Many investors define investment success as outperforming the market average over the long term. However, any portfolio may have some stocks that underperform its benchmark.I regret that it has been a long time since I last reported. Paragon Grove Berhad (KLSE:PGLOBE) shareholders have seen the share price decline 80% over three years, compared to a market decline of around 9.5%. I sincerely hope that those who can survive this price crash have a diversified portfolio. Even if you lose money, you don't have to lose the lesson.

It's worth assessing whether the company's economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let's just do that.

Check out our latest analysis for Paragon Globe Berhad.

Paragon Grove Berhad isn't currently profitable, so most analysts will focus on revenue growth to get an idea of how fast the underlying business is growing. When a company is not making profits, we usually expect good revenue growth. Some companies are willing to defer profitability in order to grow revenue faster, in which case they will expect good sales growth to make up for the revenue shortfall.

Over the past three years, Paragon Globe Berhad's revenue has grown at a compound annual rate of 11%. This is a significant sales growth rate. So it's hard to believe that the 22% annual share price decline is due to earnings. The loss may have been greater than expected. This is exactly why investors need to diversify. Even if a loss-making company grows its earnings, it may not be able to generate returns for shareholders.

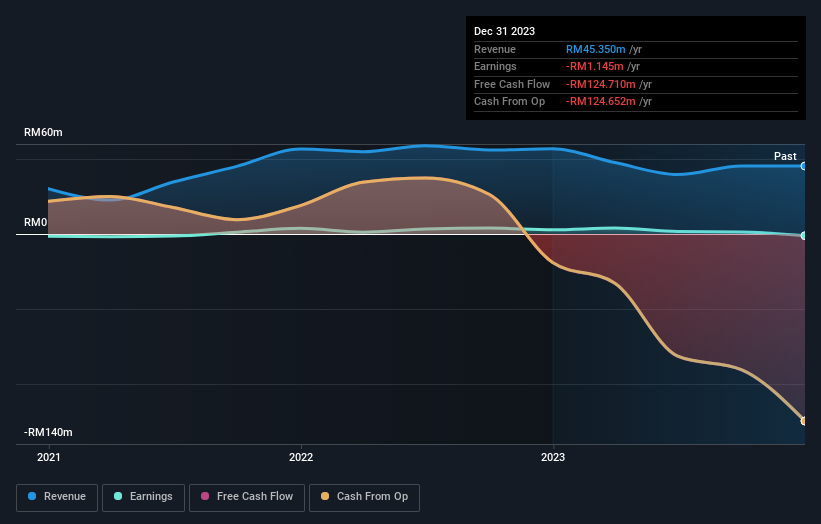

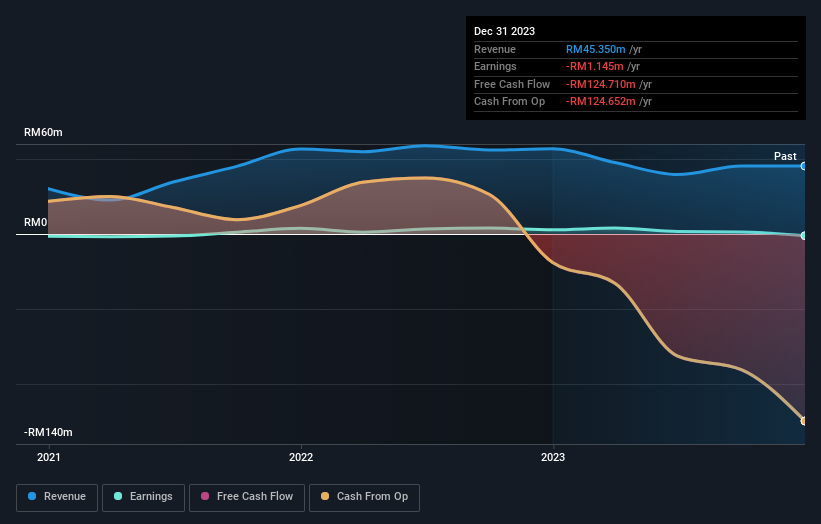

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how this balance sheet has strengthened (or weakened) over time. free Interactive graphics.

What about total shareholder return (TSR)?

It would be remiss of me not to mention the difference with Paragon Globe Berhad. Total shareholder return (TSR) and its stock price return. Arguably, the TSR is a more complete return calculation because it takes into account the value of dividends (as if reinvested), along with the hypothetical value of any discounted capital provided to shareholders. Paragon Globe Berhad's TSR in his three years was a loss of 42%. Since it pays dividends, the stock price return wasn't too bad.

different perspective

It's good to see that Paragon Grove Berhad returned a total shareholder return of 38% to shareholders in the over the last twelve months. There's no doubt that these recent returns are much better than the TSR loss of 6% per year over five years. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, consider the ever-present fear of investment risk. We've identified 2 warning signs for you Paragon Globe Berhad (at least one is a bit worrying) and understanding them should be part of your investment process.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.