Prices have fallen significantly over the past two months, a development that has surprised many. After rising slightly into the second half of 2023, precious metals prices have soared since mid-February, defying some early predictions of cooling.

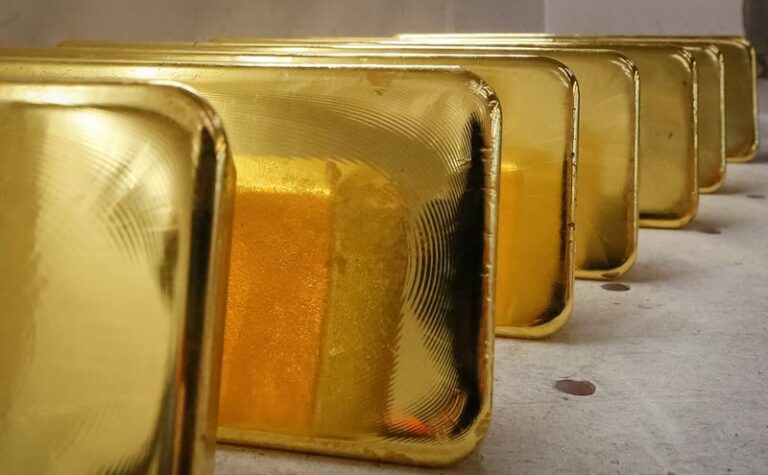

Gold prices have soared past a major psychological barrier of $2,000 an ounce this year and show no signs of slowing down. With no signs of slowing down, gold's impressive rally is forcing financial institutions to reassess their outlook. The latest revision comes from financial heavyweight Goldman Sachs, whose new forecasts suggest even brighter days ahead for this shiny metal.

Goldman raises outlook for gold price

The investment bank said in a note to clients this week that gold's relative stability after this week's better-than-expected U.S. consumer price index shows the gold bull market is not driven by the usual macro doubts. He pointed out that this was new evidence. This, combined with other factors, led Goldman Sachs to increase its expectations for the price of gold.

In fact, gold has risen 20% over the past two months, even as the market has priced in tapering Fed interest rate cuts, strong growth trends, and a record stock market.

“Traditional gold fair value would link the usual catalysts such as real interest rates, growth expectations and the dollar to flows and prices,” the bank said. “None of these traditional factors adequately explain the speed and magnitude of gold price movements so far this year. However, this significant residual from the traditional gold price model is a new feature. But it’s also not a sign of overestimation.”

We see that much of gold's rally since mid-2022 is being driven by new incremental (physical) factors, including accumulation by central banks in emerging markets and a significant acceleration in retail purchases in Asia. .

According to Goldman Sachs, these factors remain well-confirmed by current macro policy and geopolitics.

“Additionally, a bullish bias for gold remains evident given the light-tail risks from the US election cycle and fiscal settings, with Fed rate cuts remaining the likely catalyst to ease ETF headwinds later this year.” insists.

The company expects positive price factors to continue from the re-based price level and has raised its price forecast to $2,700 per ounce by the end of the year, up from its previous forecast of $2,300.