It's not a bargain, but it's a business that's gearing up for a boom.

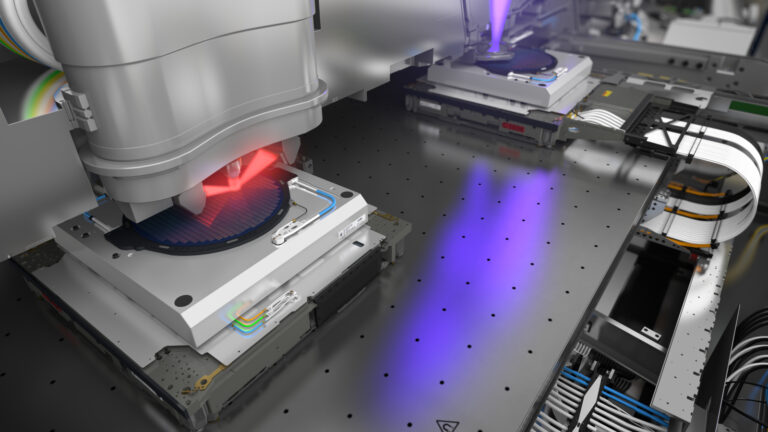

Dutch technology giant ASML Holdings (ASML -3.32%) manufactures equipment critical to the semiconductor market. Then, on April 17, the company announced financial results that caused the stock price to fall.

For context, before the financial report was released, ASML stock had risen about 50% over the past year, at times hitting new all-time highs. At its peak, the company was valued at more than $400 billion, driven by investor enthusiasm for artificial intelligence (AI).

AI will drive demand for semiconductors due to the huge need for computing power, memory, and more. This is why investors consider his ASML a top AI stock and why it has risen so much over the past year. In fact, outgoing CEO Peter Wennink told Bloomberg about the rise of AI: “I don't think it would happen without ASML and our technology.”

Therefore, investors, analysts, and executives all believe that AI is a big trend, and that ASML is a key enabler of this trend. That's why the market was concerned about the company's sharp decline in orders in the most recent quarter.

Why are investors selling ASML stock?

Looking at ASML's Q1 2024 net sales, the numbers were good. The company's net sales were 5.3 billion euros ($5.6 billion), within management's prior expectations. But investors seem to be paying more attention to booking numbers.

Think of it as a backlog. When ASML receives an order for a lithography machine, the amount will be counted towards your reservation. When a company delivers a machine, the machine is counted in net sales. Therefore, reservations can be a concrete and forward-looking indicator.

In the fourth quarter of 2023, ASML bookings reached a record $9.8 billion. However, in the first quarter of 2024, bookings decreased significantly to his $3.8 billion. Granted, the company's bookings typically fluctuate this much, but they were significantly lower than analysts expected.

Moreover, without China's influence, bookings could have been even worse in recent quarters. Countries including the Netherlands have restricted semiconductor exports to China. Meanwhile, China responded by doubling its efforts to increase domestic semiconductor supply. Also, according to Reuters, older ASML machines are not restricted.

In the first quarter of 2024, net sales to China accounted for 49% of ASML's total net sales, a record number. And in the fourth quarter of 2023, net sales to China accounted for 39%, a larger share than sales to the United States and South Korea. Combined.

Reading the tea leaves, it appears that China is rapidly purchasing ASML machinery to build domestic manufacturing capacity before export restrictions worsen. This is not something the company will benefit from forever, and the sharp decline in bookings suggests that this temporary benefit may already be fading.

Should investors buy the dip?

It sounds like you are speaking from both sides of your mouth. Meanwhile, ASML remains one of the world's best positioned companies for long-term success. On the other hand, this isn't really a push worth buying.

Please let me explain. Buying on the spur of the moment means a good trade. But in ASML's case, the stock has only fallen to where it was two months ago. Also, from a valuation perspective, it is not necessarily a bargain. After all, the company's current price-to-sales ratio of 12x is above its five-year average and far above its valuation just a few months ago.

ASML PS ratio data by YCharts. PS = price to sales.

So for investors looking for a relative bargain, I think ASML stock will hold out. That said, investors should be careful not to wait too long, as it is likely to trend higher in the long run.

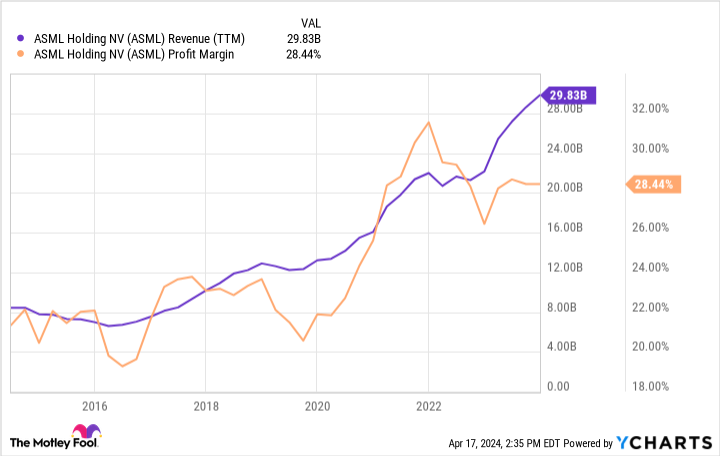

The semiconductor field has been growing long before AI became a hot topic, and is expected to continue growing no matter how AI is shaken out. And ASML equipment is essential to this process. This reality has allowed the company's revenues to grow steadily over his 10-plus years, and it has been able to achieve impressive net profit margins.

ASML Revenue (TTM) data by YCharts. TTM = trailing 12 months.

The semiconductor industry is notoriously cyclical, and ASML's management believes it has just reached the bottom of the economic cycle. Therefore, he expects 2025 and 2026 to be boom years for the company's business.

There is good reason to believe this is true. For example, ASML's U.S. customers have been underperforming in recent quarters, but the U.S. is offering incentives to increase domestic manufacturing. So the company is currently building, and in the near future he will be placing an order with ASML.

In conclusion, ASML stock fell due to disappointment with the booking. A drop in stock price doesn't necessarily mean it's a bargain buy today, but investors who think the company's best days are in the rearview mirror are probably mistaken. The company is in a good position to profit from semiconductors for the time being.