Please note that the opinions discussed below are those of the individual authors and do not necessarily reflect the views of Man Group House. All market data referenced below is sourced from Bloomberg unless otherwise specified.

“'Of course not!' said the Hatter, shaking his head disdainfully. 'I daresay you have never spoken to Time Inc.!'

“Probably not,” Alice answered cautiously. “But she knows she has to break out the time to learn music.”

“Ah! That explains it,” said the Hatter. “He won't be able to bear being beaten.”

Alice in Wonderland – Lewis Carroll (1865)

concept

Many investment strategies revolve around some concept of dividing time. At its simplest, a trend strategy represents the view that the shape of returns in the current period will be similar to that experienced in the previous period. The core of seasonality is the idea that returns are similar at specific points in the calendar.

Another way to make better use of your time in investing, if not music, is to divide it between regimes. The regime differs from the seasons. Whereas the latter moves from state to state in a predictable manner, regimes can go from one to another, and we don't know how long each symptom will last.

of this edition road ahead This is somewhat experimental and will relieve the itch that has been bothering me for a while. These are my initial thoughts and I hope they're a conversation starter. Please contact us if you wish to continue.

The number of pages is longer than usual, but the number of characters is shorter. Let's look at the definitions of the seven regimes. For each, we suggest how states would be categorized, and discuss six major assets and strategies: stocks, bonds, commodities, long-short (L/S) stock value, and L/S stock cross-sectional momentum and trends. ). ) runs through these states.

inflation

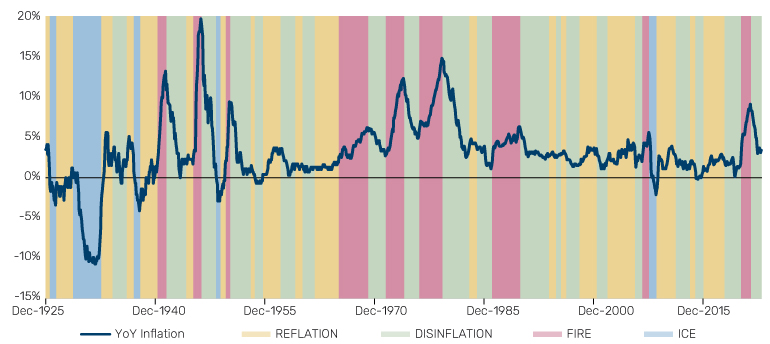

In March 2021, several colleagues and I The best strategy for times of inflation1This defines a historical episode of general price growth as when year-on-year (YoY) inflation increases by 2%, then 5%, and then peaks (a condition we label FIRE). did. One year later, we expanded this definition2 They include DISINFLATION (inflation is high and falling), ICE (inflation is low and falling), and REFLATION (inflation is low and rising). An homage to Robert Frost or George R.R. Martin, depending on your literary taste. Figure 1 shows the history of these conditions according to our definition (you can read about this in the footnotes and in his two parts referenced).

Figure 1. US CPI year-on-year change with inflation policy superimposed3

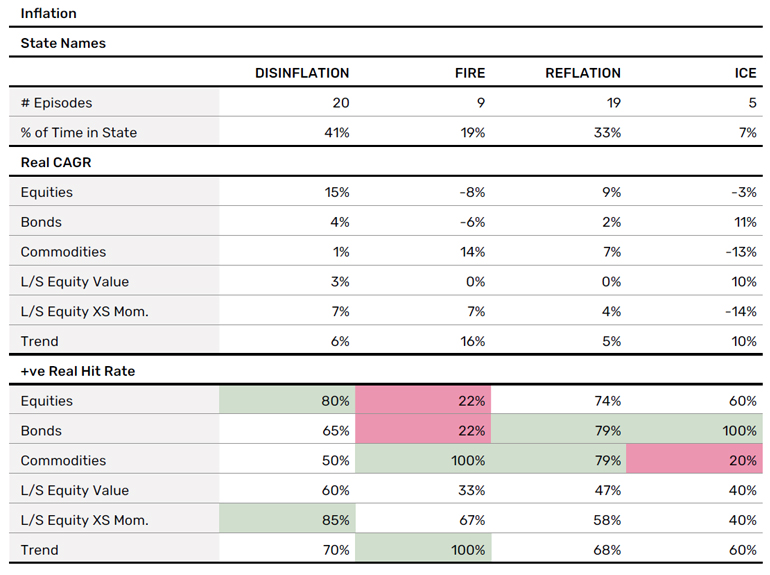

Figure 2 shows some statistics across these regimes. I could tell you a lot more, but for now I'll keep it simple. The top half of the table shows the real annualized return (strength of the state signal) and the bottom half shows the hit rate (signal persistence – red or green cells indicate consistently positive or negative performance; ).

