Mark Dufresne/E+ via Getty Images

Co-authored with Tread Softley

April always begins with the April Fool's Day celebration. Usually, this day is a day when individuals play harmless pranks on each other, and many companies get involved by releasing non-existent products with humorous intentions.

Interestingly, the history of April Fool's Day is not reliably established as to where it began. Many countries have different accounts of when this ritual began and follow different customs, but they all begin with some level of mischief. For example, in England, there was a situation where hundreds of people were tricked into going to the Tower of London to see a lion being washed. Whether you celebrate April Fool's Day or not, you too can be a victim of these harmless pranks and be called an April Fool, or someone who is tricked or successfully led.

When it comes to the market, you don't want to be fooled by anything in the income investing space. This is why I spend countless hours researching, writing, and discussing various income investments. In this way, our articles can become a source of idea generation, a place where you can get new ideas, revisit old ones, and serve as a starting point for continuing additional research.

I hope you don't get fooled or deceived this April. I'd rather find good investments, buy them, and let income rain into your portfolio every month. So today, I would like to take a look at two investment stocks that you should buy. Otherwise, it could become an April Fool's Day.

Let's dive in!

Choice #1: THQ – Yield 11.1%

abrdn healthcare opportunity fund (THQ) is a CEF specializing in the healthcare field. It was previously part of the Tekla family of funds. Then Aberdeen he acquired Tekla.

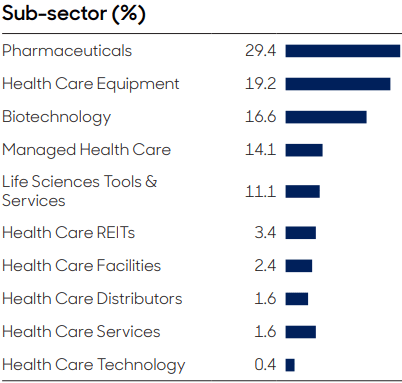

THQ invests in a variety of healthcare sectors, with a particular focus on pharmaceuticals, devices, and biotechnology. sauce

THQ fact sheet

Although the healthcare sector faces inflation and regulatory challenges, it continues to have very strong fundamentals and demand growth. Healthcare continues to be a very strong industry, and companies that successfully navigate the political and regulatory waters will continue to be highly successful. We want exposure to this sector, but high-yield options are limited. In this case, CEF is a good choice.

The Tekla investment team has a strong history of specializing in healthcare. As part of the Aberdeen acquisition, the fund retains the same management as before the merger. One thing that Aberdeen has changed is the distribution of THQ. THQ recently increased its distribution by 60% from $0.1125 per month to $0.18 per month.

The Company does not expect the change in distribution to have a material impact on the CEF's total return to NAV. CEF returns are dispersed or retained. If maintained, NAV will rise. If you are diversified, your NAV will increase less.

However, changes in distribution can affect returns based on market prices. THQ has long traded at a deep discount to NAV than its peer THW. This is likely due to the fact that THQ paid much less in distributions. With the increased distribution, we expect THQ to end up trading much closer to his NAV. Even if he doesn't, he can enjoy a high yield when he buys THQ at a discount of up to 10% to NAV. This is the beauty of income investing. If the price goes up, that's great, but if it doesn't, you can make money with dividends.

Choice #2: OXLC – Yield 18.7%

oxford lane capital corporation (OXLC) is a CEF specializing in CLOs (Collateralized Loan Obligations). Recently, there has been a lot of talk in the news about CLOs in commercial real estate. Although these “CRE” CLOs have structural similarities, they are not the type of his CLOs owned by OXLC. OXLC invests in CLOs that hold leveraged loans.

A leveraged loan is a loan originated by a bank to a company with a B/B+ credit rating. These are senior secured loans, which are at the top of the borrower's capital structure. Default rates among these loans remain low because corporate borrowers are relatively healthy.

Main risks OXLC Credit risk is involved. I own an equity tranche of a CLO. When a borrower pays off a loan, the funds are distributed in a cascade. That is, the senior debt tranche is paid in full, then the junior tranche is paid, and finally the equity tranche is left in full. As a result, the return on the equity tranche depends on her two variables: the number of borrowers who repay as agreed and the cost his CLO pays for the debt tranche.

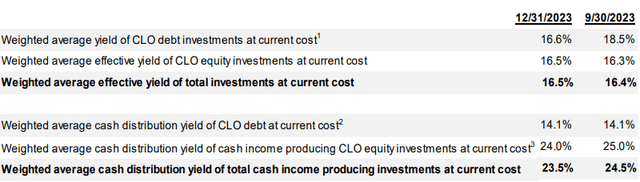

At current default rates, OXLC is delivering very high returns. Cash yields on stock positions average over 23%. sauce

OXLC Q4 Presentation

Default rates are emerging from record lows and are likely to rise further. However, we expect it to remain within historical averages. To understand how increasing defaults will impact OXLC's earnings, we can look at its GAAP “effective yield.” This calculation uses historical default rates to estimate expected post-default returns. For OXLC, this is 16.5%. Your actual return may be higher or lower, but it gives you an idea of what you can expect on average.

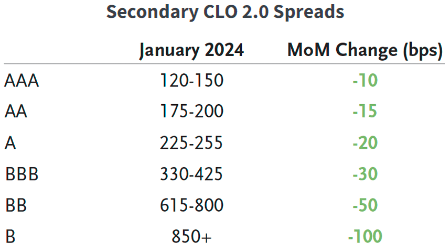

Regarding the cost of CLO debt, CLOs use floating rate debt and hold floating rate assets. As a result, changes in interest rates do not have a significant impact. What is changing is the demand for senior debt tranches. The spread over SOFR that senior tranche buyers are willing to accept varies depending on conditions. Over the past two years, senior tranche spreads have widened amid limited bank purchases. AAA spread exceeded 200 bps. It has tightened and is currently at 120-150 bps. sauce

TCW website

The equity tranche has the option of refinancing the senior debt after the call date or “resetting” the CLO to refinance all debt and reset the CLO's maturity date. If debt can be refinanced at a lower spread, equity can benefit directly from lower interest costs. OXLC's portfolio includes CLOs that could benefit from refi or reset, which we expect to occur in 2024.

Therefore, in 2024, we expect headwinds from a modest increase in default rates and tailwinds from refinancing CLO debt at lower spreads. OXLC is well-positioned to continue to provide extremely high dividends to investors while maintaining a cash flow cushion to absorb some defaults.

conclusion

With THW and OXLC, you can earn a lot of money from two revenue-generating departments right away. This is not a scenario where you are left in the desert with a stick to find water. This is an example where you are standing in the ocean and someone asks you to find water and it floods around you. Before drilling for oil, it is important to check where the oil is, rather than simply hoping for successful drilling. For many, oil was discovered by accident. Some are discovered through careful and thorough research. As time passed and technology advanced, research, rather than chance discoveries, became the main way to find new oil reserves.

Similarly, when it comes to income investing, especially with your hard-earned retirement funds, this is no time to gamble randomly or throw money into the market and expect it to come back to you. Instead, take the time to do your research, find out where you can make a good income, and take advantage of those sources. If your income exceeds your expenses, you can enjoy a comfortable and prosperous retirement. This allows you to hold and secure your extra money, reinvest it, or donate it to causes you believe in or to people you love.

That's the beauty of my income method. That's the beauty of income investing.