When you buy a stock and hold it for the long term, you definitely hope for a positive return. But more than that, you want it to rise above the market average.but Diversified United Investments Limited (ASX:DUI) missed the second target, with the share price up 23% over five years, which is below the market return. Meanwhile, the stock price has increased by 1.4% in the past 12 months.

With that in mind, it's worth checking whether a company's underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Decentralized United Investments.

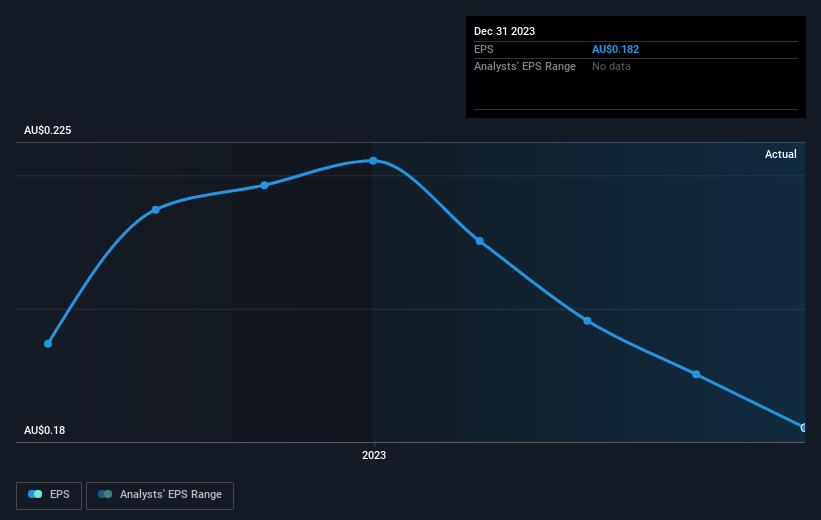

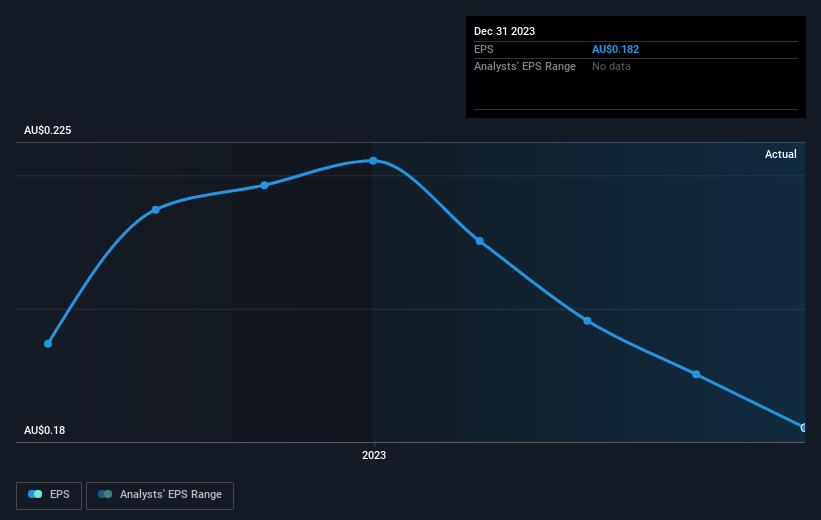

in his essay Graham & Doddsville SuperInvestors Warren Buffett has said that stock prices do not always rationally reflect the value of a company. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

During the five-year period of share price growth, Diversified United Investment achieved compound earnings per share (EPS) growth of 1.2% per year. This EPS growth rate is lower than the average annual increase in the share price of 4%. So it's fair to think the market has a higher valuation of him in this business than he did five years ago. And this is not surprising given its track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like to see that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide for a business. Dive deeper into its earnings by checking this interactive graph of Diversified United Investment's earnings, revenue and cash flow.

What will happen to the dividend?

When looking at return on investment, it is important to consider the following differences: Total shareholder return (TSR) and stock price return. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. For Diversified United Investment, the TSR for the last 5 years is 44%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

Diversified United Investments shareholders received a total return of 4.8% for the year. However, its returns are below the market. Perhaps it's a good sign that the company has an even better long-term track record, having provided shareholders with a TSR of 8% per annum over five years. Perhaps the stock is taking a breather while the company executes its growth strategy. It's good to see insiders are buying shares, but we recommend checking here to see at what price they are buying shares.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.