This week's best investment news:

Jeremy Grantham: The big contradiction in the US market! (GMO)

Best Essay (Paul Graham)

Warren Buffett's DNA (Morningstar)

Curable small cap? (Verdado)

David Einhorn – How Passive Investing Created a Divided Market for Value Investors (MM)

Howard Marks talks about the US economy (Bloomberg)

Cliff Asness: 60/40 Portfolio: Is it still a viable strategy? (TD)

Warren Buffett emphasizes GAAP (WSJ)

S&P 500 hits record high as investors ignore troubling inflation data (Yahoo)

Ken Griffin shares his thoughts on markets and industries in 2024 (CNBC)

Ariel Rogers, Paramount, MSG, Fed, Patient (Bloomberg)

There's a retail boom right now. (Rudy Havenstein)

Signs of a good investment process, revisited (Flyover stocks)

Why are blue chip stocks performing so well? (Clement)

Mohnish Pabrai’s session at SumZero Virtual Investor Summit 2024 (MP)

Financial nihilism (EP theory)

Professional Gambler Interview – Mickey Mase (SWU)

No one wants to own the product (but insiders) (Felder)

Bill Nygren: Why do new highs matter? (Oakmark)

Aswath Damodaran: All the numbers tell a story (EM)

Jeremy Siegel: It takes nerves of steel to play in momentum stocks (CNBC)

The Magnificent Seven: Lucky or Stupid? (Morning Star)

Benjamin Graham: Big Moments on the Road to Big Earnings (#13) (Beyond Ben Graham)

Bill Nygren: Is the 60/40 Portfolio Dead or Alive? (Oakmark)

Chris Davis: Life and money lessons learned working with Charlie Munger (Knowledge Project)

Sean Dobson, Amherst Holdings (MiB)

The optimists were right about FANG stocks (Morningstar)

Select uncertainty (F&F)

“Boring” money topics that I find fun (highest interest)

This week's best value investing news:

Irrefutable accounting proof: Value investing = Business Ownership (VIS)

Growth and Value at the Crossroads (ASC)

Have the trends in value investing changed? (Awesome)

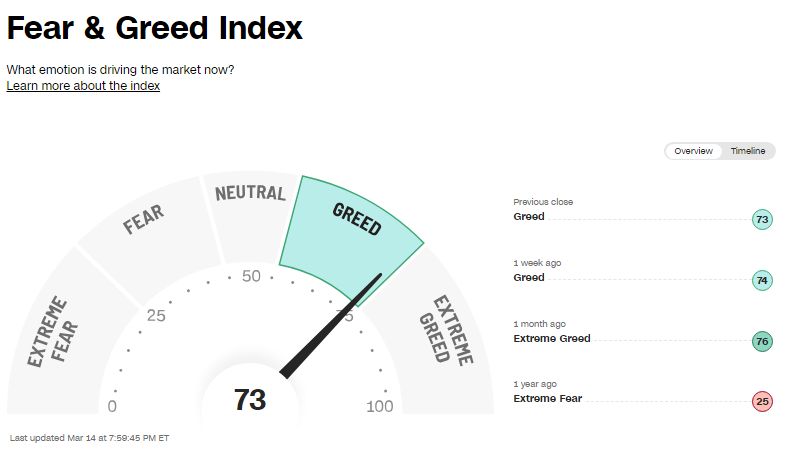

This week's Fear and Greed Index:

This week's best investing podcasts:

Turnaround (MicroCapClub)

A change of brokers, bad financial advice, and did Bryce beat the market? (Equity Mate)

Inflation, Bank Failures, Bubbles and Other Lessons from Financial History (Excess Returns) by Mark Higgins

The Complete Financial History of Berkshire Hathaway (Adam Meade) (Good Investment Talk)

Ann Marie Peterson – Capital Systems (ILTB)

Episode #524: Tim Lanzetta, NGPF – Teaching America’s Personal Finance (Meb Farber)

Value Perspective by Jim Royal (Value Perspective)

Auke Hoekstra: A bullish case for renewable energy (Value Hive)

TIP615: Current market conditions and Richard Duncan (TIP)

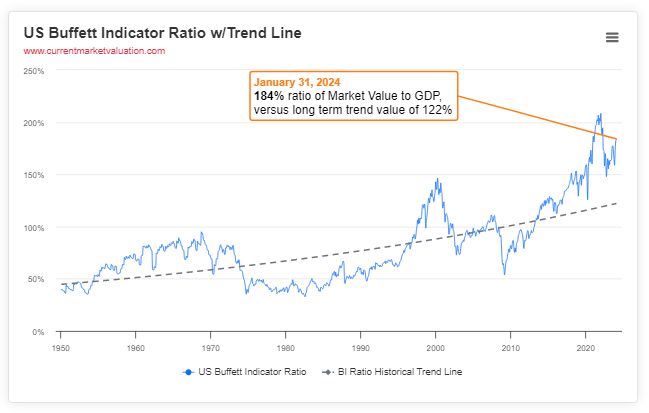

This week's Buffett indicators:

overrated

This week's best investment research:

Fighting the urge to profit (ASC)

Betting on the short squeeze as an investment strategy (Alpha Architect)

Can the Fed make a soft landing? (CFA)

Best investment tweets of the week:

Reading books is great, but some investing lessons can only be learned the hard way.

— Brian Feroldi (@BrianFerroldi) March 14, 2024

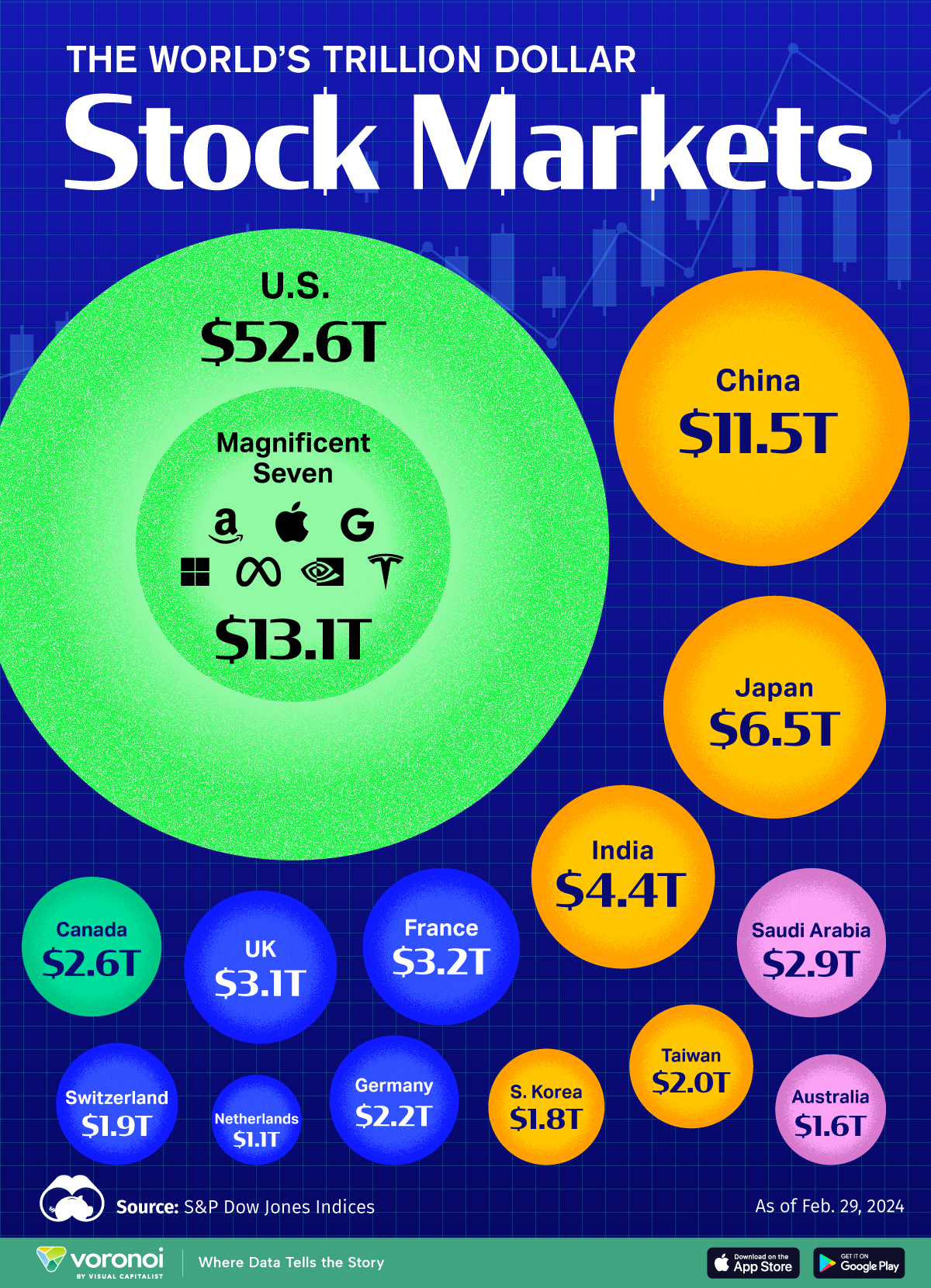

This week's best investment graphics:

The world's largest stock markets by country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

free inventory screener

Don’t forget to check out the free Large Cap 1000 – stock screener,here Acquirer multiple: