For many investors, the main point of stock selection is to generate higher returns than the overall market. However, any portfolio may have some stocks that underperform its benchmark.Unfortunately, it has been going on for a long time FLETCHER BUILDING LIMITED. (NZSE:FBU) shareholders, the share price is down 47% over the past three years, well below the market's decline of around 8.7%. Furthermore, it has fallen by 19% in about four quarters. That's not much fun for the holder.

Shareholders are down over the long term, so let's take a look at the underlying fundamentals over that time period to see if that's in line with the returns.

Check out our latest analysis for Fletcher Building.

While there is no denying that markets are sometimes efficient, prices do not always reflect underlying company performance. One way he looks at how market sentiment has changed over time is to look at the interaction between a company's stock price and his earnings per share (EPS).

During five years of stock price growth, Fletcher Building went from a loss to a profit. This is generally considered a positive, so we're surprised by the drop in the share price. So it might be worth checking out other metrics given the share price drop.

Over three years, earnings have actually grown at 3.8% per annum, so that doesn't seem like a reason to sell the stock. It's probably worth investigating the Fletcher Building further. This analysis may be missing something, but there may be an opportunity.

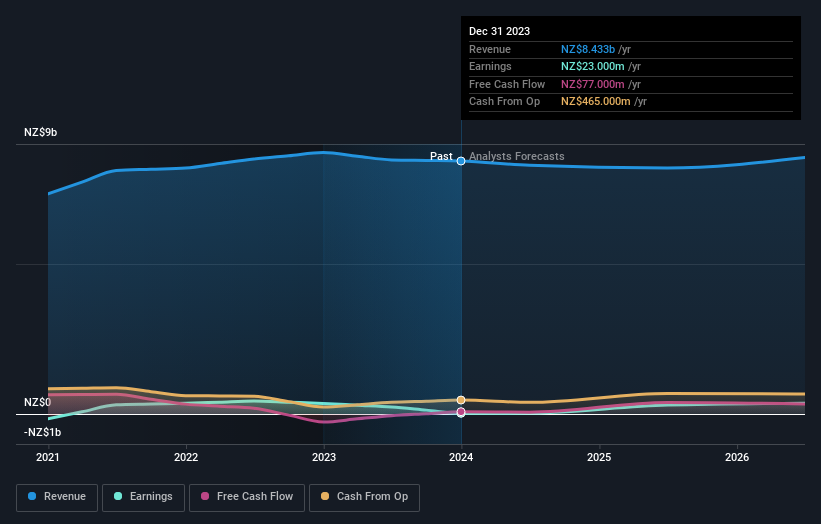

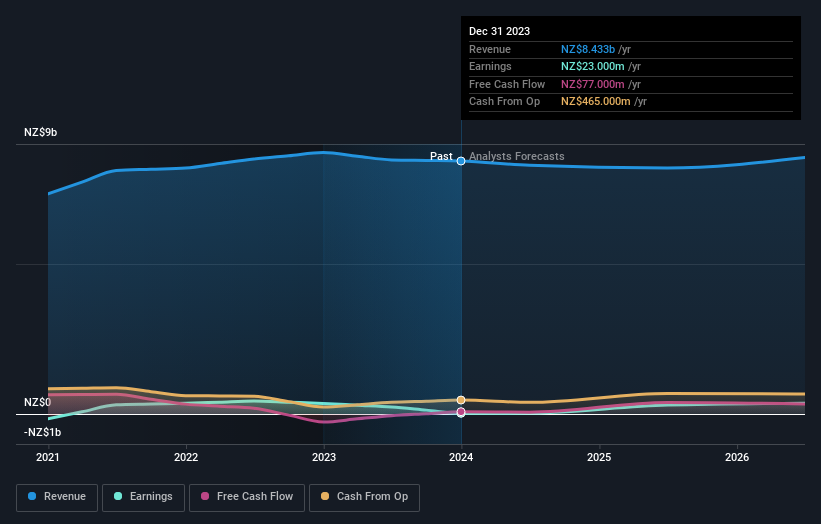

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like to see that insiders have made significant purchases in the last year. Even so, future profits will be far more important than whether current shareholders make money.this free A report showing analyst forecasts can help you form a view on Fletcher Building.

What about total shareholder return (TSR)?

It would be disrespectful not to mention the differences with the Fletcher Building. Total shareholder return (TSR) and its stock price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. Given its history of dividend payments, Fletcher Building's TSR was 36%. drop It wasn't as bad as the stock return over the past three years.

different perspective

While the broader market was down around 1.0% in the twelve months, Fletcher Building shareholders fared even worse, down 11%. That being said, it is inevitable that some stocks will be oversold in a down market. The key is to keep an eye on fundamental developments. Unfortunately, last year's performance ended on a down note, with shareholders facing a total annual loss of 0.8% over five years. Generally speaking, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.Note that the Fletcher Building is still visible 4 warning signs in investment analysis you should know…

Fletcher Building is not the only stock that insiders are buying.So take a look at this free A list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on New Zealand exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.