Please read this carefully. However, considering that this momentum applies to many fields as well as finance, we will take a quick look at other proposed institutional variables using the same format of graphs and tables. Flick to the conclusion to see some overarching observations I distilled.

Figure 2. Summary statistics of the inflation regimeFour

real growth

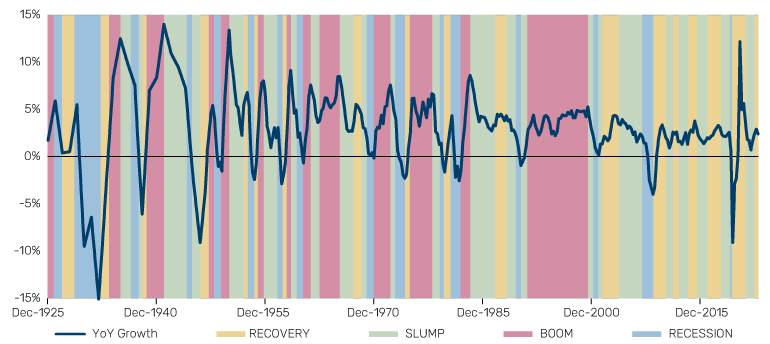

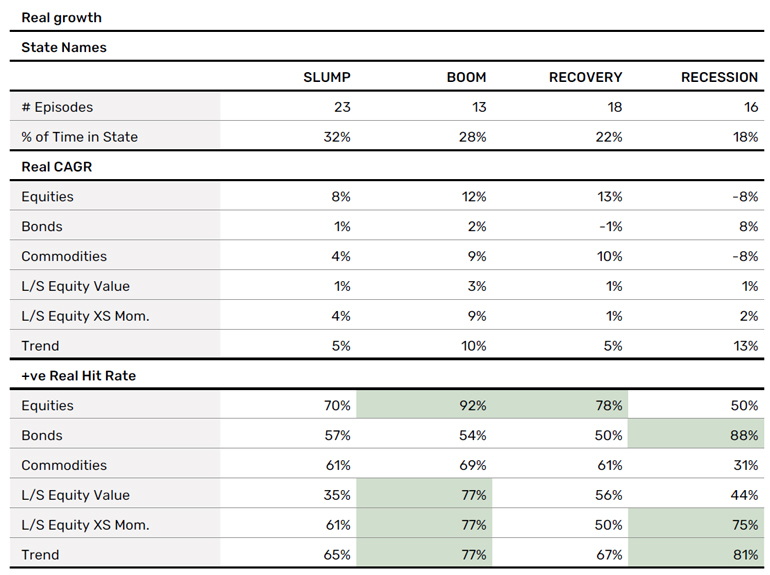

Figure 3 shows the situationally defined regimes of real growth. We use recessions as defined by the National Bureau of Economic Research (NBER) as our baseline. Additionally, using the same percentage threshold as for inflation, he defines three episodes. This works as you might expect. But simply put, BOOM is high and growth is rising, SLUMP is high and falling, and RECOVERY is low and rising.

