The euro hit a 20-year low in 2022, but the recovery since then has been modest at best. Looking at stock market performance, the S&P 500 index has outperformed his STOXX 600 index twice as much since the lows of the financial crisis, making things even tougher.

The issues highlighted today by ECB Executive Board Member Isabel Schnabel are:

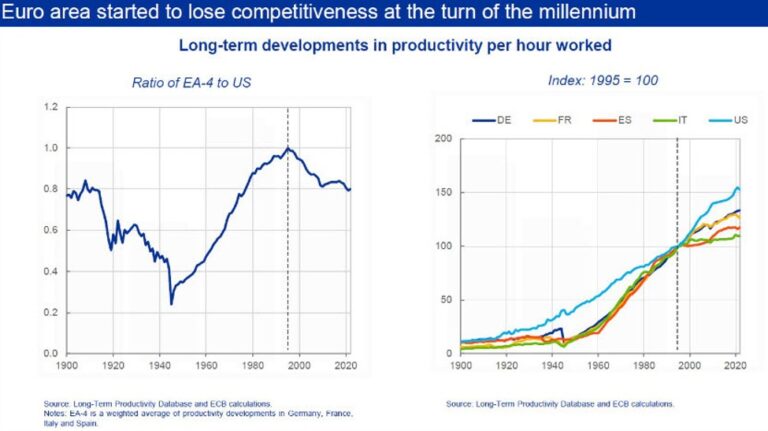

Comparison of productivity between Europe and America

She highlights several causes and solutions.

- The US invests much more in IT

- Europe's high barriers to entry protect rents for incumbents, suppress technology diffusion, and limit the entry of young companies.

- Lack of venture capital

- Companies in the euro area are smaller and smaller companies invest less in IT.

- “We need regulations that more strongly embrace and encourage competition.”

- Although the single market allows companies to compete, integration remains disappointing, especially in market services.Financial markets also remain fragmented, contributing to capital misallocation

- Further public investment is needed at national and European level

Mr. Schnabel argues that there is an urgent need to resolve Europe's energy and demographic problems, and that this is the only way to promote a long-term reversal of the euro.

Schnabel:

“Transforming from laggard to leader requires a virtuous cycle between investment and productivity growth. We need to put it to good use.”