We believe that wise long-term investing is the way to go. But no one is immune from overbuying at a high price. Expanding the example, OC Oerlikon Corporation AG (VTX:OERL) stock has fallen 70% over the past five years. This is very suboptimal, to say the least.

Shareholders are down over the long term, so let's take a look at the underlying fundamentals over that time period to see if that's in line with the returns.

Check out our latest analysis for OC Oerlikon.

in his essay Graham & Doddsville SuperInvestors Warren Buffett has said that stock prices do not always rationally reflect the value of a company. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

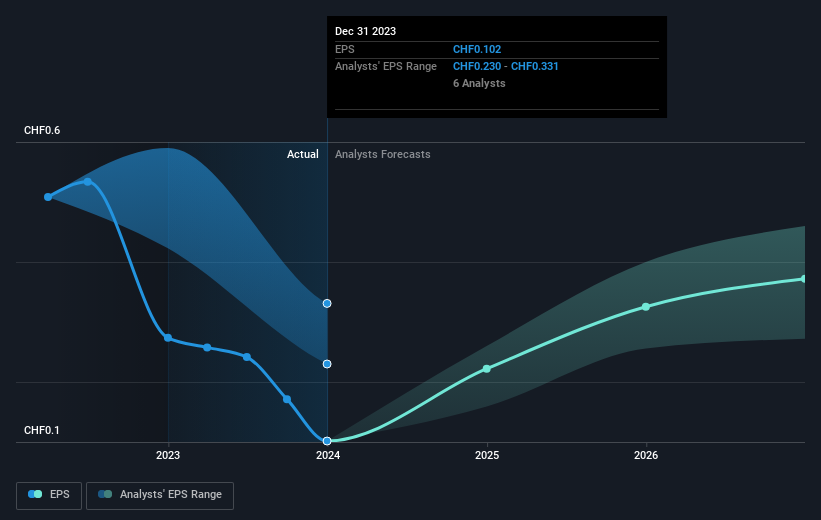

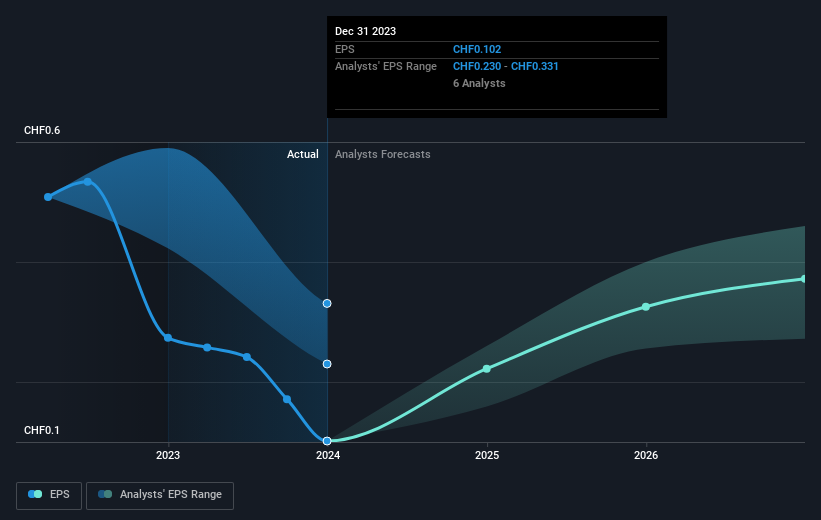

During the five years that the share price fell, OC Oerlikon's earnings per share (EPS) fell by 27% each year. This EPS decline is more severe than the 22% compounded annual share price decline. The relatively muted reaction in stock prices may be due to market expectations for an improvement in the company's business.

You can see below how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into OC Oerlikon's key metrics by checking this interactive graph of OC Oerlikon's earnings, revenue and cash flow.

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. Coincidentally, OC Oerlikon's TSR over the last five years was -59%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

OC Oerlikon investors have had a tough year, losing a total of 17% (including dividends) against a market gain of about 0.2%. Even blue-chip stocks can see their share prices drop from time to time, and we like to see improvement in a company's fundamental metrics before we get too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 10% annualized loss over the past five years. I know that Baron Rothschild said investors should “buy when there's blood on the streets,” but investors should first be sure they're buying a high-quality company. Warns you that you need to confirm. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, risk.Every company has them and we discovered that 4 warning signs for OC Oerlikon (Two of which we don't really like!) You should know.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.