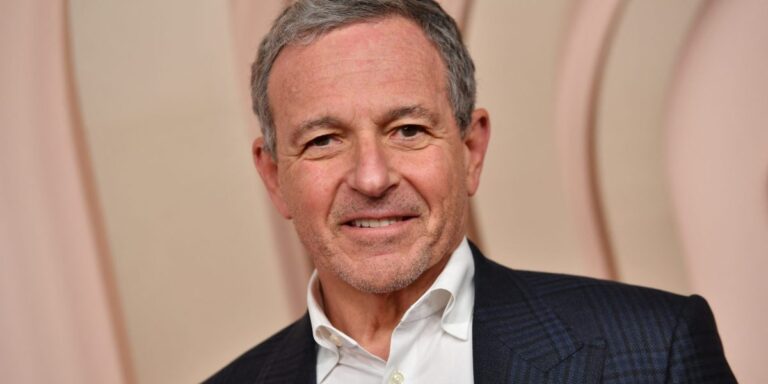

CEO Bob Iger won a landslide victory at Wednesday's annual shareholder meeting while shareholder activist Nelson Peltz tries to wrest victory from the brink of defeat in his proxy battle with Disney. I made sure. Shareholder support for Disney's director candidates, as well as shareholder rejection of efforts by Peltz and former Marvel Chairman Ike Perlmutter to secure board seats for Peltz and former Disney Chief Financial Officer Jay Laslo; It's a win for impact investors and those who believe companies must answer multiple questions. Person concerned.

From the beginning, Peltz and Perlmutter portrayed this proxy war as an epic battle in the culture wars, an underdog story in which two billionaire Davids battle a “woke” Goliath. Peltz played a grumpy character who complains about movies with too many women and black people. Mr. Perlmutter went down that path, trying to veto such projects at Marvel before he was fired last year.

Together, they positioned themselves as champions of shareholders who evaluate good governance solely by stock price. (Additional credit to Elon Musk, who backed Peltz at the last minute and promised to buy Disney stock if Peltz won. Potentially chilling given his strategy on Twitter/X. (That's the prediction. Shareholder activist Bill Ackman also played a walk-on role, accusing Disney of dirty tricks.)

While Mr. Iger is not above reproach when it comes to governance (Exhibit A is succession planning), he understands that Disney must also be responsive to its employees, customers, vendors and other stakeholders. There is. Disney's filings show that more than a third of the company's stock is held by individual investors, many of whom may have financial interests in the company. This means diversity, inclusion and good citizenship are key to achieving long-term growth. As Yale University's Jeffrey Sonnenfeld and Steven Tian point out, Mr. Peltz's talent for inflating stock prices through proxy fights has not historically increased the long-term value of stocks.

Adding value is the transformational leadership that Iger has demonstrated throughout his career. That means staying ahead of technology and consumer trends and being a company that people want to work for. In this polarized climate, it's difficult to speak out on issues like abortion and anti-LGBTQ+ laws. Disney, a major employer in Florida and a company that has targeted its products to a diverse customer base, has taken a public stance after Florida Governor Ron DeSantis signed the “Don't Say I'm Gay” bill. This created two problems. This year's battle finally came to a close last week.

Disney, an $89 billion-a-year behemoth, can afford to take on deep-pocketed warriors like Mr. Peltz and Mr. DeSantis in a way that few companies can. The company said it spent nearly $40 million just to protect its shareholders from Mr. Peltz.

For leadership consultant Bill Shanninger, that's money well spent. “For the Disney brand and its people, they have to be on the right side of history,” said Scott, who led the global talent practice at McKinsey before becoming a senior partner at Modern Executive Solutions. Mr. Shanninger says. “In the long run, you can win as an employer and as a company by committing to diversity.”

Mr. Shanninger advises leaders of large public companies to fully protect their commitment to ESG practices. In a polarized political environment, the key is to do it differently. “Share risk with the board. Engage the lead independent director in the conversation about, ‘What do we stand for?’ Have those conversations with employees and large investors, and Reiterate your core values in areas where we don't.'' You don't need to yell at someone who is weaponizing politics, left or right, to bring you down. And accept that being one of the biggest kids on the playground means you have a responsibility to stand up for those who can't.

Please see the news below for more information.

diane brady

Diane.brady@fortune.com

on our radar

Why Reddit's former CEO left a big tech company to focus on the planet (luck)

Ten years ago, Yishan Wong left a rewarding career in the technology industry, including stints at Facebook and PayPal and as CEO of Reddit, to help tackle climate change. To that end, he's leveraging the big-scale thinking he developed in Silicon Valley to launch an organization focused on large-scale reforestation, he writes: luck Explanation part. the goal? He says it's to “reduce carbon in the atmosphere by 30%.” That's a big goal and a worthy goal.

Can recovering pollutants save big industry? ( new york times)

Factories are concerned that the costs of complying with climate regulations are more than they can bear. Factory workers are worried that their jobs are at risk. Enter Italian energy conglomerate Eni. Eni collects industrial pollution as a solution and plans new business areas.of new york times The plan describes it as a “network of pipelines to pump carbon dioxide from sites and store it in old natural gas reservoirs” in Italy, the UK and other parts of Europe.