When you invest in stocks, you inevitably end up buying companies that are underperforming. However, long-term shareholders Post NL Nevada (AMS:PNL) has had a disappointing performance over the past three years. Unfortunately, they were able to survive a 70% drop in the stock price during that time.

So let's take a look at whether the company's long-term performance is in line with the progress of its underlying business.

Check out our latest analysis for PostNL

Markets are powerful pricing mechanisms, but stock prices reflect not only underlying business performance but also investor sentiment. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of stock price growth, PostNL went from a loss to a profit. This is generally considered a positive, so we're surprised by the drop in the share price. Therefore, it's worth looking at other metrics to understand stock price movements.

Note that the dividend appears to be healthy enough, so that may not explain the share price drop. On the other hand, an unexpected decline in sales of 4.0% per year could cause shareholders to sell their shares. This may make some investors concerned about its long-term growth potential (or lack thereof).

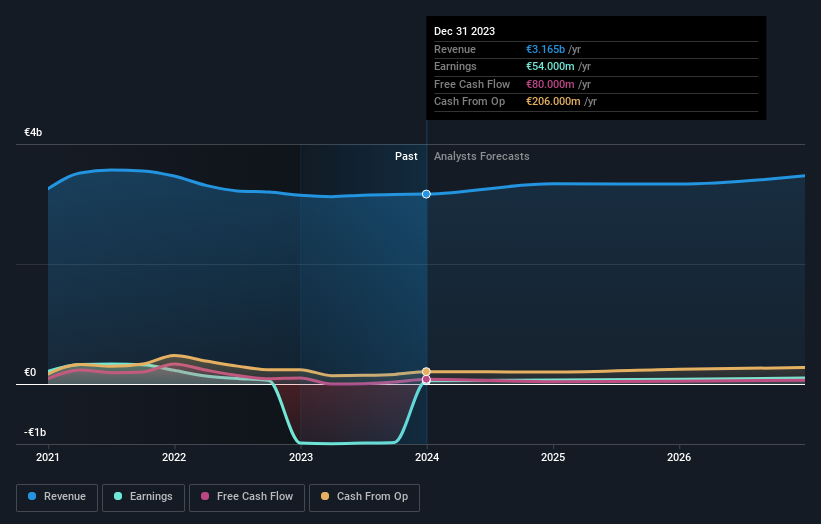

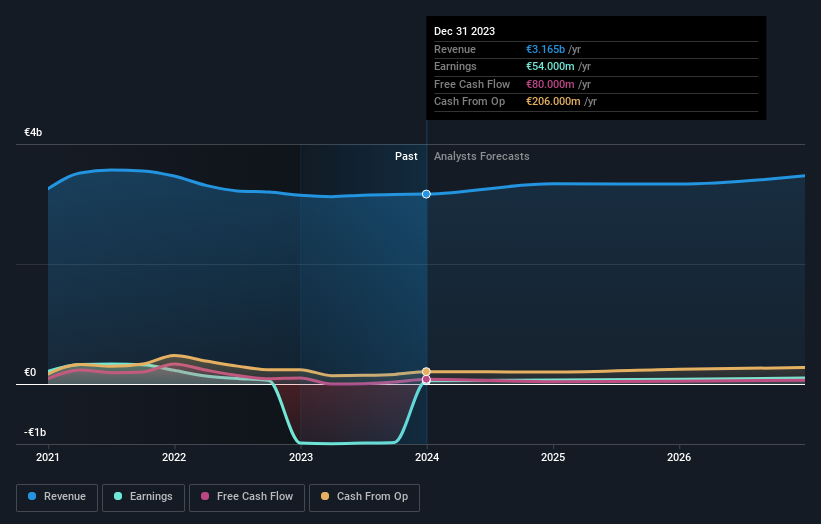

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that PostNL's earnings have been improving lately, but what does the future have in store? You might want to check this out free Report showing consensus predictions

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that PostNL's TSR over the last three years was -59%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

PostNL shareholders are down 14% for the year (even including dividends), while the market itself is up 22%. Even blue-chip stocks see their share prices drop from time to time, and we like to see improvement in a company's fundamental metrics before we get too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 4% annualized loss over the past five years. I know Baron Rothschild said investors should “buy when there's blood on the streets,” but investors should first make sure they're buying a quality business. Warns you that you need to confirm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To do so, you need to know the following: two warning signs Found on PostNL.

For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.