Deborah Clifford, Executive Vice President and Chief Financial Officer of Autodesk Inc (NASDAQ:ADSK) sold 5,553 shares of the company's stock on March 27, 2024, according to a recent SEC filing. The trades were executed at an average price of $260.01 per share, for a total value of $1,443,878.53.

Autodesk Inc is a leader in 3D design, engineering and entertainment software. The company provides a wide range of products to industries including architecture, engineering, construction, manufacturing, media and entertainment.

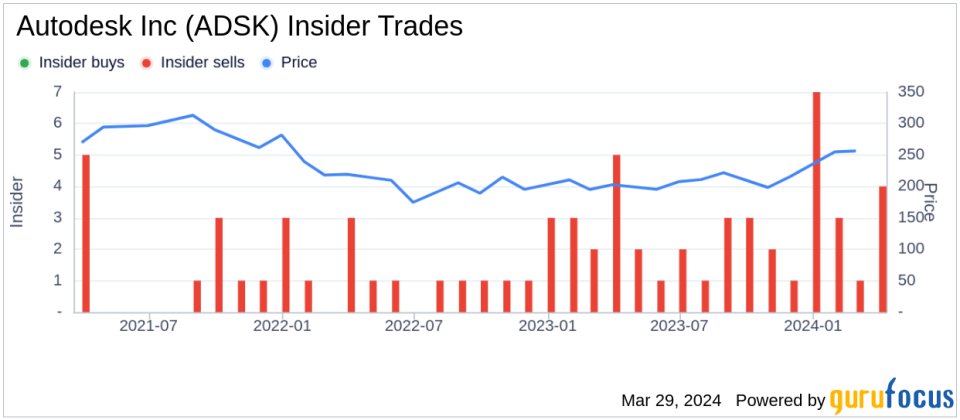

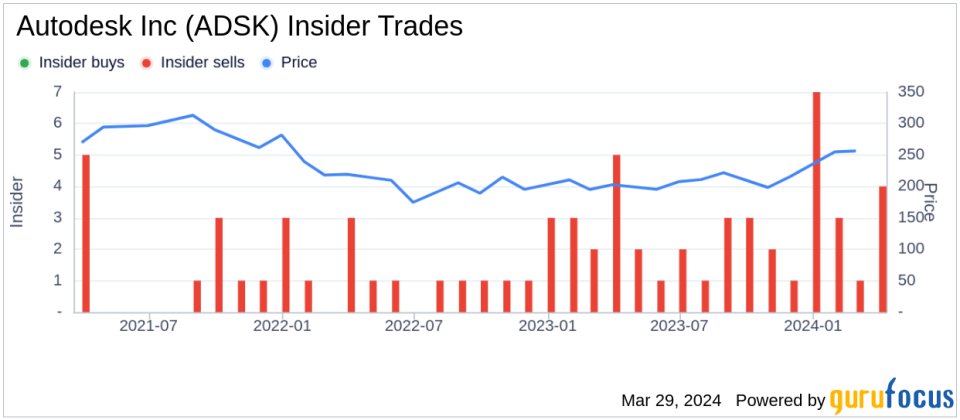

Over the past year, insiders have sold a total of 5,553 shares of Autodesk Inc stock, but bought no shares. The company's insider trading history reveals a pattern of 32 insider selling and zero insider buying during the same period.

On the day of the most recent insider sale, Autodesk Inc. stock was trading at $260.01, giving the company a market cap of $55.71 billion. The company's price-to-earnings ratio is 61.86x, which is higher than the industry median of 27.105x, but lower than the company's historical median price-to-earnings ratio.

