meanwhile iFast Corporation Co., Ltd. (SGX:AIY) shareholders are probably happy overall, but the share price hasn't been particularly strong lately, with the share price down 15% in the last quarter. But the returns over five years were surprisingly large. In fact, the stock price has increased by a whopping 501% during this time. Therefore, some shareholders may decide to take profits after receiving good results. Of course, the most important thing is whether the business can sustainably improve and thus justify a higher price. If you've enjoyed this rewarding ride, you'll probably want to talk about it.

It's also worth looking at the company's fundamentals here. That's because it helps determine whether long-term shareholder returns are consistent with the performance of the underlying business.

Check out our latest analysis for iFAST.

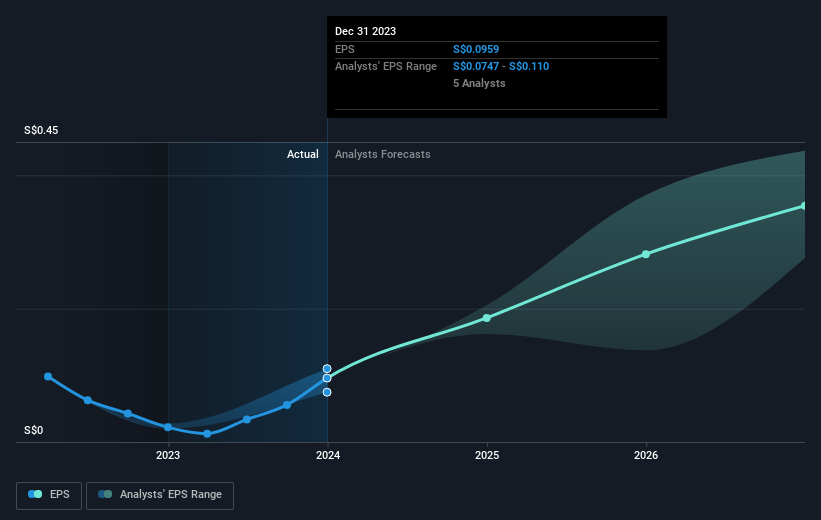

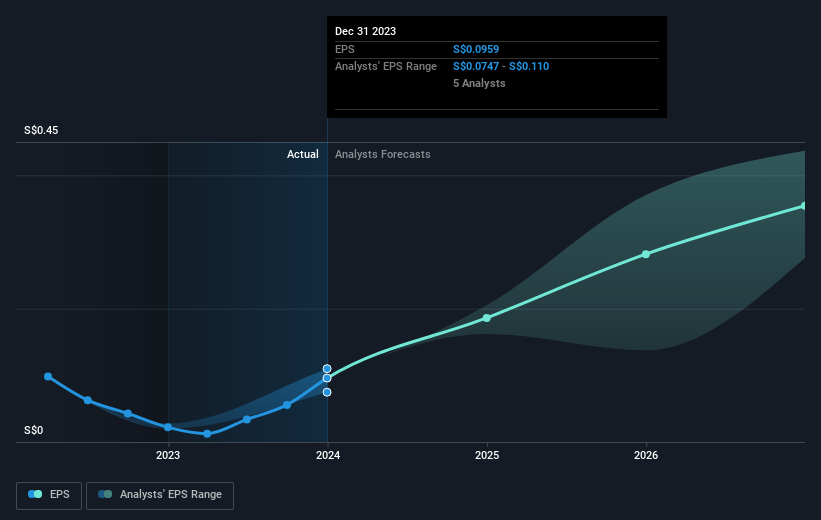

While there is no denying that markets are sometimes efficient, prices do not always reflect underlying company performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over five years, iFAST has been able to grow its earnings per share at 18% per year. This EPS growth rate is lower than the average annual increase in the share price of 43%. This suggests that market participants have been valuing the company highly recently. This isn't necessarily surprising, given its track record of profit growth over the past five years. This positive sentiment is reflected in the company's (rather optimistic) P/E ratio of 71.40.

The image below shows how EPS has changed over time (unveil the exact values by clicking on the image).

Perhaps worth noting is that we saw significant insider buying in the last quarter, which we consider a positive. Having said that, we think earnings and revenue growth trends are even more important factors to consider.this free This interactive report on iFAST's earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. Coincidentally, iFAST's TSR over the last five years was 549%, which is better than the share price return mentioned above. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

It's good to see that iFAST returned a total return of 39% to shareholders over the last twelve months. Of course, this includes dividends. That being said, his 45% annual TSR over five years is even better. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, we identified 1 warning sign for iFAST What you need to know.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singapore exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.