For shareholders, Advanced Micro Devices Company (NASDAQ:AMD) stock has fallen 16% over the past month. But the returns over five years were surprisingly large. In fact, the stock price has increased by a whopping 490% during this time. Perhaps the recent decline should be expected after such a huge rally. The most important thing for a smart investor to consider is whether the underlying business can justify the share price increase.

Given that the stock price is down 4.2% over the past week, we want to investigate the longer-term story and see if the fundamentals were the driving force behind the company's five-year positive earnings.

Check out our latest analysis for Advanced Micro Devices.

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. One way he looks at how market sentiment has changed over time is to look at the interaction between a company's share price and his earnings per share (EPS).

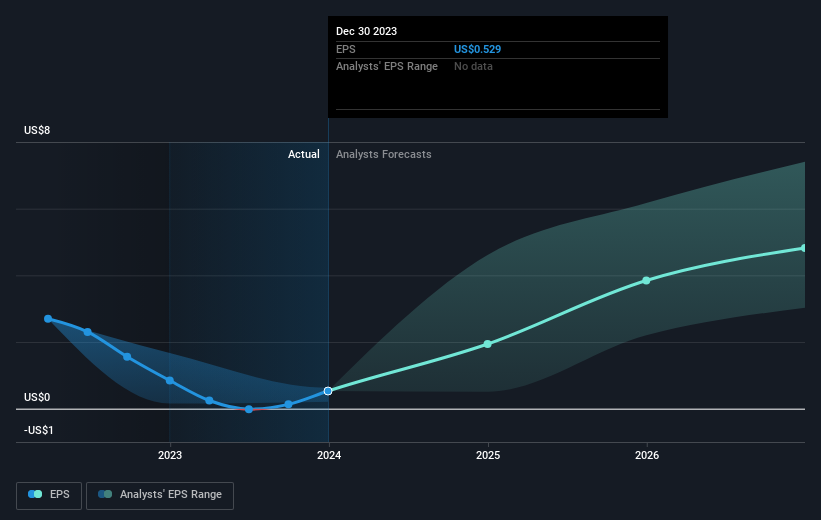

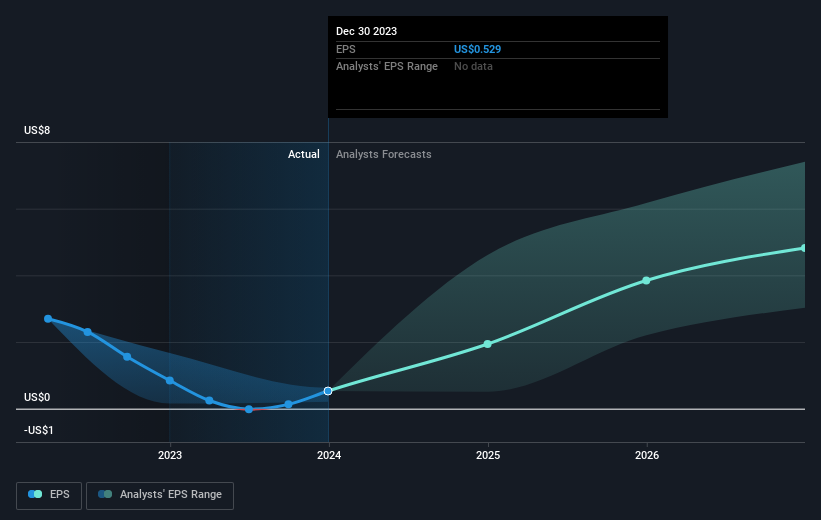

During the five-year period of share price growth, Advanced Micro Devices achieved compounded earnings per share (EPS) growth of 9.0% per year. This EPS growth rate is lower than the average annual increase in the share price of 43%. This suggests that market participants have been valuing the company highly recently. And this is not surprising given its track record of growth. This optimism is reflected in its fairly high P/E ratio of 309.00.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend taking a closer look at its historical growth trends, available here.

different perspective

It's good to see that Advanced Micro Devices shareholders received a total shareholder return of 78% over the last year. This is better than the 43% annualized return over the past five years, suggesting that the company has performed well of late. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don't miss out. It's always interesting to track stock performance over the long term. However, to better understand Advanced Micro Devices, many other factors need to be considered. For example, we identified 2 warning signs for Advanced Micro Devices What you need to know.

of course Advanced Micro Devices may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.