While some people are satisfied with index funds, active investors aim to find truly great investments in the stock market. When investors find multibaggers (stocks that rise more than 200%), they make big changes to their portfolios. for example, Cross Bioscience AG (VTX:KURN) generated an impressive return of 383% in just one year. Shareholders are also happy to see that the stock is up 30% in the past three months. Looking even further back, the stock is up 246% from where he was three years ago.

So let's assess the underlying fundamentals over the past year, to see if they have kept pace with shareholder returns.

Check out our latest analysis for kuros Biosciences.

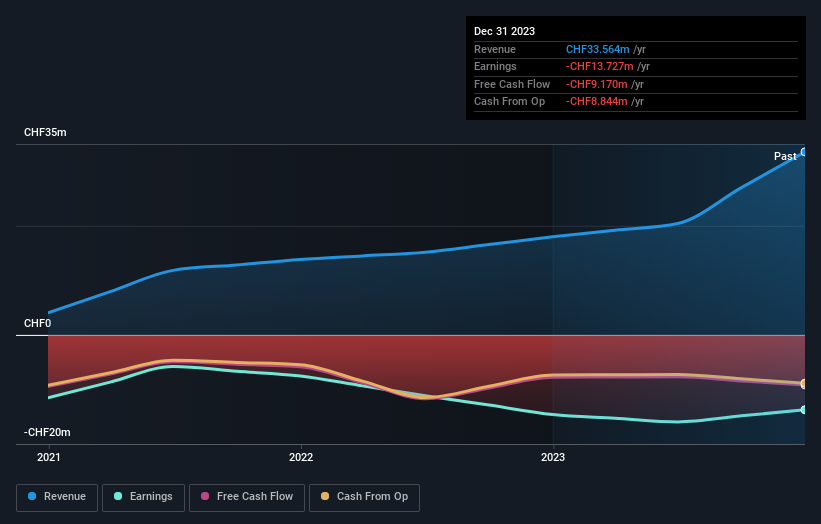

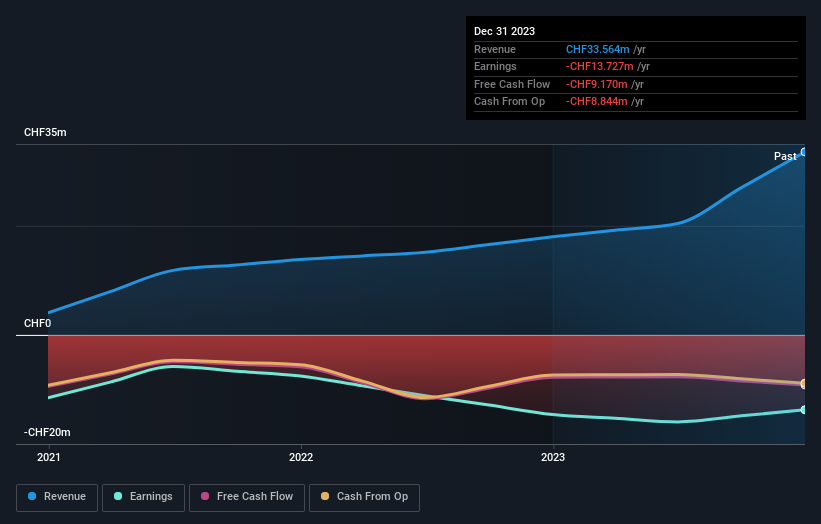

Cross Biosciences hasn't made a profit in the last 12 months, so we're unlikely to see a strong correlation between its share price and earnings per share (EPS). The next best option is probably revenue. When a company isn't making profits, we usually expect good revenue growth. That's because rapid growth in revenue can often be easily extrapolated to predict profits of considerable size.

Cross Biosciences grew its revenue by 87% last year. This is an amazing growth compared to other loss-making stocks. However, the stock price skyrocketed in response, rising 383% as mentioned above. Even the most bullish shareholder might think the stock could fall a bit after such a rally. But if the stock price settles down a bit, there could be an opportunity for high-growth investors.

The company's earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

this free If you want to investigate the stock further, this interactive report on Kuros Biosciences's balance sheet strength is a great place to start.

different perspective

It's good to see that Cross Biosciences shareholders received a total shareholder return of 383% over the last year. This is better than the 25% annualized return over the past five years, suggesting that the company has performed well of late. Optimists might think that the recent improvement in TSR indicates that the business itself is improving over time. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, we discovered that 2 warning signs for kuros Biosciences What you need to know before investing here.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.