Figure 3. Overlay of US real GDP year-on-year change and growth regimeFive

Figure 4. Growth regime summary statistics6

yield curve

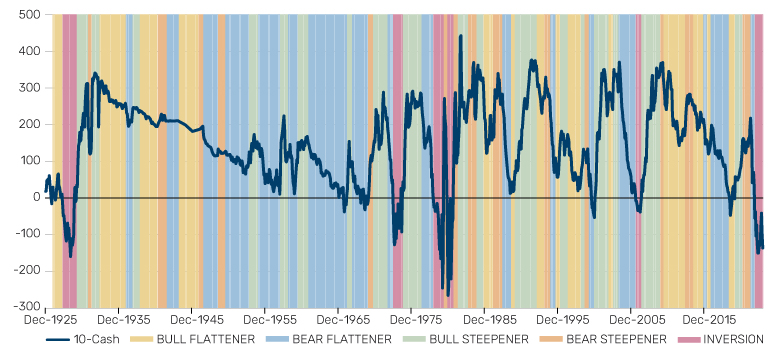

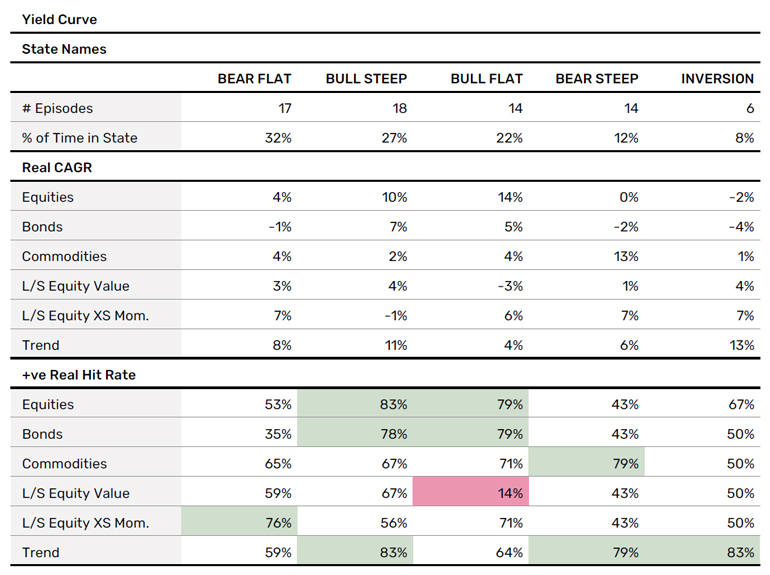

The shape of the yield curve, particularly whether its slope is positive or negative, is a source of enduring fascination with the Street. And, insiders say, it is also supported by academics.7 Figure 5 divides the history of the 10Y-3M curve according to a 2×2 matrix. That is, whether the entire curve is rising or falling (bearish and bullish, respectively), and whether its slope is steeper or flatter. Given our interest in curve inversion, we add this as a fifth regime state. Again, the exact definition is in the footnote.

Figure 5. Superposition of US 10-year to $3 million (in bps) and yield curve regimes.8

Figure 6. Summary statistics for the yield curve regime

stock market

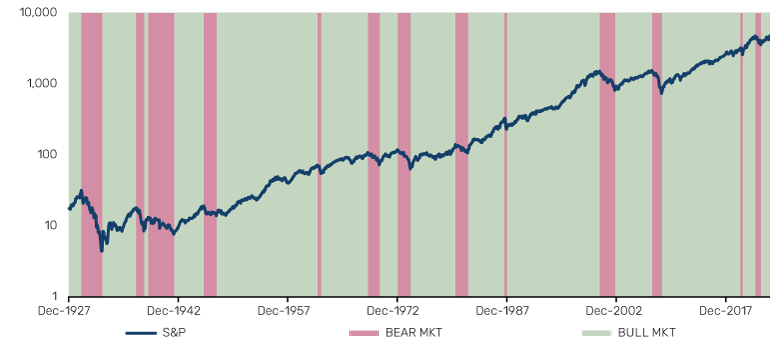

This is becoming somewhat of a reflex now, but the question of whether we are in a bull or bear market environment is often talked about. Many people may remember the wisdom of Old Partridge.9 The regime defined in Figure 7. Apologies to the purists, but I defined this by sight. Done is better than perfect.

Figure 7. S&P 500 with overlapping bull and bear market regimes (logarithmic scale)

Figure 8. Summary statistics of the stock market system

Financial policy

Figure 9 shows the actual federal funds rate in blue and the San Francisco proxy rate (which takes into account the effects of forward guidance and quantitative easing/tightening) in yellow. Based on this, we defined tightening and loosening cycles. Once again, I did this optically.

Figure 9. Actual federal funds rate and San Francisco Fed proxy federal funds rate overlaid with policy cycle.

