Investors can approximate the average market return by purchasing index funds. While individual stocks can be big winners, there are many stocks that fail to generate satisfactory returns. unfortunately, Formerly Second Bancorp Co., Ltd. (NASDAQ:OSBC) share price fell 21% in twelve months. This is well below the market return of 23%. On the other hand, stocks are actually Up 19% over 3 years. Unfortunately, the stock's momentum remains quite negative, with it down 8.4% in 30 days. This may be related to recent financial results. You can see the latest data by reading our report.

With that in mind, it's worth checking whether a company's underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Old Second Bancorp.

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months when Old Second Bancorp's share price fell, it actually improved its earnings per share (EPS) by 36%. The stock may have been overvalued previously.

It's surprising that the share price has fallen so much even though EPS has improved. However, you may find another metric that better explains stock price movements.

Given the very low yield of 1.5%, I don't think the dividend will have much impact on the stock price. Old Second Bancorp managed to grow its earnings last year. This is usually a substantial plus. Fundamental indicators cannot easily explain stock declines, so there may be an opportunity if the market overreacts.

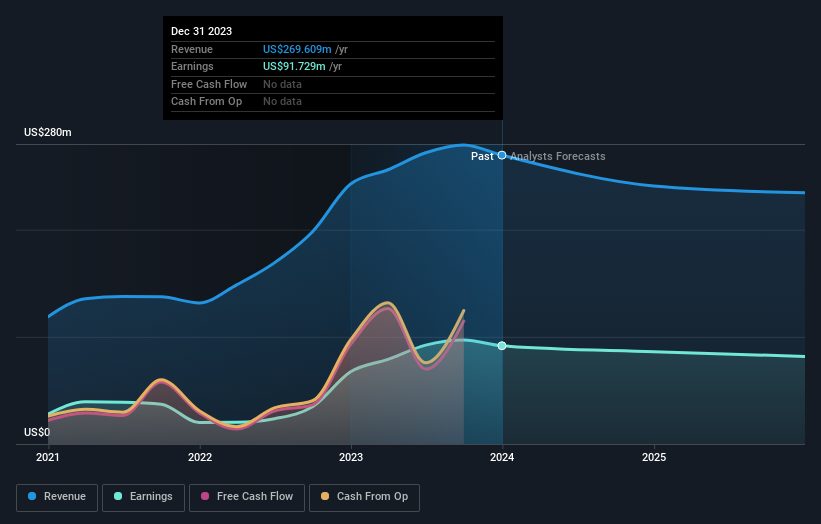

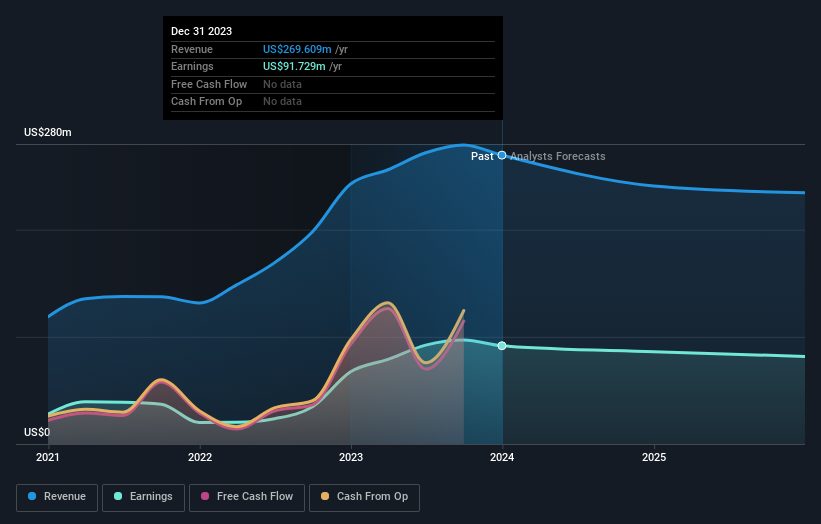

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that CEO salaries are lower than the median for similarly sized companies. While it's always worth keeping an eye on CEO pay, the more important question is whether the company will grow its earnings over the years. Find out what analysts are predicting for Old Second Bancorp in this article. interaction Graph of future profit forecast.

different perspective

Old Second Bancorp investors have had a tough year, with a total loss of 20% (including dividends), compared to a market return of about 23%. Even blue-chip stocks can see their share prices drop from time to time, and we like to see improvement in a company's fundamental metrics before we get too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 0.5% annualized loss over the past five years. I know Baron Rothschild said investors should “buy when there's blood on the streets,” but investors should first make sure they're buying a quality business. Warns you that you need to confirm. It's always interesting to track stock performance over the long term. But to understand Old Second Bancorp better, we need to consider many other factors. For example, consider the ever-present fear of investment risk. We've identified 1 warning sign We work with Old Second Bancorp and understanding them should be part of your investment process.

However, please note: Formerly Second Bancorp may not be the best stock to buy..So take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.