Nikolai Ponomarenko

I have been following Green Thumb Industries (OTCQX:GTBIF) closely and have done so since it went public in 2018. I think the company has a decent business and one of the best balance sheets of the major MSOs. The company that does this is The company's fourth quarter report will be released on Tuesday afternoon, and to me it looks overvalued compared to its peers. Currently, my model portfolio does not touch on it.

The last time I wrote about this was in late December, I said it's not the best way to invest in cannabis. Although stock prices are rising, this is not the best way to invest in cannabis. Prior to that recent article, I wrote about it in his late July, suggesting it's not a good time to buy a GTI. This was not true, as four weeks after this article news of a possible schedule change hit the market. on the other hand, Since then, the stock price has risen significantly, and the earnings of its peers have also improved. My first article was near the beginning of 2023 on him, when he explained: Cheap but not the cheapest.

The stock price has increased significantly since the beginning of 2023, and I am worried about the future. Downgrade from Neutral to Sell. I don't think GTBIF is the worst of his MSO investments, but I do think it's a bad investment at this point.

GTI Q4

Today, we shared a preview of our upcoming fourth quarter report this week with members of our investment group. Analysts expect GTI to generate revenue of $270 million, up 4% from a year ago. Adjusted EBITDA is expected to decline 4% to $78 million. Third-quarter revenue was $275 million, up 5% year over year, and adjusted EBITDA was $83 million, down 2%. Therefore, revenue growth and profit growth are expected to be slower than last year and continue to decline thereafter.

GTI's balance sheet remains stronger than those of its peers. At the end of the third quarter, it reported $299 million in debt and $137 million in cash. We pay much less corporate tax than our peers, and our current ratio (current assets divided by current liabilities) is 2.1x, which is much better than our peers.

GTI outlook

In its last article in late December, analysts expected 2024 sales to rise 7% to $1.116 billion and adjusted EBITDA to rise 6% to $331 million, Sentieo said. It is said that he was doing so. Currently, sales are expected to decrease slightly to his $1.115 million, and adjusted EBITDA to his $329 million, an increase of 6%.

The 2025 forecast, compiled by seven of 17 analysts, was for sales of $1.231 billion and adjusted EBITDA of $379 million. We now expect revenue to increase slightly by 11% to $1,237 million, and adjusted EBITDA to increase slightly by 16% to $381 million.

Even if the cannabis sales schedule changes, GTI's revenue should not increase significantly. Adjusted EBITDA will also not increase. However, if taxes are reduced, cash flow will improve. The cannabis sales schedule should change, but there is no way to know if or when that will happen.

GTI chart

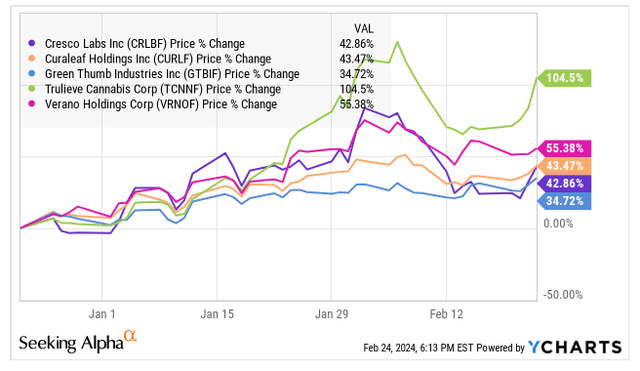

GTI is having a strong year at +26.5%, the worst of the Tier 1 MSOs. My third GTBIF article on him was published in late December, so this one is as well.

Y chart

Currently, I am not involved with any of the Big 5 MSOs in my modeling portfolio. I really like Trulieve (OTCQX:TCNNF) and wrote about it in mid-November, stating that I still liked it despite the rally. I don't do that now because I downgraded to neutral in January.

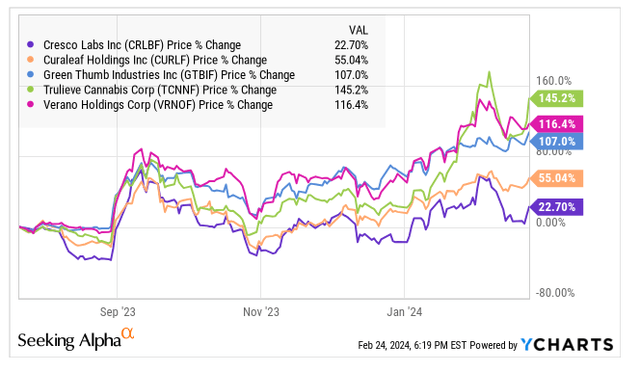

Back in July, when we published our second GTI article, GTI prices had more than doubled due to potential schedule changes. His average is up over 89.3%.

Y chart

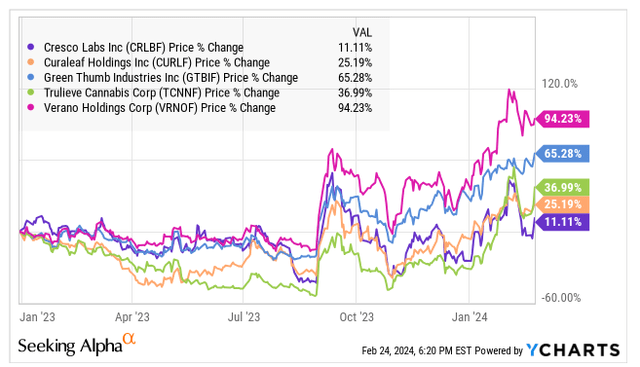

Well, if we evaluate its movements since my first article on Seeking Alpha a year ago in early January, GTI is in the middle of the pack, with a better than average return of 46.6%.

Y chart

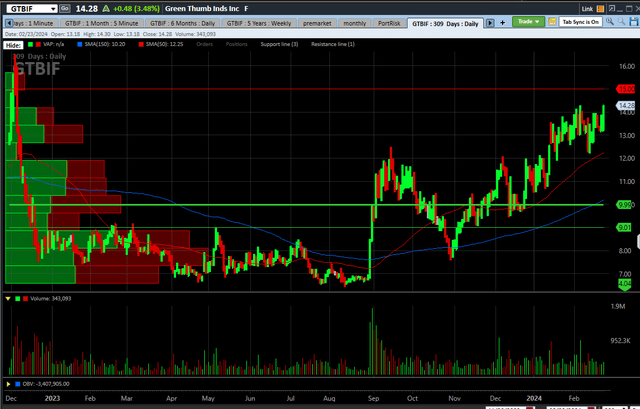

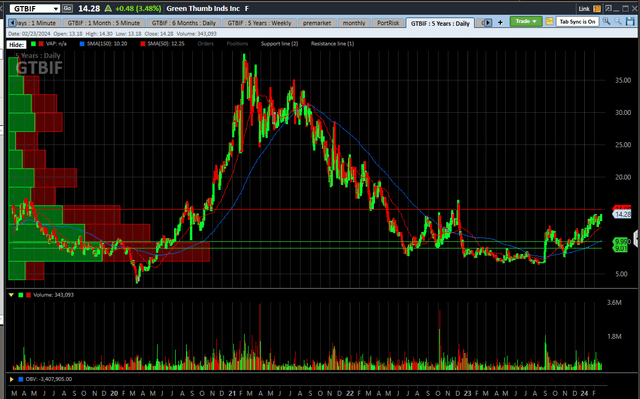

Looking at GTI's chart, the stock closed Friday at its highest since the late-2022 rally.

schwab

Volumes have declined from the levels reached in September. This chart shows resistance at $15 and support between $9 and $10.

The stock had hit a post-peak low in August, but it was still well above its 2020 low of below $4.

schwab

GTI is the only Tier 1 MSO that did not set a new all-time low in 2023.

big owner that scares me

Although GTI has lagged behind its peers, it has benefited greatly from the share gains in the AdvisorShares Pure US Cannabis ETF (MSOS) over the past few months. A few weeks ago, I warned investors that they should get out of ETFs, but they are now weaker than they were then. The article, written a few days into February, discussed how shares outstanding had soared 14.1% since the beginning of the year and 52.2% since August 25th. Three weeks later, shares are up 23.5% year-to-date.

Flows into MSOS led to purchases of GTBIF. The fund currently holds 18.58 million shares through swaps. This is a 23% increase since the end of the year due to inflows. However, despite this amount of buying, prices have lagged behind peers.

My concern is that if rescheduling doesn't happen, many buyers will consider selling. Share redemptions began near the end of 2022 and early 2023, and the ETF ultimately sold its MSOs. If something like this happens again, who will be the buyer? MSOS has his 26% of the funds in his GTBIF.

Valuations suggest the possibility of a major decline

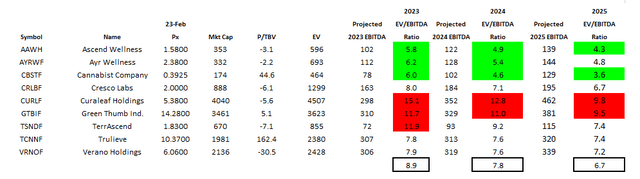

When you compare GTI to its peers, the stock doesn't look like an extreme outlier, but it does look expensive. I think many investors are encouraged by the company's better balance sheet than its peers. Compared to the other four Tier 1 MSOs, the company has the second-highest enterprise value to expected 2024 adjusted EBITDA ratio of 11.0x, which is higher than the average of 9.2x. Curaleaf (OTCPK:CURLF) stands out on the negative side, sharing strong selling from the first week of 2024 onwards.

If you look at Tier 1 and Tier 2 MSOs, the stock looks more expensive.

Alan Brochstein with Sentieo

I wrote about TerrAscend (OTCQX:TSNDF) a week ago and said it was the most expensive name in Tier 2, although it looked much better given its recent poor performance. I prefer Planet 13 (OTCQX:PLNH). It has a better balance sheet and a lower valuation relative to tangible book value than GTI. I wrote about why I liked it two weeks ago when it was $0.65 and it has since gone up. I still include it in my modeling portfolio.

I shared some goals for GTBIF with my investment group subscribers ahead of the Q3 report. In an optimistic scenario, we expected the stock to trade at an enterprise value of 10x projected 2025 adjusted EBITDA as 280E is retired. In the pessimistic scenario, we expected the ratio to be 5x because we still have 280E. This amounted to $14.85 in the optimistic scenario and $7.14 in the pessimistic scenario. Today I revised my goals to 12X and 6X. This puts the price up 31% to $18.76 and down 32% to $9.70. You could probably trade better than 12x, but you could also trade cheaper than 6x.

conclusion

In a previous article, I discussed the lack of attractiveness of GTI stock compared to some of its peers. Today, I will sell the stock at a lower price. MSO appears to be very ahead of the curve. GTBIF is a bit of a laggard, but the potential upside looks low compared to the downside. Indeed, I think some of his MSOs can have much bigger downsides than GTBIF. I prefer Planet 13. This could go up, but I think the downside is small.

I think MSO could go up once the 280E tax ends, but could go down significantly if it's not repealed. Investors can now buy NASDAQ-listed affiliates that they believe could benefit from the repeal of 280E by having stronger balance sheets and healthier customers.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.