This week's best investment news:

Howard Marks: This investor raised billions by making complex ideas simple (David Perel)

Terry Smith: My Future as a Fundsmith Equity Fund Manager (AJ Bell)

Orphans of Japan (Verdado)

The $150 billion question: What will Warren Buffett do with all that cash? (WSJ)

Jim Chanos talks about the legendary Enron short bet 20 years later (CNBC)

Bill Ackman: Investments, Financial Struggles, Harvard University, DEI, X, and Free Speech (Lex Fridman)

Charles Munger – The life and legacy of a famous deceased friend (fhmag)

Prem Watsa: Fairfax stock rebounds after short selling report, “the market has spoken'' (insurance company)

Super Investor Bruce Berkowitz (RWH) and Ignoring the Crowd

Number Goes Up (Rudy Havenstein)

Cathie Wood's $14.3 Billion Bombshell (QTR)

It's a Bull Market (Kingswell)

Morgan Housel – Selfish Writing, Fiction and Nonfiction, How to Connect Ideas (GS)

The End of History and the Triumph of the Fiat World (EP Theory)

Guy Speer's Library Tour – The Power of Reading and Learning for Wealth, Wisdom and Happiness (GS)

Easily avoidable (HumbleDollar)

Jim Bianco Interview (The Market)

Aswath Damodaran – Is the risk too big? Catastrophic Risks in Business and Investment (AD)

Ackman discount (net interest rate)

Master the long-term investment game (Safal)

Look at your fish (flyover stock)

What part of the market do you own? Part deux (Felder)

Transcription: Bill Dudley, New York Fed Director (Overview)

A fund with a yield of 94.9%? As you might imagine, there are pitfalls (WSJ)

First Eagle Investments: February Thoughts from the First Eagle Global Value Team (FEIM)

Polen Capital Management: The Rise of Emerging Market Banks (Polen)

This week's best value investing news:

About the sustainability of growth stocks and value stocks (AlphaArchitect)

Growth vs. Value Investing Explained (Forbes)

Interest Rates and IR: What a Rate Cut Means for Growth and Value Stocks (IRMag)

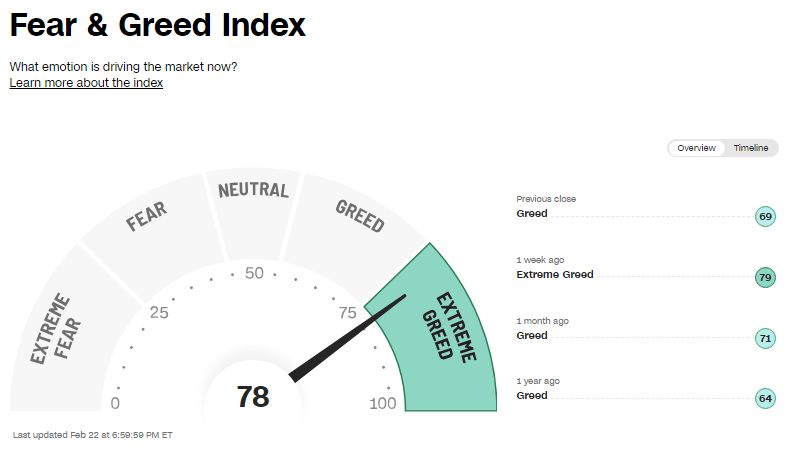

This week's Fear and Greed Index:

This week's best investing podcasts:

Super Investor Bruce Berkowitz (RWH) and Ignoring the Crowd

TIP608: Long Term Compound Interest (TIP) by Chris Mayer

Michael Mauboussin – Pattern Recognition and Open Markets (EP.370) (California)

Sian Bannister – Investing for a Higher Purpose (ILTB)

457 – Stop the Insanity (InvestED)

Will Thomson talks lithium, copper and more (BB)

Episode #521: “once in a generation” opportunity with GMO’s Tina Vandersteel (MF)

Has passive investing destroyed the market? | Mike Green (ER)

Ernest Scheider: The War Below (Lithium, Copper, and Critical Minerals) (VH)

#188: Brian Johnson: 5 Habits for a Long Life (KP)

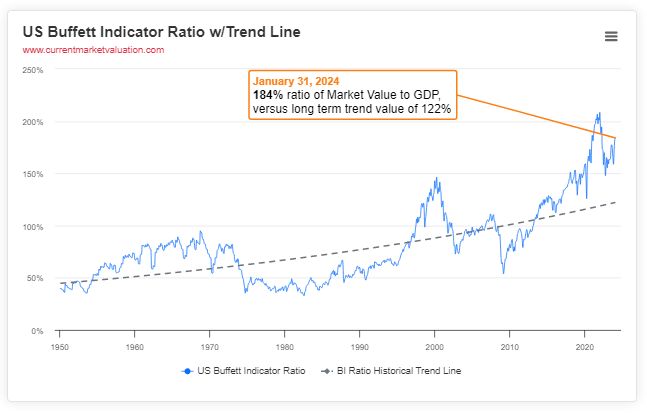

This week's Buffett indicators:

overrated

This week's best investment research:

A 140-year-old strategy is working (ASC)

Self-declared benchmarks and fund manager intentions: “fraudulent” or competitive? (Alpha Architect)

Low Volatility Factor and Occam's Razor (CFA)

Good companies and good stocks are not the same (DSGMV)

Best investment tweets of the week:

Is now a good time to add value?

Gotham Yield (as of February 20, 2024): 9.84%

Cheapest percentile: 18th

2-year average forward return*: 28.15%

*Based on historical research pic.twitter.com/coIZMqscrx— Tobias Carlyle (@Greenbackd) February 20, 2024

This week's best investment graphics:

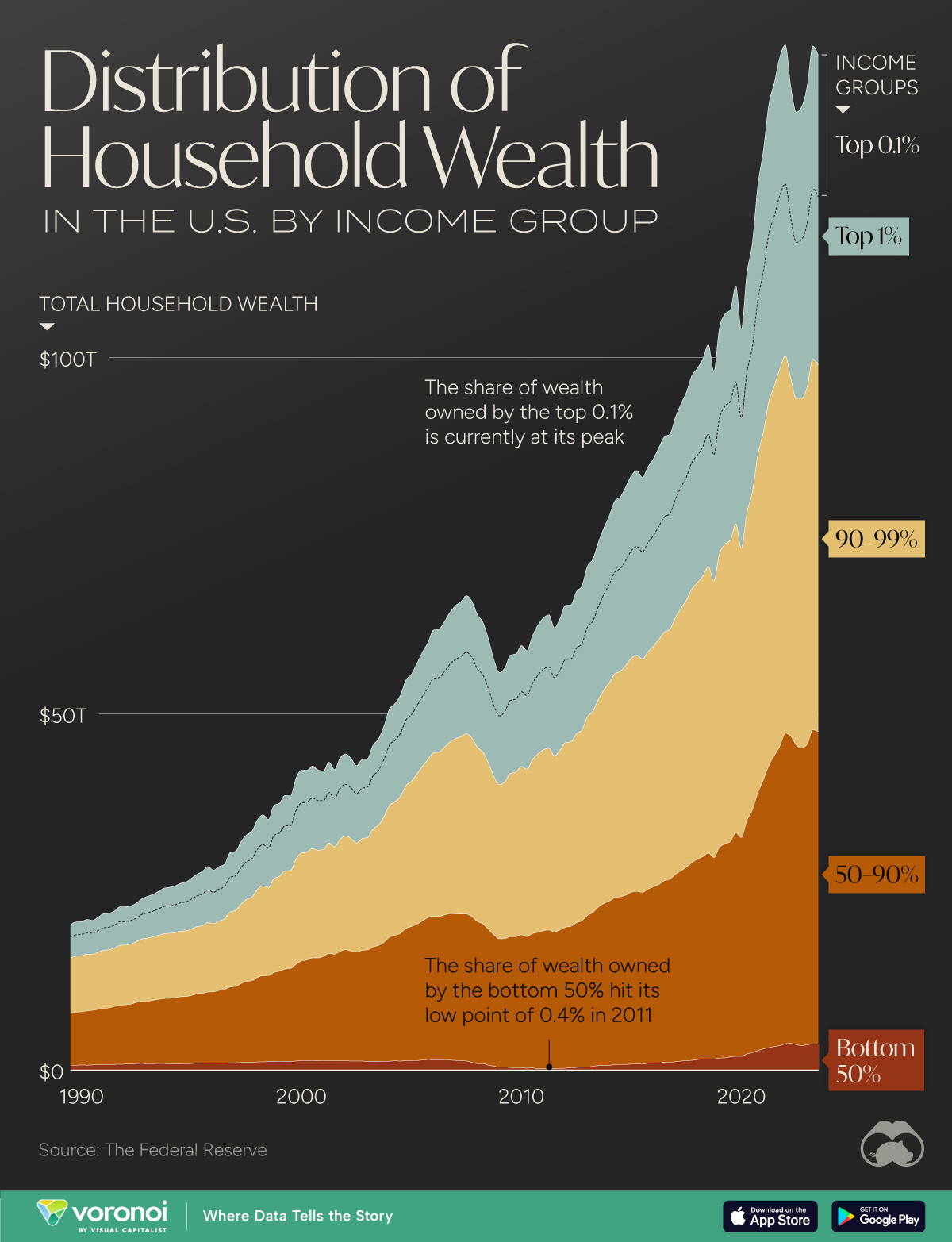

Visualizing the distribution of wealth in America (1990-2023) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

free inventory screener

Don’t forget to check out the free Large Cap 1000 – stock screener,here Acquirer multiple: