Investors have been buying up European travel, retail and luxury goods stocks, betting that the region's economic recovery will prompt consumers to spend more on holidays and big-ticket items.

Carmakers Renault and Stellantis have risen more than 25% since early February. Fund managers are betting that pessimism about European economic growth is overdone, with German entertainment group Eventim up 23% and Danish jewelery maker Pandora up 15% over the same period.

Fund managers' enthusiasm for stocks linked to discretionary spending is due in part to growing confidence that central banks have succeeded in reining in inflation without sending the economy into a slump.

“It feels like we're getting closer to the light at the end of the tunnel,” said Dan Boardman Weston, chief investment officer at BRI Wealth Management. “Consumer confidence has risen from very low levels. [ . . . ] And the European Central Bank is clearly expected to cut interest rates in June, which should provide further reassurance. ”

The gains have pushed European consumer free stocks and automaker Stoxx indexes up 10.3% and 14.5%, respectively, this year.

They also helped extend gains in the benchmark Stoxx Europe 600, which has been driven primarily by small-cap giant stocks this year.

BRI Wealth Management said it was favoring European retailers and luxury goods groups as the region's economic outlook was “starting to look a little brighter”.

John Goetz, co-chief investment officer at Pzena Investment Management, said valuations for European consumer stocks have fallen to attractive levels.

“We're just paying for a very bleak outlook, so if there's even a little bit of sun, cool!” he said. The U.S. fund manager holds stakes in French tire maker Michelin, hotel operator Accor, and German car makers Volkswagen and Porsche. “Everything automotive-related and consumer-facing is very cheap in Europe,” Goetz said.

Analysts said lower prices for natural gas, a key fuel for many European consumers, also contributed to the better-than-expected economic performance.

Last month, gas prices fell to levels before Russia began cutting supplies to Europe in 2021. The decline came as a warm winter, lower demand and increased imports of liquefied natural gas eased traders' concerns about supply shortages.

Luca Paolini, chief strategist at Pictet Asset Management, said, You can certainly make a case for that.”

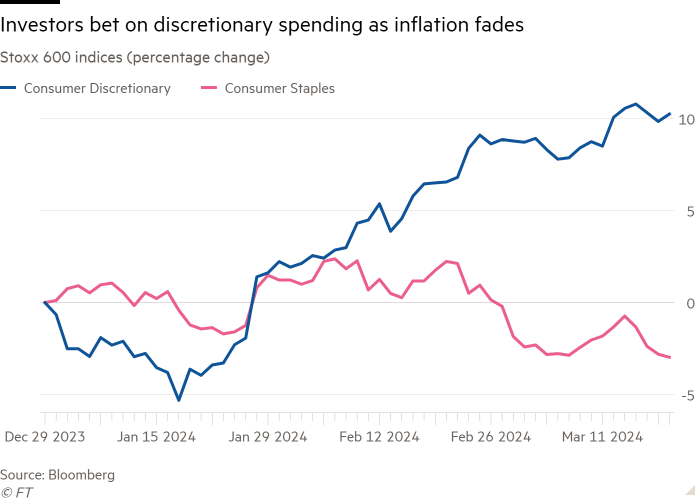

Pictet began buying more consumer discretionary stocks and cutting consumer staples in early March to capitalize on what Paolini calls the “potential for positive surprises” in European consumer spending.

Mr. Paolini believes that the companies that will benefit most from Europe's growing spending power will also benefit from the continued resilience of U.S. consumers, providing solid returns even if Europe's economic recovery stalls. said that stocks are relatively safe investments.

Retailers had lagged the broader Stoxx Europe 600 in early 2024, as the market rally was led by large healthcare and technology companies, but the sector began to rise in mid-February. I did.

Around the same time, Goldman Sachs increased its recommended allocation to European consumer, travel and leisure stocks. Sharon Bell, senior equity strategist at the bank, said these sectors “will be the clear beneficiaries of Europe's consumption recovery”.

Strategists also pointed to improvements in the European Business Activity Survey, a leading indicator of economic growth.

S&P Global's Eurozone Composite Purchasing Managers' Business Index (preliminary), which measures business activity across the eurozone, hit an eight-month high in February as growth in the services industry offset a decline in manufacturing production. It rose to 48.9. Although it fell below the 50 mark that separates economic expansion from contraction, it was an improvement from October's low of 46.5.

Citigroup's European Economic Surprise Index also turned positive in February for the first time since May. This benchmark measures how economic data compares to expectations, with positive readings indicating market expectations are consistently weaker than currently published numbers.

Some of the optimism extends to Britain's underperforming stock market. The market rose just 0.1% in 2024, while France's CAC40, which is heavy on luxury goods, rose 8.7% and Germany's Dax rose 7.4%.

“If anything, the UK has a tighter labor market and lower unemployment than other European countries,” said Goldman Sachs' Bell. “Energy prices could go down, the pound could go up and tariffs could go down. That combination is all good.”

However, some people are still not convinced. Bank of America maintains that Europe's economy remains fragile and will weaken as the effects of the ECB's interest rate hikes continue to trickle down.

Andreas Bruckner, equity strategist at the bank, said automakers and banks “look the most vulnerable” to an economic slowdown.

He recommended that his clients invest in consumer staples stocks, such as food and beverage and chemical stocks, which have underperformed the overall market this year.

“The full impact of aggressive monetary tightening has not yet been felt and will eventually trickle down to consumers,” Bruckner said. “We may be okay now, but we will see this as a false dawn.”