60% say they do not have enough savings for retirement

Duluth, Georgia, April 9, 2024–(BUSINESS WIRE)–Primerica, Inc. (NYSE:PRI), a leading provider of financial services and products in the U.S. and Canada, releases its Financial Security Monitor™ (FSM™) study for the first quarter of 2024. , two-thirds (66%) of middle-income Americans feel their education has not adequately prepared them to manage their household finances as an adult, with more It became clear that there were significant differences.

The majority of people under 65 say they have insufficient financial education, with the youngest age groups reporting the highest levels of dissatisfaction, including 73% of 18-34 year olds, 69% of 35-49 year olds, and 65% of 50 year olds. has been expressed. -64. In contrast, a majority of men over 65 (61%) feel that their education played a positive role in their preparation, and are the only demographic who believe this, while women in the same age group The majority (57%) say the opposite.

Specifically, most middle-income Americans believe that school prepared them for issues such as paying taxes (71%), paying off student loans (67%), taking out and repaying loans (64%), and planning a household budget. (59%) said they did not.

“The vast majority of young people feel left behind, and middle-income Americans feel that their education has prepared them to manage their personal finances,” said Primerica CEO Glenn J. Williams. “I don't think they are capable of doing so, and I see a clear lack of confidence.” “Recognizing these gaps will help people plan for their financial future and navigate a volatile economic environment that has left middle-income Americans incredibly uncertain about their financial situation in recent years. , must be dealt with.”

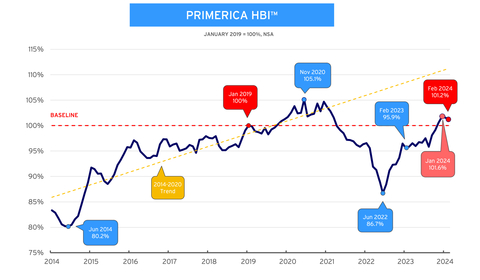

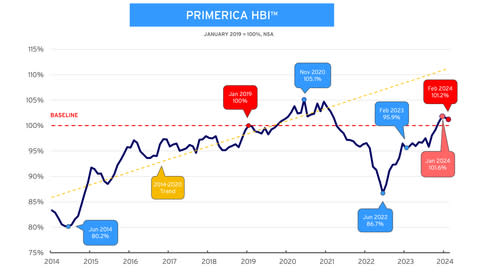

The latest FSM™ survey was conducted to coincide with the release of Primerica's Household Budget Index™ (HBI™). This shows that middle-income households saw a slight decline in purchasing power after a strong start to the year, slightly outweighed by increases in the cost of essentials such as gas. Increase in income. Although HBI fell to 101.2% in February from 101.6% in January, it is still a notable increase from 95.9% when compared to a year ago.

“Gasoline price increases are often felt immediately by middle-income Americans, with a direct impact on their purchasing power every time they fill up the gas tank. Compared to a year ago, prices for most essential goods are lower. Middle-income families are doing a little bit better because of the rise.''Although the rise has been small and gas prices have fallen some, incomes are rising faster on average than overall inflation. ” said Dr Amy Crews-Katz, CBE.®, Primerica's economic consultant. “While the slight decline in purchasing power for middle-income households from January to February is equivalent to the price of a premium coffee drink, inflation remains a thorn in the side for households trying to stick to a budget and plan for their financial future. It's a reminder that it matters.”

Key findings from Primerica’s Financial Security Monitor™ for Middle-Income Americans

-

There are generational disparities, and financial education is not sufficiently provided at school. A majority of middle-income Americans (66%) feel that the education they received growing up did not equip them to manage their finances as adults. Almost half (49%) said they were not at all well prepared, and a third (33%) said they were very or somewhat well prepared.

-

Middle-income Americans are increasingly concerned about credit card debt. More than a third (38%) of middle-income Americans are more concerned about their credit card debt than they were a year ago. The majority who feel this way report spending less overall (71%, up 9 points from December 2023), find additional sources of income (32%, up 6 points) or consolidate their debt. (16%, also increased by 6 points).

-

Most middle-income Americans combine their finances with their partner after marriage. About three-quarters (73%) of married Americans say they combine their finances with their partner, and one-fifth (20%) say they separate their finances and do other things. less than one in ten (7%) Notably, college-educated women have been shown to be more likely to keep their finances separate from their partner (64% have merged, 21% have separated, and 15% have separated). ).

-

Middle-income Americans are saving less for retirement. Despite 60% believing they don't have enough saved to retire comfortably, the percentage of people putting less money into their retirement accounts has increased by 7 percentage points over the past two years.

-

Rising prices of essential goods remain an issue. Most middle-income Americans (88%) say recent food price increases have affected them and their families. Individuals need to buy cheaper options of similar products (68%), need to buy less food (54%), need to change their eating habits (48%), or use coupons. They report needing to use them more often (37%) and buying them in larger quantities (30%). .

Primerica Financial Security Monitor™ (FSM™) Topline Trend Data

|

March 2024 |

December 2023 |

September 2023 |

June 2023 |

March |

December 2022 |

September 2022 |

June |

March 2022 |

|

|

How would you rate your personal financial situation? (Reports “very good” and “good” responses.) Analysis: Respondents remain divided when it comes to assessing their personal financial situation. |

50% |

50% |

49% |

50% |

52% |

53% |

53% |

54% |

60% |

|

Overall, do you think your income is…? (Reporting the answer that “living expenses are behind”) Analysis: Concerns about dealing with the increased cost of living have decreased over the past year. |

67% |

68% |

72% |

71% |

72% |

72% |

75% |

75% |

67% |

|

Do you have an emergency fund that can cover expenses of $1,000 or more (for example, if your car breaks down or you have a large medical bill)? (Reports a “yes” answer.) Analysis: The percentage of Americans with an emergency fund that can cover expenses of $1,000 or more has remained stable over the past year. |

62% |

60% |

62% |

61% |

58% |

59% |

60% |

61% |

62% |

|

How would you assess the economic health of your community? (Reports “not very good” and “poor” answers.) Analysis: Respondents' ratings of their community's economic health have worsened over the past year. |

60% |

57% |

55% |

54% |

59% |

53% |

55% |

58% |

52% |

|

How do you evaluate your ability to save for the future? (Reports “not very good” and “poor” answers.) Analysis: A significant majority continue to find it difficult to save for the future. |

67% |

73% |

71% |

71% |

73% |

74% |

73% |

72% |

66% |

|

Have you had any credit card debt in the past 3 months? (Report an answer of “increase”) Analysis: Credit card debt has remained flat over the past year. |

34% |

35% |

34% |

33% |

33% |

39% |

37% |

29% |

twenty five% |

About Primerica’s Financial Security Monitor™ (FSM™) for Middle-Income People

Primerica Financial Security Monitor™ has been surveying middle-income households quarterly since September 2020 to provide a clear picture of their financial health, coinciding with the release of the monthly HBI™ quarterly. Masu. The poll was conducted online from March 6 to 11, 2024. Change Research used dynamic online sampling to survey 1,312 adults nationwide with incomes between $30,000 and $130,000. Stratified by gender, age, race, education, and census region to reflect these adult populations, based on her five-year average of the 2021 American Community Survey published by the U.S. Census. Post-differentiation weighting was performed. The error is 3.0%. For more information, please visit Primerica.com/public/financial-security-monitor.html.

About the Primerica Household Budget Index™ (HBI™)

The Primerica House Budget Index™ (HBI™) is produced monthly on behalf of Primerica by Principal Economic Consultant Dr. Amy Crews Cutts, CBE®. The index measures the purchasing power of middle-income households with household incomes between $30,000 and $130,000 and is created using data from the U.S. Bureau of Labor Statistics, the U.S. Census Bureau, and the Federal Reserve Bank of Kansas City. Masu. The index looks at the cost of necessities such as food, gas, utilities and health care, as well as earned income, to track the difference between inflation and wage growth.

HBI™ is expressed as a percentage. If the index is above his 100%, the purchasing power of a middle-income household will be stronger than in the base period, and there may be extra money left at the end of the month that can be spent on entertainment, extra savings, etc. . Debt reduction. If it is less than 100%, households may need to reduce overall spending to below-budget levels, reduce savings, or increase debt to cover expenses. HBI™ uses his January 2019 as a baseline. This point reflects recent “normal” economic times prior to the COVID-19 pandemic.

Previous HBI™ values may be revised periodically due to revisions in the publication of the CPI Series and Consumer Expenditure Survey by the U.S. Bureau of Labor Statistics (BLS). Since the release of his HBI™ data in October 2023, health insurance costs will be included in HBI™ data calculations as part of the health care component due to the newly recognized methodology used by the BLS to calculate medical costs. It will no longer be included. Health Insurance CPI. The Health Insurance CPI, calculated by the BLS, does not measure the consumer cost of health insurance, such as the cost of premiums paid or the combination of premiums and deductibles, but rather measures the premium value held by health insurance companies. measurements and do not believe to be an accurate reflection of consumer experience. . The healthcare component continues to include medical services, prescription drugs, and equipment. Previously published values have been adjusted to reflect this change. For more information, visit housingbudgetindex.com.

About Primerica Co., Ltd.

Primerica, Inc., headquartered in Duluth, Georgia, is a leading provider of financial products and services to middle-income households in North America. Independent licensed agents assess the needs of Primerica customers and provide appropriate solutions through the term life insurance we underwrite and the mutual funds, annuities, and other financial products we primarily distribute. By educating Primerica customers on how to better prepare for a more secure financial future. of a third party. The Company insured over 5.7 million lives and held over 2.9 million customer investment accounts as of December 31, 2023. Primerica, through its insurance subsidiary, became the third largest issuer of term life insurance in the United States and Canada in 2022. Primerica's stock is included in the S&P MidCap 400 and Russell 1000 stock indexes and trades on the New York Stock Exchange under the symbol “PRI.”

View source version on businesswire.com. https://www.businesswire.com/news/home/20240408765232/ja/

contact address

public relations

Gana Ann, 678-431-9266

gana.ahn@primerica.com

PR for investors

Nicole Russell, 470-564-6663

nicole.russell@primerica.com