©Reuters.

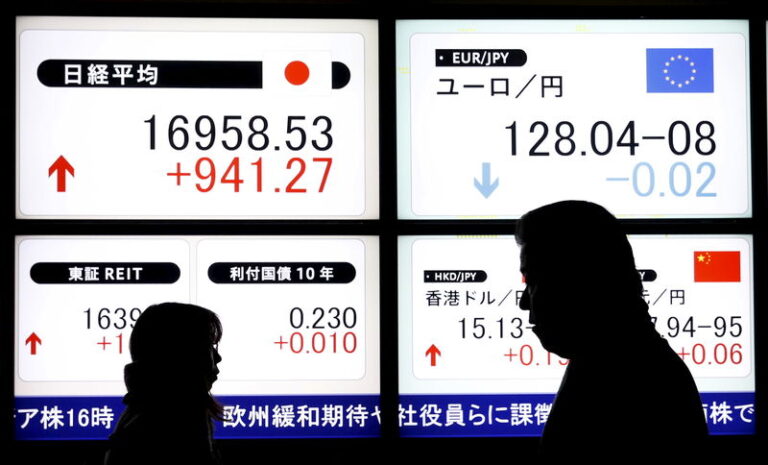

Investing.com — Japan's Nikkei 225 index edged lower in early trading Thursday after Federal Reserve Chairman Jerome Powell gave the clearest signal yet that interest rates are coming in 2024. It rose to an all-time high, following Wall Street's overnight gains after Federal Reserve Chairman Jerome Powell gave the clearest signal yet.

Speculation over a possible policy shift by the Bank of Japan also benefited large bank stocks, while the tech sector's rally appears to have subsided.

Immediately after the move, the stock rose by 0.6% to hit an all-time high of 40,499.0 points. The index has languished in the past two sessions after topping the 40,000 mark for the first time earlier this week.

While the recent rise in the Nikkei Stock Average was driven primarily by gains in technology stocks, Thursday's gains were led more by industrial and financial stocks.

Kawasaki Heavy Industries Co., Ltd. (TYO:) rose 8.3% to be the index's top gainer, while megabank Sumitomo Mitsui (NYSE:) Financial (TYO:) also rose nearly 4%.

Japanese stocks closed higher overnight on positive sentiment from Wall Street after Federal Reserve Chairman Jerome Powell said the Fed would eventually cut interest rates in 2024.

Powell gave no clear indication of the size or timing of the rate cut, but the market still rallied on expectations for lower lending rates this year.

In Japan, heavily weighted bank stocks rose as there was growing belief that the Bank of Japan was nearing the end of its ultra-low interest rate system.

Shares of Mitsubishi UFJ (NYSE:) Financial Group (TYO:), Japan's largest bank, rose 1.8%. Resona Holdings Co., Ltd. (TYO:) added 3.4%.

Official data released on Thursday showed the number of Japanese employees rose by 2% in January, more than expected. Other data also showed real wages fell at the slowest pace in 13 months.

Rising wages are one of the main factors the Bank of Japan is considering when raising interest rates for the first time since 2007.

The central bank plans to raise interest rates by March or April 2024 at the earliest.