Figure 10. Summary statistics of the monetary policy regime

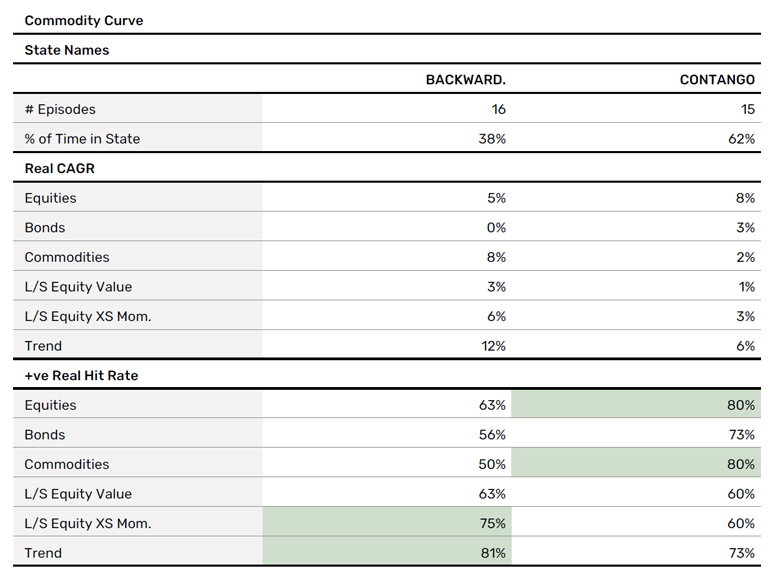

product curve

It's getting a little more difficult to understand. We do not hesitate to praise the great efforts of our competitors and refer our readers to this excellent paper on the long-term history of AQR's product performance.Ten. As part of this, we defined whether the entire futures curve is backwardated or contango. We took this data and created the regime shown in Figure 11, encompassing episodes where contango or backwardation was less than 6 months in the previous state.

Figure 11. Commodity curve regime

Figure 12. Summary statistics for the commodity curve regime

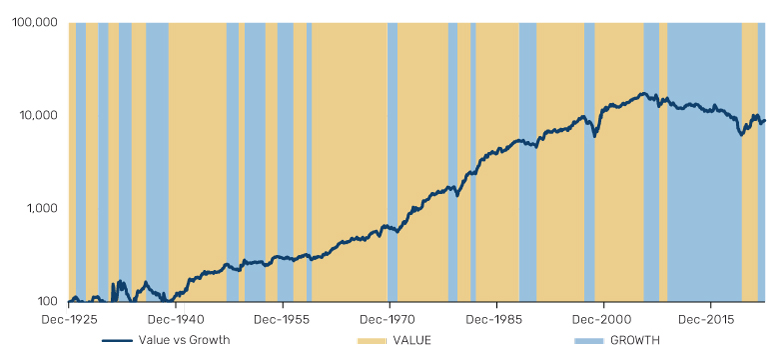

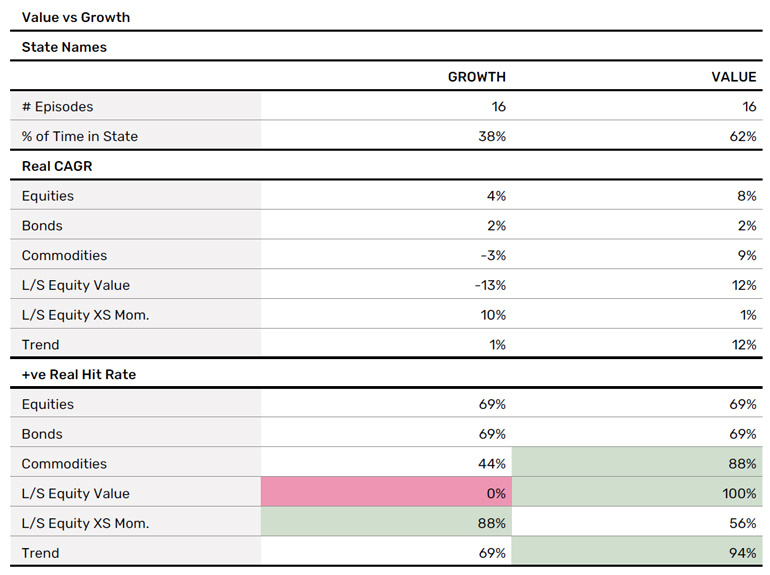

value and growth

Do investors value promises or payments? Figure 13 shows the long-term performance of the Fama-French HML factor (as a proxy for the strategy of buying cheap stocks and selling expensive stocks) compared to value (yellow). It is divided into state and growth (blue) state.

Figure 13. FF HML performance overlaid with value and growth regimes (100, rebased on logarithmic scale)

Figure 14. Value and growth regime summary statistics

In summary

Here are nine observations drawn directly from the data. I know it should be a 10, but I force myself to do it.

- Inflation is perhaps the most predictable of the regime's frameworks, both in terms of the magnitude of its returns and the persistence of their direction. If you can use only one economic data point to guide your decision-making, you should use the U.S. composite CPI.

- By my definition, there hasn't been a real growth boom since the 1990s. Expectations are high for AI's productivity miracles.

- L/S stock value has always been one of the most difficult investment strategies to fit into an institutional framework. For example, it's a myth that we always benefit from high inflation, even if recent events have made it so. Indeed, the only heuristic that follows from the above is to stay out of the yield curve when it is bullflattening.

- Stock bull markets are 80% of history. Remember a simple lesson…

- Bonds are positive (in real terms) in just over half of equity bear markets. Historically, there have been better defensive diversification tools than traditional equity foils.

