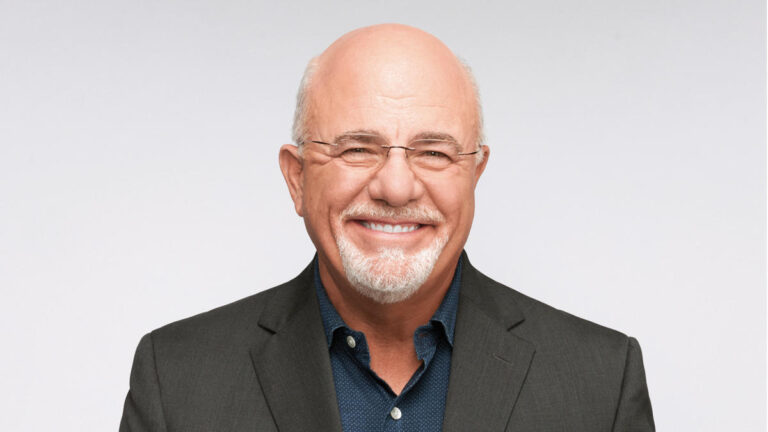

You may want to downsize your home for a variety of reasons. Maybe your children are already adults, you're nearing retirement, or you just want to save money. Whatever the reason, financial guru and podcast host Dave Ramsey says that while doing so may feel like a step back at first, “on closer inspection it's quite a step back.” The benefits will become clear.”

See: How long will $1 million in retirement benefits last in each state?

Search: 6 genius things every wealthy person does with their money

“Save money, save time, and reduce clutter in your life. Downsizing may be just the fresh start you and your family need!” he claims in the article. did.

sponsor: Do you owe the IRS more than $10,000? Schedule a free consultation to see if you qualify for tax relief.

Reduce your mortgage payments and “snowball your way out of debt”

If your mortgage is reduced, you can use the freed up money to pay off your debt.

“Let's say you owe $18,000 in student loans. If your interest rate is 6% and your minimum monthly payment is $200, you'll be paying that loan for another 10 years,” Ramsey wrote.

Read: Barbara Corcoran says, 'Forget about Florida and move here for a cheaper home'

increase retirement benefits

Once you're debt-free, Ramsey argued, it's time to start building wealth for the future. He recommended investing 15% of household income in Roth IRAs and pre-tax retirement plans.

“If you're still pushing your way to 15%, that extra $500 can be the fuel to get you there. And $500 can make all the difference!” he says. I have written.

The third financial benefit of downsizing is that you can use that extra money to replace your home with a paid-off mortgage.

“Take the money you get from selling your current home and pay cash to buy a smaller home. Imagine what you could do without a mortgage,” Ramsey argued.

Additional financial benefits of downsizing your home

As Experian explains, downsizing can also reduce your utility bills. The same goes for eliminating gardens and lawns, which can significantly reduce your water bill.

Plus, according to Experian, smaller homes are generally cheaper to insure.

Ultimately, your taxes may also be lower.

According to Experian, “square footage is an important factor when assessing a home's value for tax purposes, so smaller homes generally result in lower property taxes,” in states with low or no income taxes. states that it may be wise to consider moving to . Fixed asset tax and consumption tax.

“Florida and Nevada are popular retirement reduction options, in part because they have no state income tax,” Experian noted.

GOBankingRates Details

This article originally appeared on GOBankingRates.com: Dave Ramsey: 3 Financial Benefits of Downsizing Your Home