I am happy to report this. LINK ADMINISTRATION HOLDINGS LIMITED. (ASX:LNK) is up 94% in the last quarter. However, the fact remains that the returns over the past five years have been unsatisfactory. In fact, stocks are down 70%, far short of the returns you'd get from buying index funds.

Shareholders are down over the long term, so let's take a look at the underlying fundamentals over that time period to see if that's in line with the returns.

Check out our latest analysis for Link Administration Holdings.

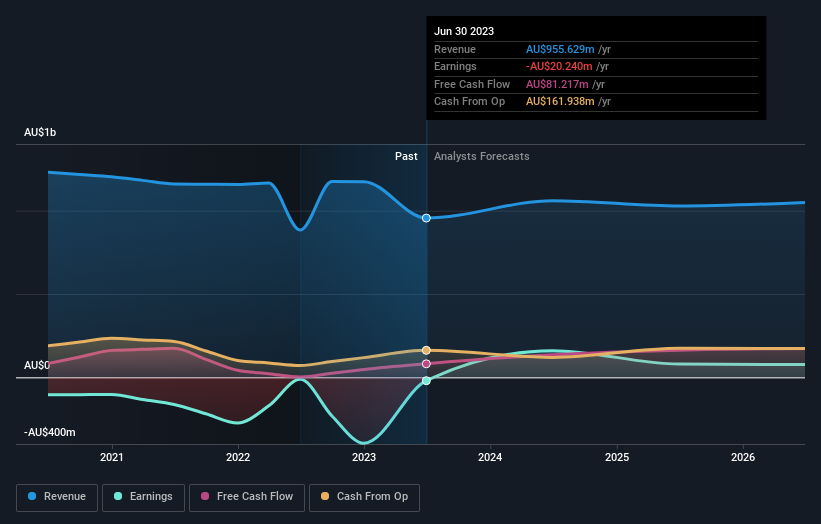

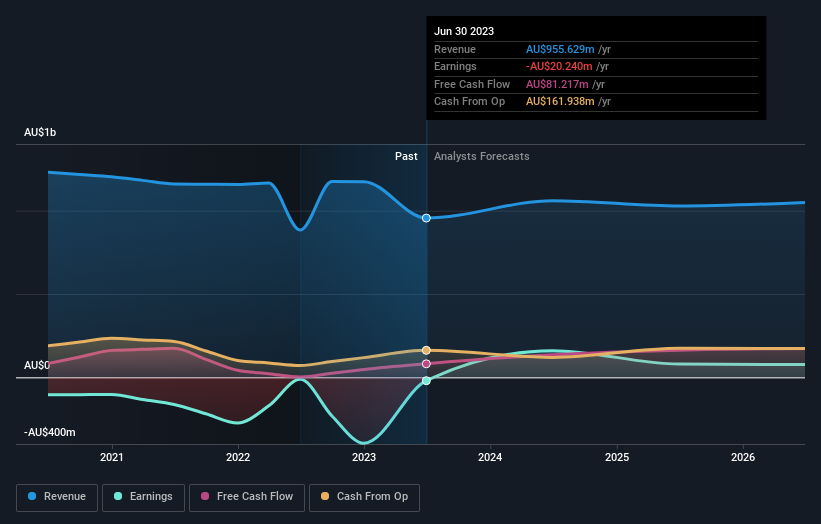

Link Administration Holdings hasn't made a profit in the last 12 months, so we're unlikely to see a strong correlation between its share price and earnings per share (EPS). The next best option is probably revenue. Shareholders of unprofitable companies typically expect strong earnings growth. It's hard to be confident that a company is sustainable when its revenue growth is modest and it doesn't make any profits.

Over the past five years, Link Administration Holdings's revenue has decreased by 5.7% per year. That's not what investors generally want. Given that the company is losing money and its earnings are trending in the wrong direction, it's understandable that the stock price has compounded to fall 11% over five years. There seems to be less imminent chance of investors getting excited about this stock than Louise Brooks. In the end, it might be worth paying attention to. If earnings recover, stock prices may follow suit.

You can see below how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is important.It might be well worth taking a look at ours free Report how your financial situation has changed over time.

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. Coincidentally, Link Administration Holdings' TSR over the past 5 years was -32%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

We're pleased to report that Link Administration Holdings shareholders have received a total shareholder return of 11% over one year. Of course, this includes dividends. This is certainly higher than the annual loss of about 6% over the past five years. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. It's always interesting to track stock performance over the long term. But to understand Link Administration Holdings better, you need to consider many other factors. Note that Link Administration Holdings is still listed. 2 warning signs in investment analysis one of them is a little unpleasant…

We would further like Link Administration Holdings if we see some significant insider buying.While you wait, check this out free A list of growing companies with significant recent insider purchasing.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.