Important points:

- Cathie Wood made a name for herself as a growth-focused investment manager during the pandemic.

- When the market heats up, Wood's picks tend to get even hotter.

- Mr. Wood's transparent trading activities allow retail investors to see which stocks he is currently bullish on.

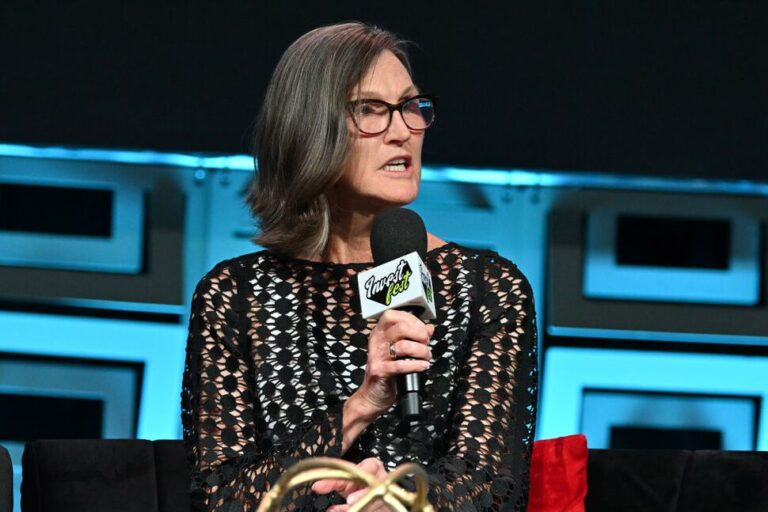

Cathie Wood is one of Wall Street's most colorful, controversial, and high-profile wealth managers. When she founded Ark Investment Management 10 years ago, she already had over 30 years of experience in the financial industry, including global thematic management at Alliance Bernstein Holding LP (ticker: AB). She spent 12 years as chief investment officer (CIO) in the strategy division.

Today, as Ark's CIO, she manages nearly $17 billion in assets within the Ark Investment family of exchange-traded funds and Ark Venture Fund, her dedicated venture capital fund.

Cathie Wood is proud of her reputation as a forward-thinking investor. She believes that high-tech and scientific innovation is the key to the stock's long-term growth potential. She looks for companies that are bringing new and disruptive technologies to market.

None of Cathie Wood's ETFs are conservative investments. These are volatile and should be considered as active funds. That's why she emphasizes the long-term nature of ETF families. That being said, Cathie Wood has demonstrated her talent for picking winners. If she's right, her return could be spectacular.

Unique among top portfolio managers, Mr. Wood publishes all his holdings and all his trades every day. Here are the six stocks Cathie Wood is buying right now.

- Recursion Pharmaceuticals Co., Ltd. (RXRX)

- Ginkgo Bioworks Holdings Co., Ltd. (DNA)

- Ansys Co., Ltd. (ANSS)

- New Holdings Co., Ltd. (NU)

- CERS Co., Ltd. (CERS)

- 10x Genomics Inc. (TXG)

Recursion Pharmaceuticals Co., Ltd. (RXRX)

RXRX is a clinical-stage biopharmaceutical company that develops treatments for debilitating diseases by applying advanced automated data science to the fields of chemistry and human biology. They use advanced quantitative analysis and artificial intelligence to analyze diseases and develop treatments.

The company currently has five drugs in various stages of clinical trials and three drugs in preclinical testing. Some of the treatments in the preclinical stage of development include his RBM39 to treat ovarian cancer and anti-PD-L1 drugs to assist doctors in treating lung cancer and other tumors. Food and Drug Administration approval for any of these drugs is years away, but when they do, it could mean massive profits for companies and huge returns for shareholders.

Cathie Wood believes RXRX's approach to pharmaceutical research represents the future of the field. She owns it in several ETFs, including $135 million worth of her flagship Ark Innovation ETF (ARKK). Mr. Wood has purchased more than 1 million shares through 2024 just for the ETF.

Ginkgo Bioworks Holdings Co., Ltd. (DNA)

Cathie Wood's purchase of 731,000 shares of DNA for inclusion in ARKK on January 17 of this year attracted the attention of many investors. Two days later, she purchased another 755,000 shares for the fund, and interest in this unique company began to grow.

DNA uses advanced gene splicing and gene editing techniques to literally reprogram an organism's cells to produce useful and beneficial products. Applications for the technology range from new treatments for humans and animals to fortifying food ingredients to supporting the development of clean energy sources.

Their customers include pharmaceutical companies, agricultural industries, energy companies, chemical manufacturing companies, and food processing companies.

With Cathie Wood's recent purchases, her ARKK now owns over 124 million shares of DNA stock, valued at just over $154 million. DNA represents 2% of that $9.3 billion ETF.

The ARK Autonomous Technology & Robotics ETF (ARKQ) is a Cathie Wood ETF that invests in domestic and international stocks of companies that Wood feels are leading the way in robotics and autonomous technology and applications.

ARKQ is a $1 billion ETF, and Cathie Wood has invested about 1.3% of her assets, or just over $13 million, in ANSS. This fact should demonstrate Wood's confidence in the stock's growth potential.

ANSS is a high-tech company that develops high-precision simulation software for engineering companies. The company's products allow engineers to simulate the performance of bridges, skyscrapers, roads, vehicles, aircraft, and almost anything else they build. ANSS software takes into account thousands of variables and can tell product developers whether something will work long before a prototype is built. This has great potential not only for design and manufacturing efficiency, but also for consumer safety.

Mr. Wood has purchased 2,600 shares of ARKQ so far this year.

Nu is a fintech company serving businesses and individuals in Latin America. The company offers its own debit and credit cards, along with a mobile payment system that allows bank customers in Brazil, Mexico, Colombia and elsewhere to send money, pay bills and perform basic banking transactions. Nu also offers savings and checking accounts. They focus on the region's fast-growing small business and entrepreneurial population. They are also expanding into the insurance market.

Wood has been positive about NU for some time and has been adding to the Ark Fintech Innovation ETF (ARKF). The fact that her holdings in NU in ARKF amount to approximately 2.3 million shares and are worth more than $20 million should be noted by fintech investors and Cathie Wood watchers.

By January of this year, Wood had added 323,000 NU shares to ARKF.

Cerus is a California-based biomedical products company with an important goal of making the world's blood supply safer. The company's flagship product is called Intercept. This is a blood screening system that can detect harmful pathogens and other biological contaminants in donated blood before it is used on patients in hospitals or emergency situations.

Mr. Wood believes in the company's unique technology and understands that CERS can have a significant impact if realized to its full potential.

Mr. Wood owns 6.1 million CERS shares in the Ark Genome Revolution ETF (ARKG). The total value of these shares is over $11 million. In two purchases between January 16 and January 19, she bought an additional 37,000 shares of ARKG's CERS stock.

On November 6, 2023, Cathie Wood purchased 74,000 TXG shares for ARKK and 33,000 shares for ARKG. The stock closed the day at $38.65. Shares rose to $57.75 during intraday trading on Dec. 28 and are currently trading at about $41 per share. Mr. Wood has continued to buy his shares quite aggressively throughout that time. In fact, she saved up about 710,000 shares for these two of her ETFs in her recent buying spree. Her most recent purchase was 6,300 shares of ARKG on January 19th.

TXG describes itself as a life sciences technology company that develops software to analyze living things and biological systems. Its products and processes are highly sophisticated. These include complex chemicals and precision equipment. In short, 10x develops and distributes equipment used to test and analyze DNA, allowing scientists and researchers to measure gene activity and map the details of gene expression. .