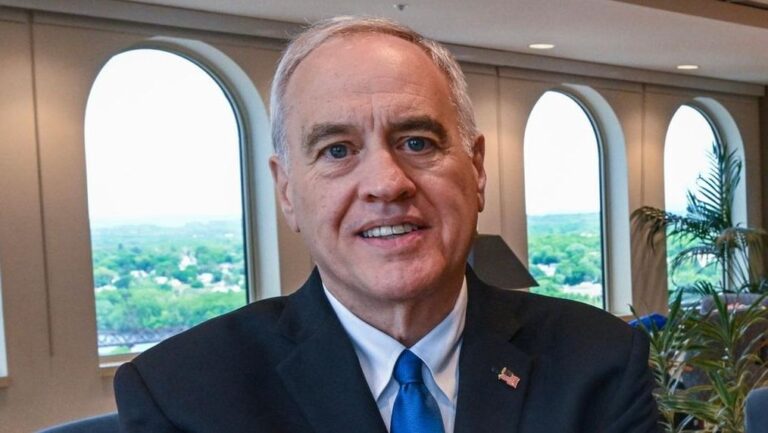

ALBANY — State Comptroller Thomas DiNapoli will cut the state pension fund's direct investments in eight more oil and gas companies, including ExxonMobil, as part of a plan to fight global warming through Wall Street.

DiNapoli argues that investing in oil and gas companies, even blue-chip stocks like ExxonMobil, poses long-term risks for investors. Because he believes oil and gas companies are not ready for the transition to a future low-carbon economy. Mr. DiNapoli announced last week that he would sell $26.8 million in securities in eight companies as part of his climate plan, and said he would next evaluate the fund's investments in utilities across the country.

“I strongly believe that climate change is a risk not only to the planet but also to investors,” DiNapoli told Newsday. “It's not about managing politics. It's about managing risk and return.”

Mr. DiNapoli is the sole trustee of a $259.9 billion pension that serves more than 1 million public sector employees and retirees. The fund's return on investment also reduces the cost that state and local governments must pay to pension plans as employer contributions. A low return on investment can result in high costs for employers.

But critics say there are always risks in investing and such “arbitrary” preferences should not be followed.

“Arbitrary considerations like this make it more difficult for a pension fund's investments to generate the highest possible returns,” said Ken Girardin, research director at the fiscally conservative Empire Public Policy Center in Albany. said. “And because these pensions are guaranteed by state taxpayers, there is a risk that taxpayers will have to pay higher costs.”

Last year, Mr. DiNapoli, a Great Neck Plaza Democrat, sold $238 million in securities in 21 shale oil and gas producers, including Hess Corporation, which also were unprepared for the transition to a low-carbon society. He said he could not prove that it was in place. economy. In 2021, he directed the sale of more than $7 million in investments in “oil sands” companies. Oil sands companies produce heavy crude oil from a mixture of sand, water, clay and asphalt, which requires more costly and carbon-intensive production methods.

The independent Citizens Budget Commission, which analyzes state spending, has not taken a position on Mr. DiNapoli's climate plan, but said his pension investments are generally sound.

“New York state has the most generous pension system in the nation, largely due to effective investments and the Comptroller's conservative forecast,” said Patrick Orechi, director of state research for the commission. ” he said. “Nevertheless, auditors have a fiduciary responsibility to protect pension plan assets.…While any investment decision involves some degree of risk, auditors have a fiduciary responsibility to protect pension plan assets. There is a track record.”

Republican leaders in New York criticized Mr. DiNapoli's strategy.

“Constitutionally, the state is obligated to pay for pensions, and if the pension fund cannot be maintained, the additional costs will be paid directly by property tax payers,” said Minority Leader Sen. Robert Ortto (R-North Tonawanda). It will become.” “To treat this any other way is irresponsible and an example of foolish politics.”

assemble. Will Barclay (R-Pulaski) said making pension investments based on politics is a “dangerous precedent.”

“Restrictions on investments in certain oil and gas companies fit into the state's climate change plan, but the focus should be on how to maximize pension fund growth to provide maximum benefits to retirees. ' he added.

DiNapoli's climate action plan will no longer invest pension funds directly in private market companies focused on oil, gas and coal extraction and production, and will increase “climate index investments” by 50% over the next two years. It is expected to cost more than $10 billion. By 2035, he will double that investment.

The state pension fund still maintains a $500 million investment in ExxonMobil as part of its stock grouping in a single index. DiNapoli called it a “passive” investment that he doesn't directly manage.

An ExxonMobil spokesperson did not respond to a request for comment. According to the company's website, its response to climate change includes reducing methane emissions and developing systems to reduce emissions.

Mr. DiNapoli also drew criticism from the left for maintaining investments in indexes that included ExxonMobil.

Senate Finance Committee Chairwoman Liz Krueger (D-Manhattan) said, “The decision not to fully withdraw from Exxon, let alone the other oil majors that continue to aggressively push humanity over the climate cliff, is a short-circuit.'' I am disappointed in the decision.”

“But,” Krueger said, “the fact remains that Comptroller DiNapoli has taken a far more responsible approach to the climate crisis than many comparable trustees who have taken no action at all. …Today's excuses to justify gradualism will ring hollow to our sickly grandchildren.” These are the irreversible consequences of our inaction. ”