-

increase in revenue: Fourth quarter revenue was $44.5 million, an increase of 23.4% year over year.

-

Improving gross profit margin: Full-year gross profit margin expanded by 240 basis points to 24.7%.

-

Net income: Net income for the fourth quarter was $2.9 million, a significant improvement from the net loss of $0.20 million for the fourth quarter of 2022.

-

Adjusted EPS:Adjusted EPS for the fourth quarter was $0.18, compared to a loss of $0.03 in the year-ago quarter.

-

Increase in backlog: The company reported a healthy backlog of $103.5 million, up 2.4% sequentially.

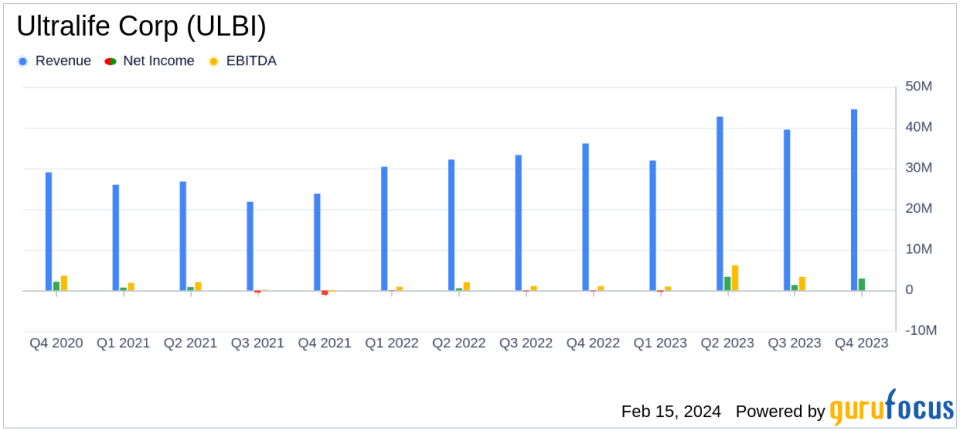

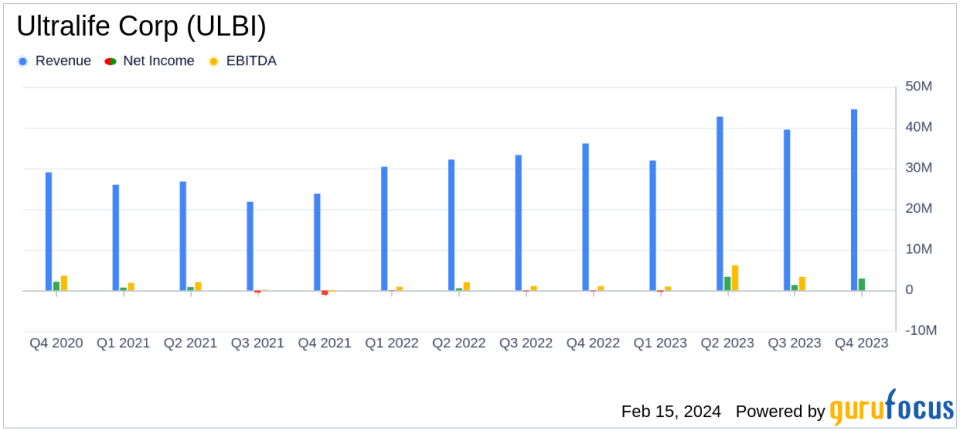

On February 15, 2024, Ultralife Corporation (NASDAQ:ULBI) released its 8-K filing, announcing its financial results for the fourth quarter and year ended December 31, 2023. The company offers a wide range of power solutions and communication systems. Fourth-quarter net income increased significantly globally, with significant increases in revenue and gross margin.

Financial performance summary

Ultralife Corp's fourth-quarter revenue jumped to $44.5 million, an increase of 23.4% compared to $36.1 million in the year-ago period. This growth was driven by government/defense sales up 28.8% and commercial sales up 20.2%. Sales in the Battery & Energy Products segment, the company's main source of revenue, increased by 11.1%, while sales in the Communication Systems segment recorded a notable increase of 121.9%.

The company's gross profit for the quarter was $11.4 million, or 25.6% of revenue, while its gross profit for the fourth quarter of 2022 was $8.1 million, or 22.4% of revenue. This gross profit improvement is due to more efficient level load production and improved price feasibility. Operating expenses as a percentage of revenue decreased, resulting in an increase in operating income of $3.4 million, for a total of $3.6 million for the quarter.

Challenges and strategic focus

Despite the positive results, Ultralife Corp faced challenges such as delays in parts from suppliers, which affected the telecommunications system's gross margin. However, the company's strategic focus on gross margin expansion, organic growth, and operating leverage, along with continued investment in new product development, positions it well for future growth.

Mike Mana, President and CEO, highlighted the company's performance and said:

Our strong fourth quarter results cap off a year of accomplishments on our top priorities of restoring gross margins through price enablement activities, supply chain improvements, level production and lean manufacturing initiatives. ”

He also emphasized that the company is focused on building on its momentum from 2023 to maintain profitable growth and generate increased cash flow.

Financial statement highlights

Ultralife Corp's balance sheet reflects its stronger financial position, with total assets increasing to $178.3 million from $168.4 million a year ago. The company also successfully reduced accounts payable and improved its cash position, ending the year with $10.3 million in cash, compared to $5.7 million in cash at the end of 2022.

The income statement shows a notable swing from a full-year loss to adjusted EPS of $0.52. Net income for the fourth quarter was $2.9 million, a significant improvement from the net loss reported in the prior-year period. Adjusted EBITDA for the quarter was $4.8 million, or 10.7% of sales, demonstrating the company's improved profitability.

Ultralife Corp's fourth quarter and full-year 2023 results reflect a company successfully navigating market challenges and executing on strategic initiatives. The company's focus on margin expansion, operational efficiency and product innovation has produced measurable results and positions it for continued success in the future.

For more detailed information, investors are encouraged to review the complete financial results and listen to the earnings conference call, which will provide additional insight into the company's performance and outlook.

For more information, see Ultralife Corp's full 8-K earnings release here.

This article first appeared on GuruFocus.