Wall Street has a tendency to get overly excited about things, often projecting strong financial performance over one or two quarters into the indefinite future. When this happens, investors can push stock prices to levels that seem unrealistic in hindsight.

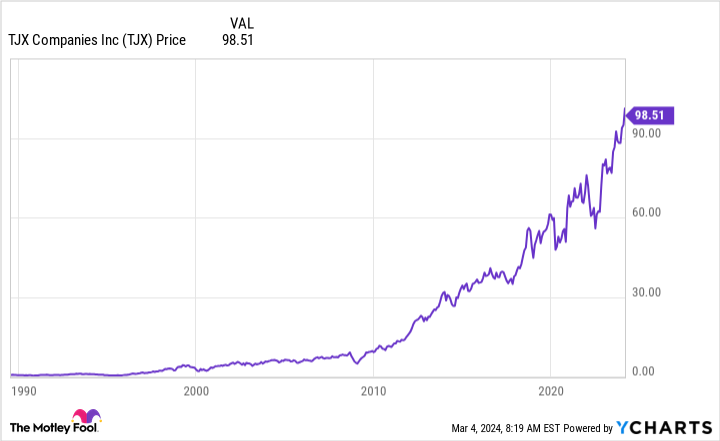

TJX companies (New York Stock Exchange: TJX) is currently trading near all-time highs after announcing strong financial results for FY2024. Are investors too optimistic about the discount retailer's future performance?

TJX had a very good year.

In Q4 FY24, TJX was able to increase same-store sales by 5%. This exceeded even our internal expectations. It was definitely a powerful show. Notably, much of the increase was due to increased store foot traffic. In other words, more people are looking for the deals that TJX offers customers at its multi-brand off-price stores, including TJ Maxx, Marshalls, HomeGoods, HomeSense, Winners and Sierra.

It's clear that the company's business model is currently resonating with people. Add to this the company's plans to open new stores, and the future certainly looks pretty bright. Wall Street has bought into the story, pushing the retailer's stock toward all-time highs.

However, a potential problem arises when you start considering valuations. For example, the price-to-sales ratio is near the highest level in the company's history. The only time it was higher was during the early days of the coronavirus pandemic, when stores were closed, sales plummeted and valuations were severely distorted. Basically, when you look at this metric, Wall Street is valuing his TJX stock higher and higher. Additionally, increases in the price-to-earnings ratio, price-to-book ratio, and free cash flow multiple suggest that the stock is currently well-valued, if not overvalued.

If Wall Street is overly optimistic about TJX's prospects, everything will have to go well for the stock to maintain its current rally. Going even higher may require significant improvements to the retailer's already strong performance.

What's the problem here?

That could be a problem. First, TJX itself is telling investors to temper expectations as fiscal 2025 begins. Specifically, management aims to keep same-store sales from growth of 5% to between 2% and 3%. Considering the midpoint of this guidance, same-store sales growth this year could be at most 50% lower. This may be enough to make investors question the valuation they've given the retailer, even though it's actively opening new stores.

There is another subtle issue here as well. As mentioned above, most of the same-store sales growth was driven by new customers. why? The answer is probably that people are looking to expand their purchasing power and, as a result, are shopping at off-price stores more than ever before. That's great for now, but once consumers start feeling confident again, they may return to their normal spending habits. This means a return to full-price stores, which could put downward pressure on TJX's same-store sales.

The bigger problem for investors is that once a stock's valuation soars, even a little bit of negative sentiment can have a big impact on Wall Street. TJX's business is booming and the company has proven it knows how to execute. There is nothing inherently wrong with business. But that doesn't mean stock prices won't fall, as even good companies can go through tough times at some point in their lives. Add to this high valuations and you have a recipe for a significant stock market decline. To that end, it's worth pointing out that this stock has experienced price declines of more than 25% multiple times in its history.

TJX is expensive but that may change

Considering TJX stock's current valuation, it's hard to say that investors should use up their money to buy it. High ratings can last for a long time, but it's probably best to be patient and quell any feelings of missing out in some way.

It's probably best to wait until the current strong performance wears off (which is likely to happen at some point) and investors move on to more exciting stories. That will likely lead to a decline in materials stocks and an opportunity to acquire a growing retailer with a solid business at an attractive price point. After all, paying too much for a good company can actually end up being a bad investment.

Should you invest $1,000 in Tjx Companies right now?

Before buying Tjx Companies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Tjx Companies wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Reuben Greg Brewer has no position in any stocks mentioned. The Motley Fool recommends his Tjx Companies. The Motley Fool has a disclosure policy.

Are investors expecting too much from TJX?Originally published by The Motley Fool