- Equities have almost always performed well when real growth has been strong and monetary policy has been easy. Trends almost always work when values are on the Ascendant. These are thick pitches.

- Trends and commodities have always worked in conditions of high and rising inflation. Bonds have always worked in deflationary environments, as well as when monetary policy is easy. These are obese pitches.

- L/S Equity XS Mom. has so far achieved a real 10% in states with poor value performance, and vice versa, he has achieved 1%. There's a reason these two are often seen as bed buddies.

- Consistency of momentum in both time series and cross sections. L/S Equity XS Mom on almost every framework. All states have a positive trend more than half of the time. This is partly by design, as many regime definitions include a constraint that regimes cannot be shorter than 6 months. But it also suggests that the pattern will often reassert itself if it can survive the initial reversal.

Actually I was thinking 1 in 10. There is no silver bullet. All regime frameworks, at least all the frameworks examined here, are messy. Things are going well to some extent, but not definitively and not to a relaxing degree. Nature of work. Sigh. we will continue to fight. The beatings continue until morale is restored.

1. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

2. https://www.man.com/maninstitute/varying-by-degrees-fire-and-ice

3. Inflation regime defined by Mangroup's DNA team according to the following rules. FIRE: If CPI YoY exceeds his 2% and peaks above 5%. ICE: CPI goes below 1%, then below -1% and ends at the bottom, or goes through -4% and back. DISINFLATION: If CPI has declined on a past 12-month basis and is neither FIRE nor ICE. Also assume that DISINFLATION cannot follow ICE. REFLATION: CPI has increased over the past 12 months and is neither FIRE nor ICE. Also assume that REFLATION cannot follow FIRE.

4. For stocks, use data from Kenneth French. Bonds use a variety of archival sources from the Bloomberg Barclays 7-10 Year Treasury Aggregate Bond Index as and when it becomes available. For Commodities, we use the AQR Equal Weight Commodity Futures Index, followed by the Bloomberg Commodity Equal Weight Sector TR Index. L/S stock value and SX mom. Fama-French HML and Mom. Each is a factor that adds the cash rate and subtracts the 2% cost. The trend is the unique historical backcast that the Man AHL has built dating back to his 1900s and his 50% performance in average excess revenue over that period minus his haircut. It will be connected and available to the Société Générale Trend peer group.

5. Recession episode as defined by NBER. Boom: A period when the growth rate peaks above 2% and above 5%. SLUMP: Growth is declining on a 12-month basis, so it's neither a boom nor a recession. Recovery: Growth has increased on a 12-month basis, and we are not in a boom, recession, or ice age.

6. All asset data is the same as in Figure 2. This is the same for all subsequent summary statistics tables.

7. Professor Campbell R. Harvey, an advisor to the Man Group, was one of the first to comment on the link between inverted yields and recessions. 1988, “Real Term Structure and Consumption Growth”, Journal of Financial Economics, Vol. 1988, “Real Term Structure and Consumption Growth”. 22, No.2, pp.305-333

8. Bloomberg Yield Curve Data. The state is defined as: First, we look at whether the curve is flattening or steepening, defined as the change in the shape of the curve over the past 12 months. Next, look at whether the average 10-year and 3 million interest rates are going up or down. Past 12 months (bears and bulls, respectively) – Next, observe if the curve is inverted. Curve inversion takes precedence over all other states. Some short reversals will not appear as such because we exclude conditions less than 6 months old and extend conditions on both sides in such cases.

9. If you don't, you should hurry up and read Edwin Lefebvre's book. Reminiscences of a securities man.

10. Reference: https://www.aqr.com/Insights/Research/Journal-Article/Commodities-for-the-Long-Run

Index definition

Bloomberg Barclays 7-10 Year Government Bond Index

The index measures the performance of the U.S. Treasury market and includes U.S. Treasury public debt with maturities ranging from, but not limited to, seven years up to and including 10 years. Certain special issues such as state and local government series bonds (SLGs), TIPS, and STRIPS are excluded.

Bloomberg Commodity Equal Weighted Sector TR Index

The index is designed to be a liquid, diversified benchmark for commodity investments, providing broad, equal-weighted exposure to commodities. No single product or sector dominates the index.

Societe Generale Trend Index

This is an equally weighted CTA fund index that calculates the daily return of a selected CTA pool from the world's largest managers.

AQR Equal Weight Commodity Futures Index

A measure of the performance of an equal-weighted portfolio of commodity futures using monthly data.