Stock pickers are typically looking for stocks that outperform the overall market. And the truth is, if you buy a quality business at the right price, you can make big profits.For example, in the long run SFS Group AG (VTX:SFSN) shareholders have enjoyed a 26% share price increase over the past five years, significantly outpacing the market return of around 17% (not including dividends). On the other hand, recent gains have been less impressive, with his shareholder return including dividends only 2.9%.

So let's assess the underlying fundamentals over the past five years to see if they have kept pace with shareholder returns.

Check out our latest analysis for SFS Group.

In Buffett's words, “Ships will sail around the world, but a flat-Earth society will thrive.'' There will continue to be a wide discrepancy between prices and values in the marketplace. ..'' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

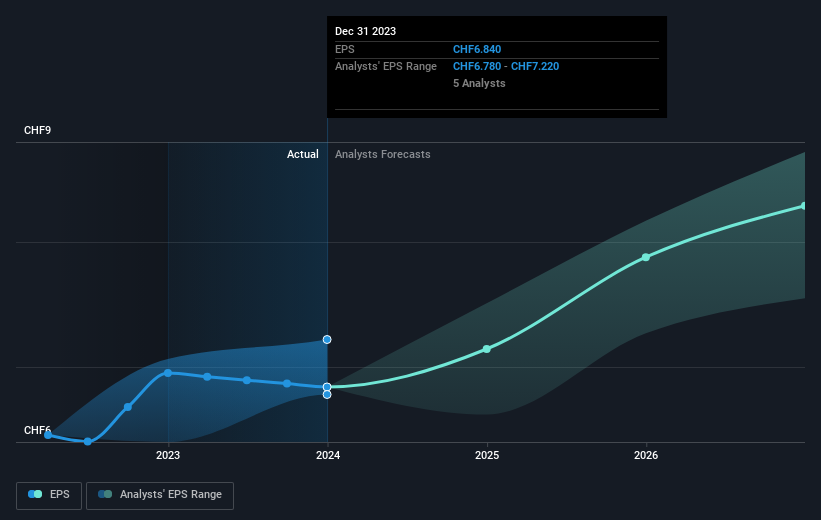

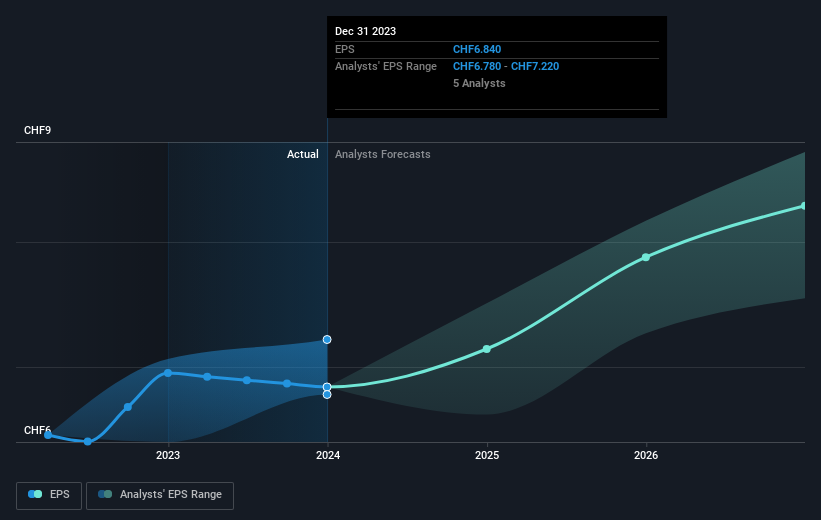

During the five-year period of share price appreciation, SFS Group achieved compound earnings per share (EPS) growth of 5.9% per year. This EPS growth is higher than the average annual increase in the share price of 5%. Therefore, the market seems to have a relatively pessimistic view of the company.

You can see below how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend taking a closer look at its historical growth trends, available here.

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that SFS Group's TSR over the last five years was 39%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

SFS Group offered a TSR of 2.9% over the last twelve months. Unfortunately, this falls short of market returns. Looking back over five years, the return is even better, at 7% per annum over five years. Perhaps the stock is taking a breather while the company executes its growth strategy. It's always interesting to track stock performance over the long term. However, to better understand SFS groups, many other factors need to be considered. Note that the SFS group is still visible. 1 warning sign in investment analysis you should know…

For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.