Investors are often guided by the idea of discovering the “next big thing.” Even if that means buying “story stocks” that don't yield any returns, let alone profits. In some cases, these stories can cloud investors' minds and lead them to invest based on their emotions rather than the merits of a good company's fundamentals. Loss-making companies are not yet profitable, so the inflow of external capital may eventually dry up.

Despite the era of blue-sky investing in tech stocks, many investors still employ traditional strategies.Buy shares in profitable companies such as london security (LON:LSC). Even if the company is fairly valued by the market, investors would agree that generating consistent returns continues to provide London Securities with the means to add long-term value to shareholders.

See our latest analysis on security in London.

London Securities' earnings per share are increasing

If a company can continue to grow its earnings per share (EPS) over a long enough period of time, the stock price should eventually follow suit. Therefore, there are many investors who want to buy stocks in companies that are growing EPS. Over the past three years, London Security has grown his EPS by 15% per year. Assuming the company can maintain it, this growth rate is pretty good.

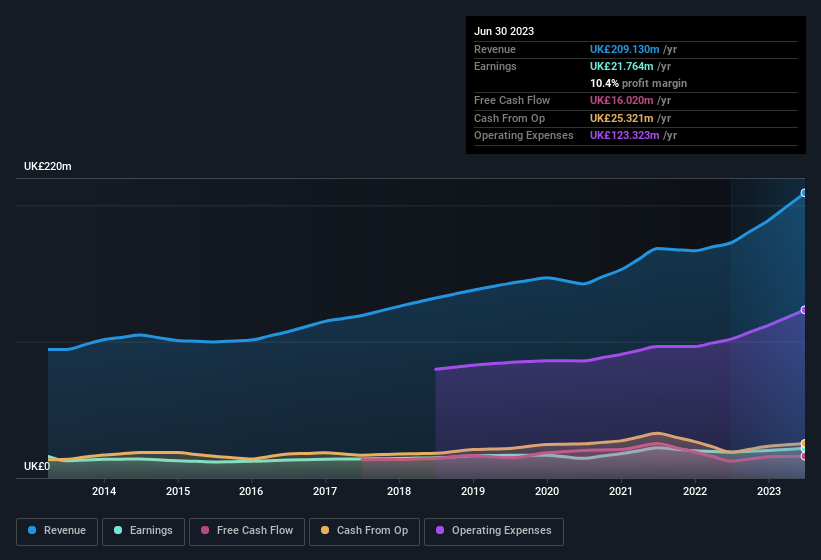

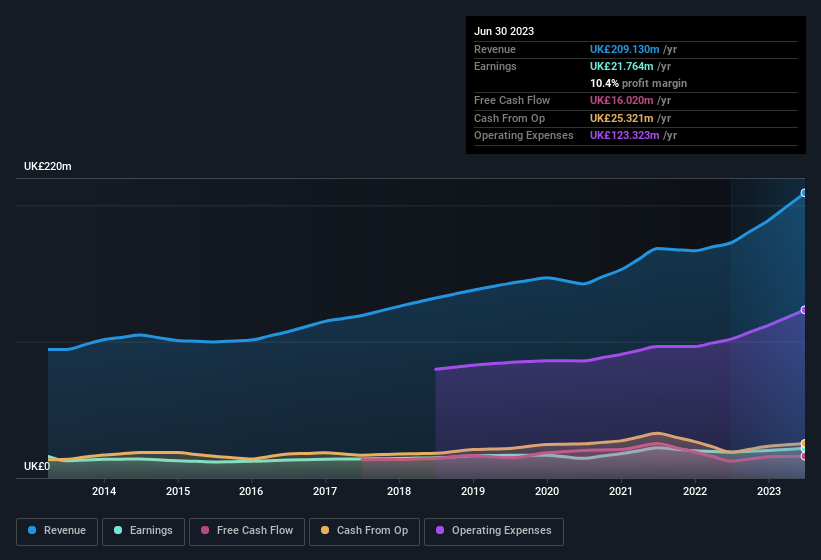

To reassess the quality of a company's growth, it's often useful to look at its earnings before interest and tax (EBIT) margin, as well as its revenue growth. We note that London Security achieved a similar EBIT margin to last year, but revenue increased 21% to UK£209m. That's progress.

The graph below shows how the company's revenue and revenue have trended over time. Click on the image for more detailed information.

While it's always good to see rising profits, you should always remember that a weak balance sheet could come back to bite you. So before you get too excited, check out the strength of London Securities' balance sheet.

Are London Securities insiders aligned with all shareholders?

It's good practice to check a company's remuneration policy to ensure that the CEO and management team aren't setting excessive salaries to prioritize their own interests over those of shareholders. The median total compensation for CEOs at companies similar in size to London Securities, with market capitalizations between GBP158m and GBP632m, is approximately GBP796,000.

The CEO of London Securities has received a total remuneration package worth £473,000 for the year to December 2022. This is below the average for companies of similar size and seems quite reasonable. Although CEO pay levels are not the most important indicator for investors, modest pay can support stronger alignment between CEOs and public shareholders. The argument is generally made that a reasonable salary level is evidence of good decision making.

Is London's security worth monitoring?

One key encouraging feature of London Security is that its profits are growing. In addition, our confidence in the board is strengthened by the fact that the CEO's compensation is reasonable. All things considered, it's definitely worth taking a closer look at security in London. However, before you get too excited, here's what I discovered. One London Security Warning Sign What you need to know.

While picking stocks with low earnings growth and no insider buying can still yield results, for investors who value these important metrics, promising growth potential and insider confidence are important. Below is a selected list of UK companies with .

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.