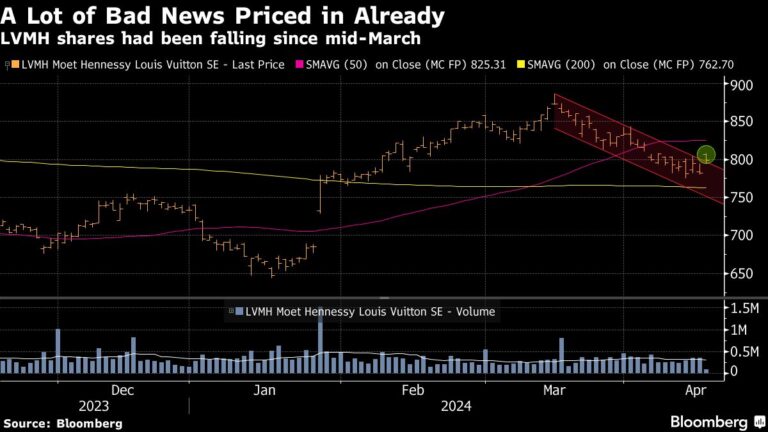

(Bloomberg) — European stock markets ended the day slightly higher, as encouraging results from LVMH and a big jump in earnings estimates from Adidas offset a sharp selloff in tech stocks.

Most Read Articles on Bloomberg

The Stoxx Europe 600 index pared some of its early gains and was up 0.2% by the London close. Luxury stocks such as Hermès International, Burberry Group and Richemont rose after LVMH's results eased concerns about demand for luxury goods. Asos soared as the online fashion retailer's recovery began to gain momentum and it expected profits to rise next fiscal year.

The tech sector fell 2.6% as ASML Holding NV's orders fell short of expectations, spooking other semiconductor stocks such as ASM International NV and Aixtron SE. The sector's decline was the biggest since July and came as ASML led the rally with a gain of more than 50%, while the Stoxx 600 tech index rose 25% over the past year.

Matthieu Lacheter, head of equity strategy at Julius Baer, said the April-October period is likely to see increased volatility due to the U.S. presidential election and continued heightened geopolitical tensions. Still, Ratcheter recommended staying invested, saying, “This will open up opportunities for investors to position themselves for the next cycle.”

Investors continue to price in the outlook for monetary policy, as expectations for interest rate cuts have waned following a flurry of U.S. economic data released in recent weeks. Federal Reserve Chairman Jerome Powell said Tuesday that officials need more confidence that inflation is heading toward the central bank's 2% target before borrowing costs fall. Although he pointed out that it is likely to take some time, U.S. Treasuries rebounded and regained a sense of calm.

Volatility indicators have entered the area of concern for the first time since last year, with all eyes on earnings amid geopolitical tensions.

Geopolitical concerns further dampened sentiment as Israel considers its response to Iranian missile and drone attacks.

“Rising risk aversion continues to accumulate in risk assets, penalizing equity markets while supporting dollar and gold prices,” said Daniel Barrera, chief investment officer at Piguet, Garland & Cie SA. ” Still, with investor sentiment so low, the stock market “could gradually recover lost ground in the coming days once political tensions ease to some extent,” he added.

For more information on the stock market, please see below.

-

The stock market is on a really slippery slope right now: Understanding the stock market situation

-

M&A Watch Europe: Vinci, Naturgy, UniCredit, Alpha Bank, Talgo

-

Luxury grocer offers unusual private sector IPO to UAE: ECM Watch

-

US stock futures rose.United Airlines, Tesla Gain

-

Superdry withdraws from LSE: London Rush (corrected)

Want more news on this market? Click here to visit our First Word channel, packed with actionable news from Bloomberg and selected sources. You can customize it to your liking by clicking Actions on the toolbar or pressing the Help key for assistance. Click here to subscribe to the daily list of European analyst rating changes.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP