If you want to compound your wealth in the stock market, you can do so by purchasing index funds. However, investors can increase their returns by choosing and owning stocks in companies that are outperforming the market. Corero Network Security plc (LON:CNS)'s share price is up 83% over the past year, clearly outpacing the market decline of around 0.1% (not including dividends). That should put a smile on the faces of shareholders. In contrast, the long-term return is negative, as the stock price is down 18% from where it was three years ago.

It's also worth looking at the company's fundamentals here. That's because it helps determine whether long-term shareholder returns are consistent with the performance of the underlying business.

Check out our latest analysis for Corero Network Security.

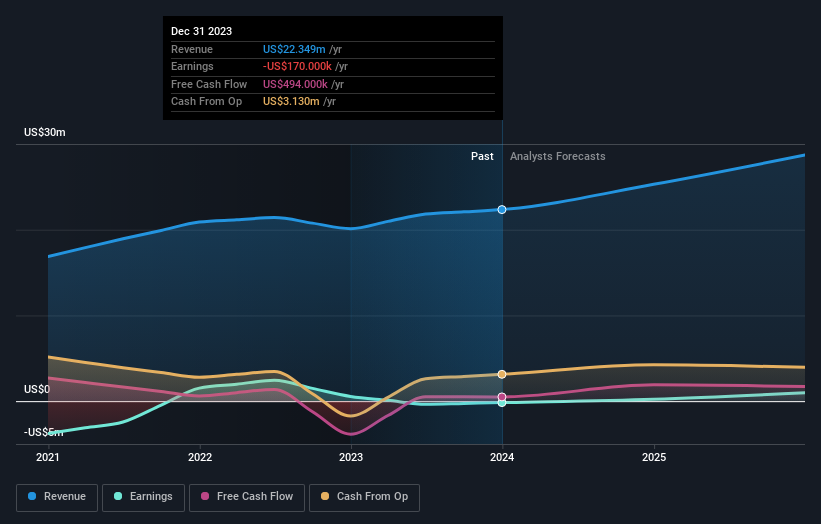

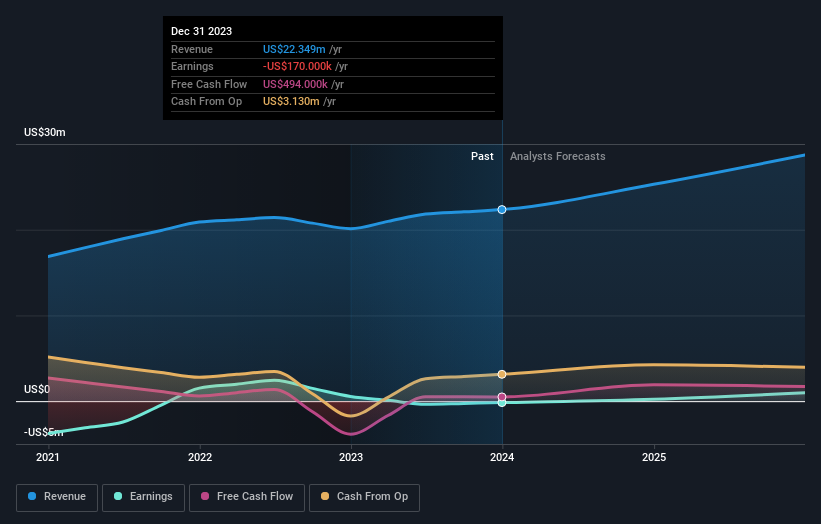

Considering that Corero Network Security didn't make a profit in the last twelve months, we'll focus on its revenue growth to get a quick look at the company's business development. Generally speaking, unprofitable companies are expected to have steady revenue growth every year. Some companies are willing to defer profitability in order to grow revenue faster, in which case they will expect good sales growth to make up for the revenue shortfall.

Corero Network Security grew its revenue by 11% in the last year. That's not great considering the company is losing money. The share price has increased 83% in that time as revenue has increased. While not a huge profit, this seems pretty reasonable. Given that the market doesn't seem too excited about this stock, it might be worth taking a closer look at the financial data if we can spot any signs of stronger growth trends in the future.

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Perhaps worth noting is that we saw significant insider buying in the last quarter, which we consider a positive. Having said that, we think earnings and revenue growth trends are even more important factors to consider.I recommend checking this free Report showing consensus predictions

different perspective

It's good to see that Corero Network Security shareholders received a total shareholder return of 83% over the last year. This is certainly higher than the annual loss of about 0.5% over the past five years. This makes us a little wary, but the business may have turned its fortunes around. It's always interesting to track stock performance over the long term. However, to better understand Corero Network Security, you need to consider many other factors. For example, we discovered that 1 warning sign for Corero Network Security What you need to know before investing here.

Korero Network Security isn't the only stock that insiders are buying.For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on UK exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.