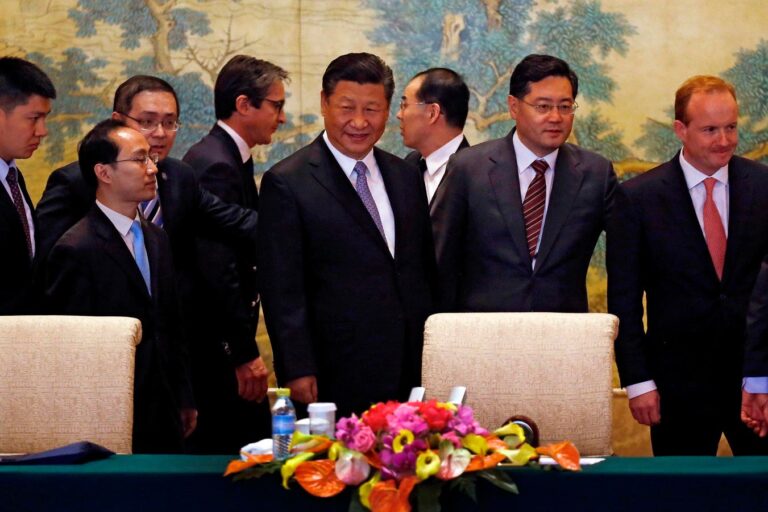

Chinese President Xi Jinping (C) chats with the chief executive and others. (Photo by Andy Wong/Pool/AFP) … [+]

Chinese President Xi Jinping is wooing foreign business leaders. Last November, he took time from the Asia-Pacific Economic Cooperation (APEC) summit and a meeting with President Joe Biden in San Francisco to speak at a dinner for U.S. executives. There, he pledged that his country would remain a safe, reliable and profitable investment destination. It recently hosted a gathering of foreign executives in Beijing to reassure foreign executives and encourage direct investment in China.

There are good reasons for President Xi to court foreign investment. China's economy needs the kind of growth stimulus it provides. The pace of real growth has slowed, and Chinese consumers and Chinese private businesses are losing confidence in the country's economic future. More and more people are choosing to save rather than spend. Declining real estate values and declining stock prices are generally discouraging investment and risk-taking. Chinese private companies have actually reduced the amount of money they had set aside for expansion. Government spending on infrastructure is now more difficult than ever, with the Chinese government running larger budget deficits than it would like and local governments facing massive debt overhangs. Mr. Xi and China need foreign stimulus in dollars, yen and euros just to meet this year's lowered 5% real growth target. However, foreigners remain silent.

Indeed, U.S. leaders have expressed enthusiasm in responding to Xi's entreaties. They enthusiastically praised Xi's speech in San Francisco, even giving him a standing ovation. This year's invitation to Beijing received a bigger response than last year. Last year, only 23 executives from major U.S. companies participated. This year, that number has increased to his 34 companies, with more senior executives from big-name companies such as Apple, McKinsey, Blackstone, AMD, Qualcomm, Micron Technology, ExxonMobil, Cargill, Bristol-Myers Squibb, Pfizer, and Hewlett. is participating. -Packard. But despite the smiles, applause, and positive responses, the money didn't follow. It's also unlikely.

Beijing Ministry of Commerce reported that in the first two months of this year, foreign direct investment into China continued to decline for several months. In January and February, China raised funds worth about 215 billion yuan ($30 billion), down about 20% from a year ago. This latest reading shows a downward acceleration from the overall 8% decline in 2023. If actions speak louder than words, dwindling flows of foreign funds are drowning out the applause President Xi heard in San Francisco.

The most powerful reason for predicting the future is why money is moving away from you. Part of the problem is China's slowing growth pace. There is also the legacy of the pandemic and years of lockdowns caused by President Xi Jinping's zero-corona virus policy. In the meantime, repeated and inevitable delivery failures have damaged China's reputation for reliability, which once attracted investment capital from the United States, Europe and Japan. Nothing the Chinese government can do now will change this history, but the memory will fade over time.

The Chinese government also cannot change the problem of rising costs. China is currently suffering from deflation, but years of rising wages have eroded its former reputation as a low-cost producer. Over the past decade, Chinese wages have increased by more than 100%, or about 7.5% annually. Over the past five years, the pace has slowed, but only slightly. Wage growth averaged about 5.5% per year during this recent period. Most importantly for investment flows, this rate of increase is faster than domestic wage growth in the United States, Europe, and Japan, and faster than China's competition for foreign investment funds in countries such as Vietnam, Indonesia, the Philippines, and Mexico. . There is little chance that China will reverse this situation, especially as public dissatisfaction within China is already high.

Although possible, it is highly unlikely that Beijing will reverse major obstacles to investment flows, namely its growing obsession with security and espionage. Executives in the United States, Europe, and Japan have all complained of greater intrusions stemming from this obsession, and how these intrusions have affected their ability to conduct business, especially when it comes to data collection, communications with headquarters, etc. It explains how it will cause problems. The executives pointed to raids carried out under the Chinese government's latest spying law on two U.S. consultancies, Bain & Company and Mintz Group. In the case of Mintz, several employees were detained and the company was fined. Such disruptions, at least not yet widespread, have put a pause on investment decisions in China, similar to the recent imposition of similar new laws in Hong Kong. If the Chinese government were to shift policy on this front, there could be major changes, but that seems unlikely.

Mr. Xi clearly recognizes the economic need and existing obstacles to China's overseas investment. He's turned on that charm, and if the standing ovation in San Francisco is any indication, he's feeling it in a big way. But as the behavior of foreign investors shows, they are looking for substance over glamor.