©Reuters.

Investing.com — Most Asian stocks were in a flat-to-low range on Thursday on expectations for further clues on U.S. interest rates from key inflation data, while Chinese markets rebounded from steep losses in the previous session. did.

Regional markets followed Wall Street's overnight midpoints, but U.S. stock futures were weaker in Asian markets as several Federal Reserve officials also warned that the central bank had far more work to do to rein in inflation. It fell.

Their comments made markets even more nervous ahead of the Fed's recommended inflation measure, which will be released later in the day. This result is expected to reiterate that the US inflation rate will remain strong in January.

Japanese stocks fall further from record highs amid half-baked data

Japan's index fell 0.4% and the broader index fell 0.3%, as both indexes fell further from record highs hit earlier in the week.

A series of economic indicators released on Thursday showed a mixed picture of Japan's economy. Growth in January was higher than expected, but much lower than expected.

The statistics were released amid growing uncertainty over when the Bank of Japan will start raising interest rates. A better-than-expected announcement earlier this week raised expectations that the Bank of Japan could end its negative interest rate system by April at the earliest.

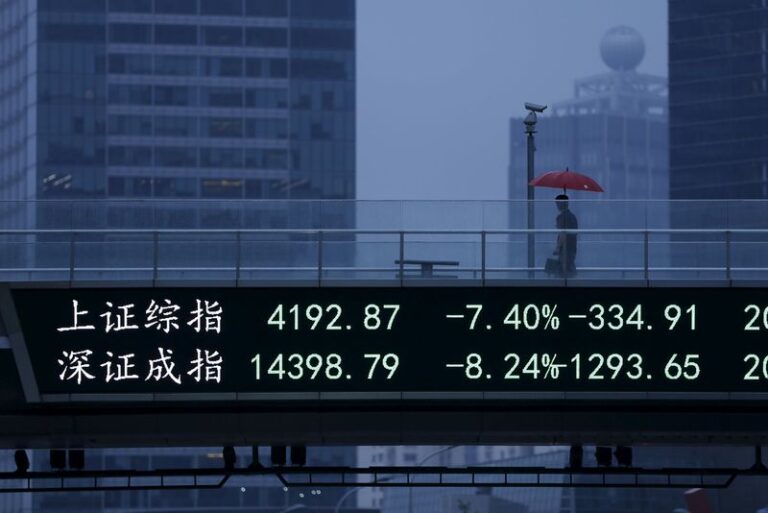

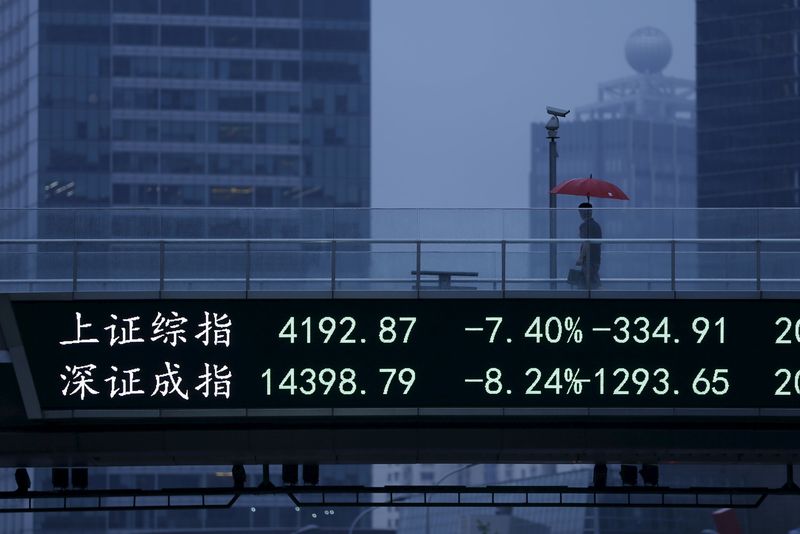

The Chinese market is recovering from a significant decline. PMI is awaited

China's index and index rose 0.8% and 0.9%, respectively, after falling more than 1% each in the previous session on renewed concerns about the property market crisis.Concerns arose after developers fell on hard times country garden Holdings Company Ltd (Hong Kong:) has received a liquidation application from its creditors.

Thursday's rally was driven by China's security regulator saying it would further tighten its control over derivatives markets to boost investor confidence. Regulators have introduced a series of new rules in recent weeks to boost the domestic market, including limits on short selling.

Hong Kong's index rose 0.2%, but gains were limited by Wednesday's showing that economic growth in the fourth quarter was slightly weaker than expected.

All eyes are now on China's key statistics for February, which will be released this Friday, and are expected to provide further clues about the country's economic recovery potential.

Asian markets in general remained in a flat to low range. Australia was flat after January figures showed slower-than-expected growth amid continued pressure from high inflation and interest rates.

South Korean stocks, in particular, fell 0.5% as semiconductor manufacturing stocks rose sharply on the previous day, with profit-taking selling taking place.

Indian index futures signaled a move towards sideways after the index fell more than 1% on Wednesday due to heavy profit-taking.

Indian investors are also nervous ahead of a key event scheduled for later on Thursday, which is expected to see some moderation in the strong economy.