The main purpose of stock selection is to find stocks that beat the market. However, results among individual stocks in any portfolio are mixed.Therefore, it is not to blame in the long run Kinder Morgan Co., Ltd. (NYSE:KMI) shareholders are questioning their ownership decisions, and the share price has fallen 12% in five years.

It's worth assessing whether the company's economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let's just do that.

Check out our latest analysis for Kinder Morgan.

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

During 50 unfortunate years of declining share prices, Kinder Morgan actually saw its earnings per share (EPS) improve by 10% per year. Given the stock price reaction, one might suspect that EPS is not a good indicator of performance during the period (perhaps due to temporary losses or gains). Alternatively, past growth expectations may have been unreasonable.

It's strange to see the stock's performance so weak despite sustained growth. Perhaps other metrics can give you some clues.

A stable dividend doesn't really explain why the stock price is falling. It's not immediately clear why the stock is falling, but further research may provide some answers.

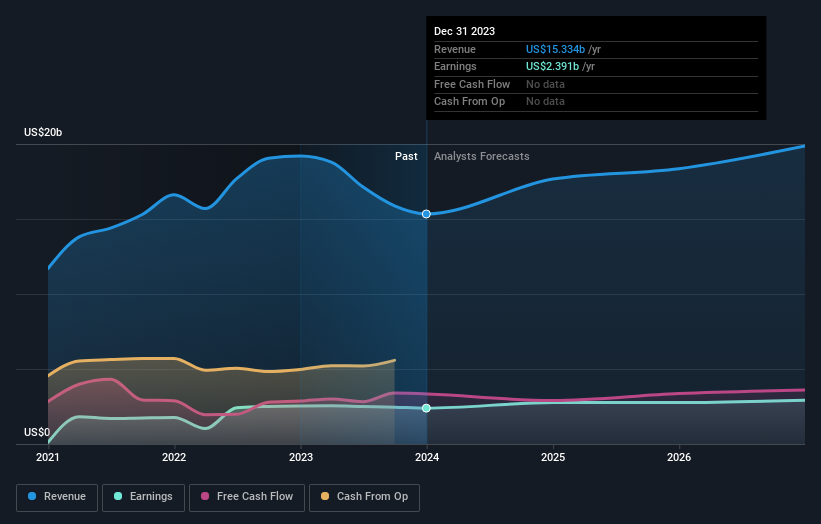

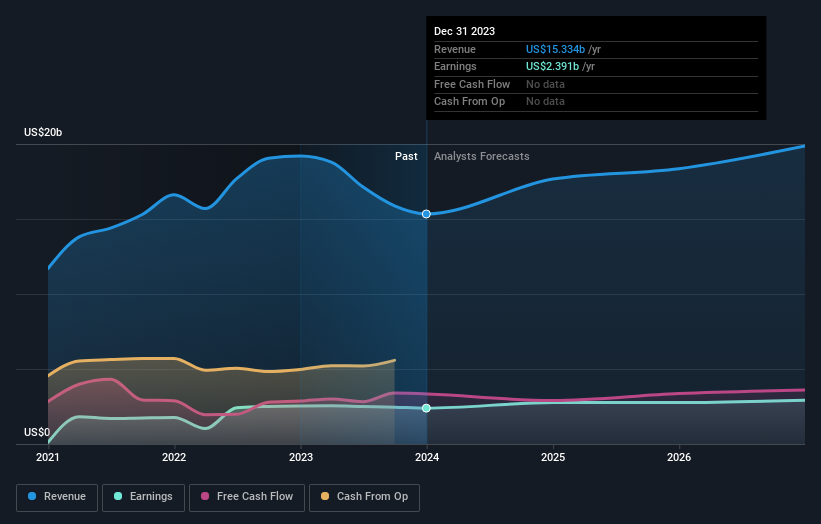

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that CEO salaries are lower than the median for similarly sized companies. But while CEO pay is always worth checking, the really important question is whether the company can grow its earnings going forward. So it makes a lot of sense to check how much profit analysts think Kinder Morgan will earn in the future (free profit forecast).

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. For Kinder Morgan, the TSR over the last 5 years is 21%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

Kinder Morgan shareholders are up 5.2% for the year (even including dividends). However, its returns are below the market. On the bright side, this is still a profit, and he's actually better than his five-year average return of 4%. This suggests that the company may be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.Still, note that Kinder Morgan shows 3 warning signs in investment analysis one of them is a little unpleasant…

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.