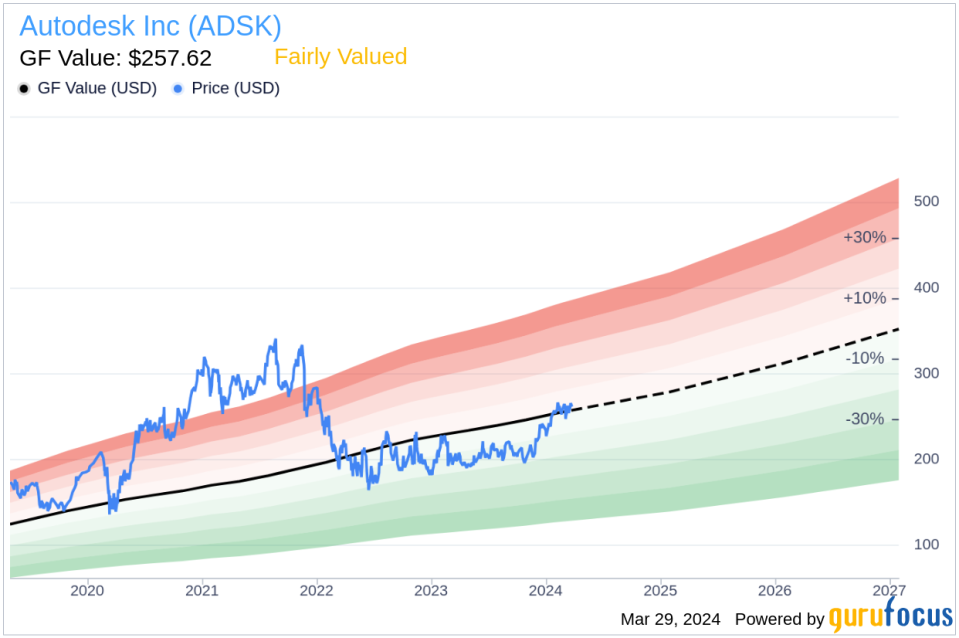

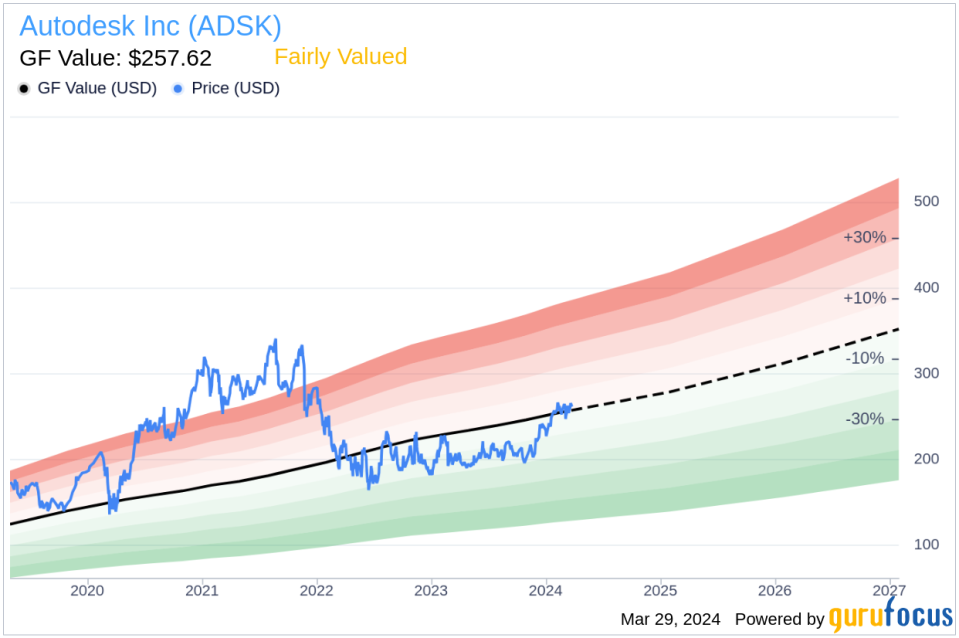

The company's price to GF value ratio is 1.01 and GF value is $257.62, indicating that Autodesk Inc is fairly valued by the market according to GuruFocus' intrinsic value estimates.

GF Value is determined by considering historical trading multiples, GuruFocus adjustment factors based on past earnings and growth, and future earnings forecasts provided by Morningstar analysts.

Investors and analysts often monitor insider sales as they can get an insider's perspective on the value of a company's shares. However, insider trading should not be used in isolation when making investment decisions, as it can be influenced by many factors such as personal financial requirements and diversification strategies.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.