Jeremy Grantham, founder of investment firm GMO, is always on the lookout for potential threats to markets and the economy. So when things are feeling pretty rosy, it's a good time to try reaching out to him.

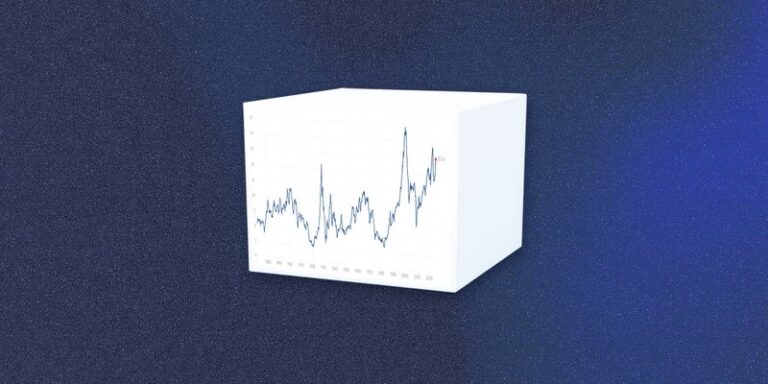

Right now, Grantham is understandably a little nervous about the state of U.S. stock valuations, particularly the state of the economy-adjusted price-to-earnings ratio (also known as “CAPE” or “Shiller”). . PER”). It is a widely trusted indicator often used to evaluate the S&P 500 and is calculated by dividing the index price by the moving average of his 10-year returns adjusted for inflation.

Needless to say, it's very expensive.

CAPE or Shiller Price Earnings Ratio from 1871 to 2024. Source: Finimize.

Profits are also at record highs, and Grantham worries that the U.S. market is demanding perfection. (And no one can achieve it.)

Now, Grantham is a value investor at heart, which is the focus of his $60 billion company. Therefore, he is not one to rush to invest in assets that appear frothy. Right now, he says, there are only two areas of the S&P 500 that look attractive from a value perspective: blue chip stocks and resource companies.

Blue-chip stocks typically perform significantly better in bear markets because their strong balance sheets, high profitability, and sound business models protect them from economic downturns. Stocks typically underperform slightly in bull markets, but that hasn't been the case lately. Blue chip stocks are leading the market these days, leaving the rest of the market behind. Currently, almost a third of the funds managed by GMO are kept in the Quality Strategy Fund. And the top 10 holdings are clearly a high-quality group. Microsoft, UnitedHealth Group, Meta, Alphabet, Safran SA, Amazon, Johnson & Johnson, SAP, Apple, and Accenture. The Magnificent Seven, Nvidia and Tesla, are conspicuously absent from the top 10.

Resource stocks (think energy and metals) are currently trading at cheap valuations. Furthermore, these stocks have historically moved in the opposite direction (i.e., are inversely correlated) to the overall U.S. market. This makes it a great diversifier for your portfolio.of SPDR S&P Metals & Mining ETF (Ticker: XME, expense ratio: 0.35%) Energy Select Sector SPDR Fund (XLE; 0.09%) could make for a good resource investment strategy. (It's also worth remembering that some of Warren Buffett's largest holdings are in oil companies and metals.)

GMO's $1.6 billion U.S. Opportunistic Value Fund unsurprisingly owns some of the cheapest energy companies, including: exxon mobil and chevronBut the firm also invests in Alphabet and Meta, and interestingly these two tech giants feature in both the value and quality funds.

But there's a big world out there to invest in. Grantham sees opportunities in stocks in other developed countries, including Japan.In fact, he thinks the Japanese yen will eventually appreciate. at least It is 20% against the US dollar, making it a great opportunity to take advantage of the strong yen and purchase yen-denominated assets. He also sees opportunities at the value and lower-growth end of emerging market stocks, which currently trade at a significant discount to their normal range.