Too many new investors go from 0 to 100 miles per hour. I already know. That's exactly what I did when I started my job. There are many reasons why this happens, many of which go back to how human emotions work. Take it from someone who made a lot of mistakes in his early investing. A much better way is to start investing slowly as you learn.

The advent of exchange-traded funds (ETFs), which didn't exist when I started investing, makes them relatively easy to learn and invest in. There are many options you can get started with, but the really good ones are: Vanguard S&P 500 ETF (NYSEMKT: VOO).

Why start slow?

It's important to understand that everyone (everyone!) makes mistakes with investing. No one is perfect and no one has all the answers. The problem is that very few investors, especially successful investors, spend much time talking about their mistakes. It's much more fun to talk about the winners.

The problem here is that when you first start investing, one investment mistake can wipe you out. Emotionally, you may never invest again, which will likely have a negative impact on your long-term finances.

The solution is to jump in with both feet and stop risking everything on one investment. for example, Nvidia (NASDAQ:NVDA) is a hot stock today and all sorts of positive things are being said about it. However, the stock price is up over 250% in one year, which is an incredible increase in a very short period of time. New investors may see this and think there's no way this stock can lose, hoping the stock price will continue to rise. After all, this is an artificial intelligence play, and that's the big question of the moment.

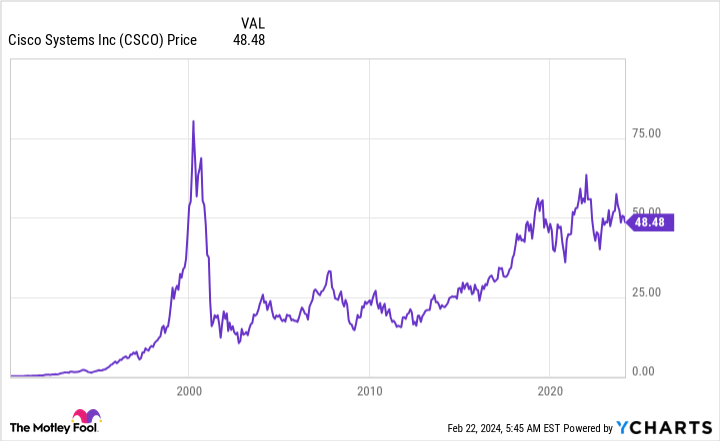

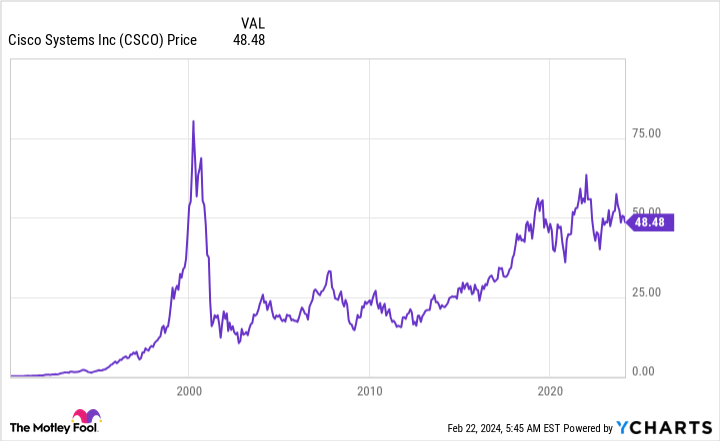

Nvidia may continue to rise, but anyone who's been on Wall Street long enough knows that trees don't grow skyward. Eventually, fickle investors will find another hot topic and abandon Nvidia. This is a pattern that repeats with great consistency for a variety of reasons, ranging from a slowing company's growth trajectory to, frankly, just boredom on the part of investors. As an example, Cisco Systems (NASDAQ:CSCO)another technology name, has yet to recover to the peak levels it reached before the dot-com crash at the beginning of this century.

The best way to avoid getting caught up in the Wall Street hype machine is to start broadly and gradually start to dip your toe into buying individual stocks. The Vanguard S&P 500 ETF lets you do just that.

What is the Vanguard S&P 500 ETF?

Exchange traded funds are pooled investment vehicles in which many investors provide capital to professional managers who invest in groups. One of the biggest benefits of this is that pooled investment vehicles can typically purchase a more diverse portfolio than a single member of the pool could purchase on their own. The Vanguard S&P 500 ETF is S&P500 indexas the name suggests.

The S&P 500 index is one of the most commonly used market barometers. You'll find it very easy to track the “story” behind your investment performance in the Vanguard S&P 500 ETF. It helps you learn while investing. It's also a broad market agent, giving you a diversified portfolio that helps limit the damage from owning poorly performing stocks (remember, even the best investors make mistakes) .

The S&P 500 Index is a carefully selected list specifically intended to be representative of the U.S. economy. So there is some human intervention in the mix, and the overall portfolio is unlikely to be too focused on his one area. That said, the index is weighted by market capitalization, so the largest companies are allocated the most cash. The largest companies are usually among the best performing, so this subtle way of concentrating a little more on a few stocks usually ends up being a net gain.

But the best part is that the Vanguard S&P 500 ETF is incredibly cheap to own, with an expense ratio of just 0.03%. That means a single investment gives him exposure to about 500 stocks (plus all the diversification and other benefits that come with it), and he only gets paid 0.03%, which is very low on Wall Street. It's a number. The only potential downside is that the dividend yield is only around 1.4%, but that's to be expected given the size of the portfolio.

Start with ETFs and prepare for the next step

So, start by opening a brokerage account and purchasing the Vanguard S&P 500 ETF. Keep saving your money and invest in this diverse market agency. And read everything you can about investing and the markets. Once you have some money saved up, buy a stock for a few thousand dollars, or no more than 5% or 10% of your nest egg. If you like the experience, keep learning and investing more. If not, you can stick with the Vanguard S&P 500 ETF for life.

Should I invest $1,000 in the Vanguard S&P 500 ETF right now?

Before purchasing Vanguard S&P 500 ETF shares, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and the Vanguard S&P 500 ETF wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 20, 2024

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has positions in and recommends Cisco Systems, Nvidia, and Vanguard S&P 500 ETFs. The Motley Fool has a disclosure policy.

What's the best way to invest in stocks without any experience? Start with index funds.Originally published by The Motley Fool