key insights

stock price Jeffries Financial Group, Inc. (NYSE:JEF) has increased significantly over the past few years. However, earnings growth has not kept pace with share price momentum, suggesting that other factors may be driving the share price direction. Some of these issues will be on the minds of shareholders when the company holds its general meeting on March 28th. It will also be an opportunity for them to influence management by exercising their voting rights on company resolutions such as CEO and executive compensation that may affect future corporate performance. Based on the information we've gathered, we think shareholders should be cautious about increasing her CEO's compensation until the company shows notable improvement.

Check out our latest analysis for Jefferies Financial Group.

How does Rich Handler's total compensation compare to peers?

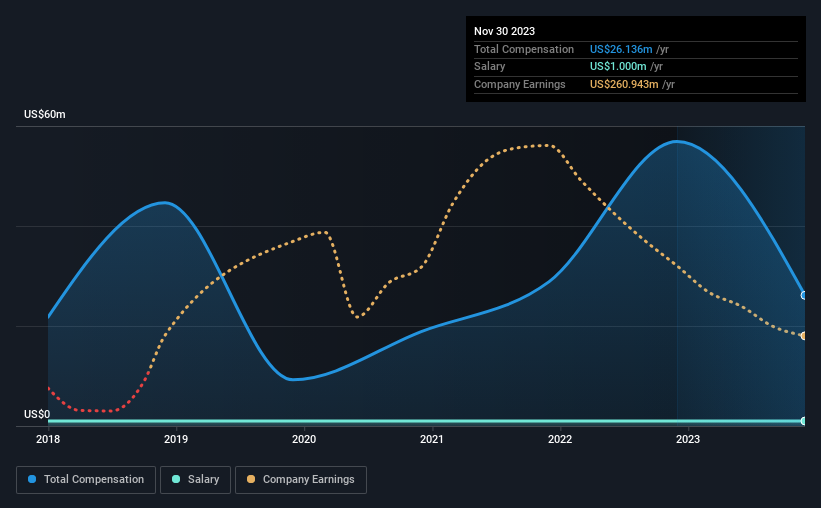

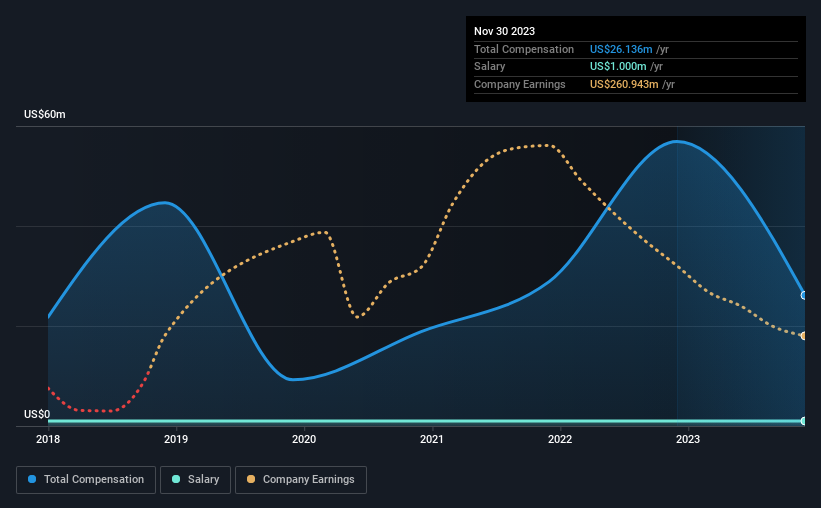

According to our data, Jefferies Financial Group has a market capitalization of US$9.5b, and the company paid its CEO total annual compensation worth US$26m in the year to November 2023. This is a significant decrease of 54% compared to last year. We always consider total compensation first, but our analysis shows that the salary component is less, at US$1 million.

We looked at similarly sized companies in the US Capital Markets industry with market capitalizations between USD 4 billion and USD 12 billion and found that the median total CEO compensation for that group was USD 8.2 million. Therefore, our analysis reveals that Jefferies Financial Group, Inc. pays Rich Handler above the industry median. Furthermore, Rich Handler holds US$835 million worth of shares in the company in his own name, indicating that they have a lot of influence in the game.

|

component |

2023 |

2022 |

Percentage (2023) |

|

salary |

1 million USD |

1 million USD |

Four% |

|

other |

25 million USD |

USD 56 million |

96% |

|

Total compensation |

26 million USD |

USD 57 million |

100% |

In terms of industry, salaries accounted for approximately 9% of total compensation and other compensation accounted for 91% of the pie among all companies analyzed. Investors may find it interesting that Jefferies Financial Group paid Rich Handler a marginal salary over the past year and instead focused on non-salary compensation. If non-salary compensation makes up a large portion of total compensation, it indicates that executive pay is tied to company performance.

Growth of Jefferies Financial Group Inc.

Over the last three years, Jefferies Financial Group's earnings per share have decreased by 23% per year. Revenues were down 21% year over year.

The decline in EPS is a bit concerning. And the impression gets even worse when you consider that revenue is down year-over-year. Therefore, given this relatively weak performance, shareholders probably won't want to pay his CEO a high salary. It might be important to step away from the current format a bit and check out this free visual depiction. What analysts expect For the future.

Was Jefferies Financial Group Inc. a good investment?

Jefferies Financial Group Inc. has received positive reviews from shareholders, with a total shareholder return of 68% over three years. So they may not be concerned at all if their CEO's compensation is higher than normal for similarly sized companies.

As conclusion…

Jefferies Financial Group primarily uses non-salary benefits to compensate its CEO. Despite a high return on shareholder investment, the lack of revenue growth makes us skeptical that the share price can maintain its current momentum. Shareholders should take full advantage of the upcoming opportunity to ask the board about any key concerns they may have and to reconsider their investment thesis regarding the company.

While CEO compensation is an important area to focus on, you should also pay attention to the company's other attributes. Our research revealed that 2 Red Flags for Jefferies Financial Group One of them is not very favorable to us.

The quality of the business is probably far more important than the CEO's compensation level.So check this out free List of interesting companies with high return on equity and low debt.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.