Gin

introduction:

We regularly write articles about different types of SWAN (Sleep Well At Night) strategies. One is a near-perfect portfolio strategy. For most people, investing isn't, and doesn't need to be, a hobby. Therefore, it is understandable that you should not invest. It becomes an all-consuming activity. In fact, research shows that taking fewer actions almost always yields better results. But at the same time, most people are looking for high growth, high recurring income, or a combination of both. Investing in a broad market index such as the S&P 500 (SP500) may be a reasonable strategy, especially for young people who are decades away from retirement.

Later in this article, we will explain that while the S&P 500 can provide reasonable returns over the long term, it is not without significant drawdowns. But for income-seeking investors and retirees, it's a failure. In two respects. First, it provides little income, which is the main objective for income-seeking investors. Secondly, the ride is usually very unstable and the timing of withdrawal can cause a lot of headaches and sometimes even serious problems such as a series of return risks (this is usually Occurs when a sharp multi-year correction occurs during the trading period). early stages of retirement). (The question, then, is how to form a portfolio that achieves income and growth goals without causing undue stress or anxiety to the owners. That's the purpose of this article.

What is hedging? Why do we need it?

Everyone's situation is different. However, we can only speak in generalized terms to represent the average investor. Most people cannot tolerate very large drawdowns in their portfolios, even if they don't need the funds for a long time. A very large drawdown can cause an emotionally stressful situation in which a person loses the ability to make rational decisions. Fortunately, the United States has not experienced a very severe correction (like the one in 2008-2009) for quite some time. Sure, there was a correction due to the coronavirus in 2020, and the S&P 500 saw a steep 35% decline, but it has since recovered very quickly from its lows. The S&P 500 has performed extremely well over the past decade, in fact, outperforming most strategies. However, this has not always been the case, and it is likely that this will not be the case in the future. We cannot say with certainty whether the S&P 500 will deliver the same level of return over the next 10 years, or even half as much.

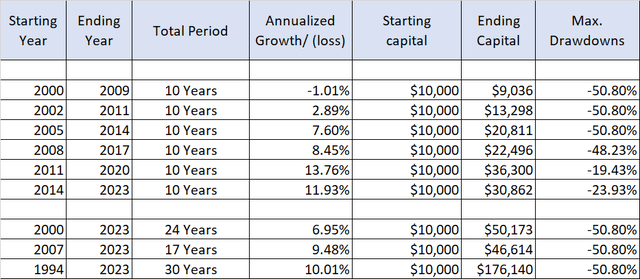

Table-1: 10-year annualized return of S&P 500 with different starting years:

author

So, the important thing to remember is that markets are unpredictable, and even if the returns are good over a period of time, the journey will be bumpy and sometimes very difficult. Some kind of hedging mechanism is needed to avoid large drawdowns. The problem, however, is that most types of hedging have costs, and those costs can be significant over time.

However, we are not talking about typical hedging mechanisms. But what we're talking about is allocating a portion of your portfolio to a rotation strategy that has a built-in hedging mechanism. Depending on the type of securities chosen, such strategies can also provide high growth or high income. The next section describes one such strategy.

What is a near-perfect portfolio strategy (NPP strategy)?

A strategy typically has three buckets. However, you can increase or decrease the number of buckets depending on your individual situation. I'll explain in a moment. The goal is very simple.

- Earn 5% to 6% of your income on an annual basis (withdrawable).

- Grow your capital (including dividends) to at least match or exceed the performance of the S&P 500 over 10 to 15 years.

- Roughly 60% or less of the S&P 500 (in extreme cases) to reduce volatility by 1/3 and minimize drawdowns.

At first glance, the goals seem ambitious, but the objective is to achieve these goals over the long term (10 years or more), although there is no guarantee that the portfolio will be able to achieve all of the goals each year.

Three buckets of nuclear power strategy

I. DGI – Dividend Growth Investing:

Investing in DGI is not complicated. You can start with just 5 stocks, but this is just the bare minimum. We recommend at least 10-15 stocks for better diversification. In fact, for retirees and conservative investors, the appropriate number may be even higher (such as 25 stocks).

Now, the first question that comes to mind is how to choose these 10 stocks (or more)? It depends on your goals.

If you're in an accumulation phase where yield is less important than growth, you should choose high-growth stocks like Mastercard (MA) and Microsoft (MSFT) over Verizon (VZ) and Realty Income (O). there is. Conversely, if you are in the exit stage, or plan to enter the exit stage soon, you should choose stocks like Verizon and Realty Income over Mastercard and Visa. If you're in the middle and want to pick 10 stocks, pick 5 high-dividend stocks and 5 high-dividend stocks. Similarly, if you decide to have 15 stocks, we recommend 5 stocks each from the high growth, medium growth, and high yield categories.

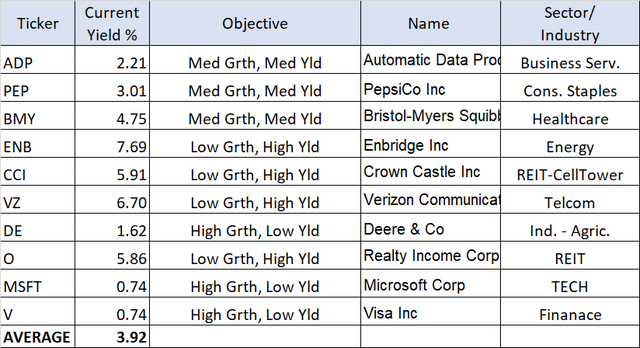

In this article, we will assume that the investor is 50 years old and wants to pursue a middle path. So we select his 10 stocks that range from low yield (high growth) to high yield (low growth). Select 3 high growth stocks, 3 high yield stocks, and 4 medium growth stocks (medium yield).

Note: Please note that I am only trying to provide an example of the type of inventory you need in this bucket. At this point, we have not gone into analysis of whether these prices are appropriate. Therefore, they should not be treated as purchase recommendations.

Stocks included: (ADP), (PEP), (BMY), (ENB), (CCI), (VZ), (DE), (O), (MSFT), and (V).

Table-2: DGI Bucket Portfolio:

author

II. High Income Bucket (CEF Investments):

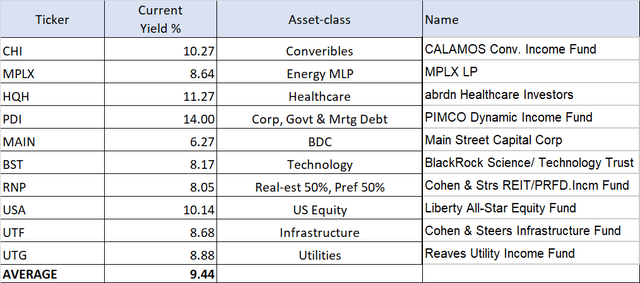

This bucket focuses on very high yields of 8% and above. Select around 10 funds or stocks with an average yield of 8% to 9%. The idea here is that this bucket takes on most of the risk while increasing the overall portfolio yield by at least 1.5 to 2 percentage points. You can expect some growth from this bucket (but not significantly). Most of our selections will be from CEFs (Closed End Funds), BDCs (Business Development Companies), REITs (Real Estate Investment Trusts), and Energy MLPs (Master Limited Partnerships). Now, as you can see below, this portfolio offers a yield above 9%, but it may not have much growth above 9%. Indeed, if you are in the accumulation phase, you can reinvest the entire proceeds in securities to provide decent growth over time. In some cases, drips may be even more beneficial as some funds offer additional discounts.

Funding included: (CHI), (MPLX), (HQH), (PDI), (MAIN), (BST), (RNP), (USA), (UTF), and (UTG).

Table-3: High income CEF bucket portfolio:

author

Note: Please note that MPLX is a master limited partnership and provides a K-1 form (partnership income) for tax purposes, rather than the regular 1099-DIV.

III. Hedge bucket (rotating bucket):

Remember, we started with the goal of having a SWAN (Sleep Well At Night) type of portfolio. We all want to have peace of mind while our investment portfolio is working to deliver high income and decent growth, right? That's where this bucket comes in. This bucket provides a degree of hedging for the overall portfolio, limiting drawdowns to acceptable levels in the event of a panic, recession, or major correction. This is also called a “rotating” bucket.

There are many variations of this bucket, and the Marketplace service offers many different types of rotating buckets. However, this article provides one such rotating bucket.

6% Income Asset Rotation Bucket:

Pool four securities of different stocks. asset class, We will choose two from among them and invest in them every month. At the end of each month, compare the total performance of the four securities over the past three months, select the top two securities, and invest your bucket capital in these two securities in the ratio of 2/3 and 1/3. That is, 66% is allocated to the first security (in terms of performance) and 34% is allocated to the second security. This process repeats every month.

List of 4 securities:

- Invesco QQQ Trust ETF (QQQ)

- iShares 20+ Years Government Bond ETF (TLT)

- SPDR Gold Trust ETF (GLD)

- Cash (in the form of money market funds).

Note: An example of a money market fund is Fidelity Govt. Money Market Fund (SPAXX). This ensures that we pay some interest every time our cash is left in a money market fund.

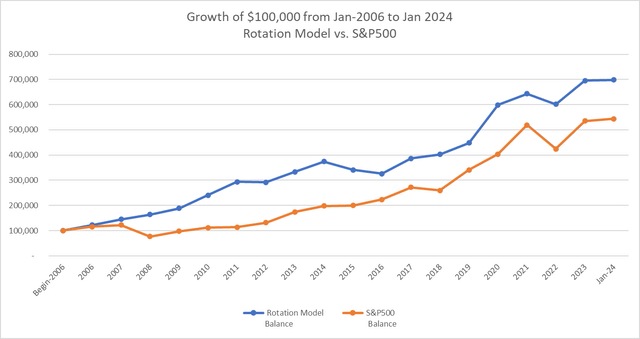

Backtested performance of rotating buckets:

This bucket performed very well in backtesting conducted over an 18-year period from January 2006 to January 2024. On average over 18 years, the S&P 500's annual return was 1.5 percentage points higher. More importantly, the drawdown was significantly lower at just -18.5% versus -51% for the S&P 500. Volatility was 25% lower than the S&P 500.

Chart-1:

author

A nearly perfect portfolio combined:

When we backtested the performance of this combined portfolio, here are some results from early 2008. Granted, if he had created this portfolio in 2006, it might have looked similar, but it wouldn't have been the same. Also, sticking to your strategy consistently over a long period of time is not easy and requires strong conviction. For the purposes of backtesting the DGI and CEF buckets, certain securities had to be exchanged as they did not have a very long history. For example, DGI replaced Visa with Mastercard. For the CEF bucket, in the past few years we have replaced BST with STK (Columbia Premium Tech Fd), PDI with PTY (PIMCO Corp & Income Opp Fd), etc.

Table-4:

|

Results (January 2008 to January 2024) |

A near-perfect 3-bucket portfolio** |

S&P500 |

|

annual rate of return [CAGR] |

11.74% |

9.75% |

|

$100,000 growth |

$596,400 |

$446,376 |

|

maximum.drawdown |

-22.5% |

-48.5% |

|

standard deviation |

13.8% |

16.18% |

|

market correlation |

0.63 |

1.0 |

**Allocation percentages for different buckets were taken as DGI bucket 42%, Rotation bucket 42%, and CEF bucket 16%.

Thoughts as a conclusion

There is no perfect or risk-free investment strategy. The above strategy deploys three separate buckets with their own goals and objectives. They also tend to have different attributes and behave differently from time to time, reducing volatility and maximizing overall returns. Additionally, the overall portfolio has his three goals: 5-6% return, 10%+ total return, and less than two-thirds of his S&P 500 drawdown. The backtest results show that this strategy meets all three of his goals. exceeded some.

However, you should keep in mind that these are backtest results and not actual results. There will always be some gap between the two. Additionally, future market conditions may differ materially from those of the past 17 years, and past performance cannot guarantee the same results. However, from what we see, this is a highly diversified portfolio, invested in many different sectors and asset classes, giving us a very balanced portfolio overall. We believe this portfolio will not only outperform the S&P 500, but also have less volatility and drawdown, making it a SWAN-like portfolio.