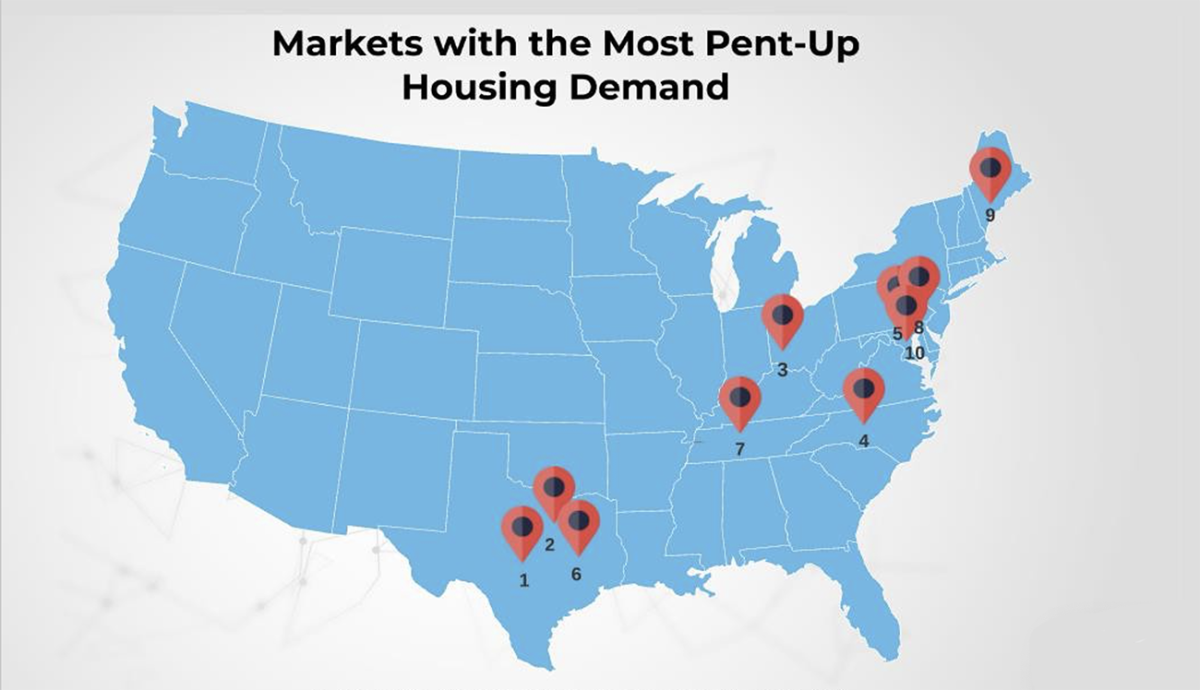

Top 10 markets with the highest pent-up housing demand

- Austin – Round Rock – Georgetown, Texas

- Dallas-Fort Worth-Arlington, Texas

- Dayton Kettering, Ohio

- Durham, North Carolina – Chapel Hill

- Harrisburg Carlisle, Pennsylvania

- Houston – The Woodlands – Sugar Land, Texas

- Nashville – Davidson – Murfreesboro – Franklin, TN

- Philadelphia-Camden-Wilmington, PA-New Jersey-De-Maryland

- Portland – South Portland, Maine

- Washington-Arlington-Alexandria, DC-VA-MD-WV

Download the full report