-

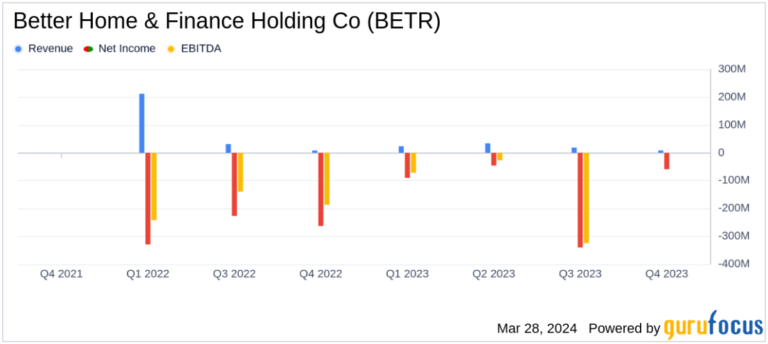

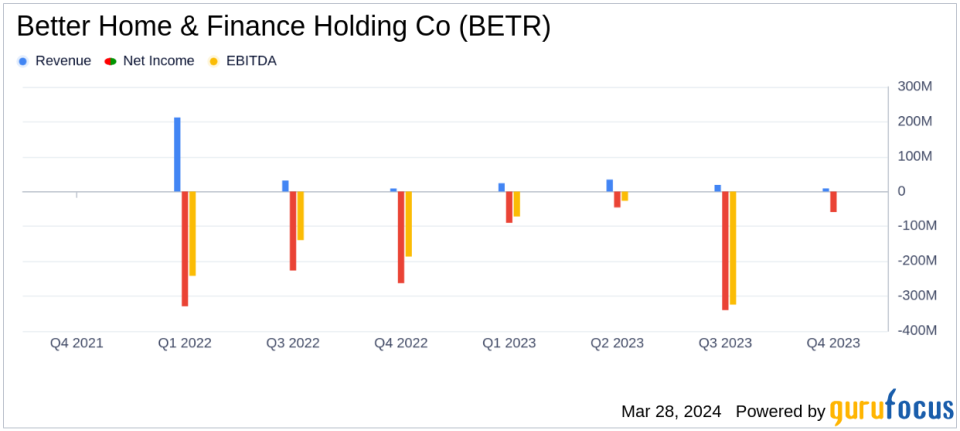

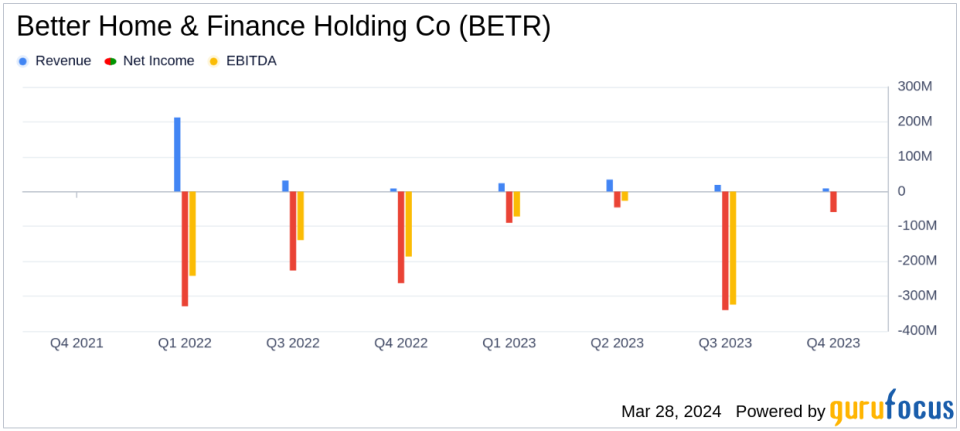

Revenue: BETR reported full-year 2023 revenue of $77 million.

-

Net loss: The company suffered a net loss of $534 million for the year.

-

Reserve loan amount: BETR funded a total of $3 billion in 8,569 loans in 2023.

-

Adjusted EBITDA loss: Full-year adjusted EBITDA loss was $163 million.

-

Cost reduction: Total expenses were reduced by 71% year-over-year and more than $1.1 billion compared to 2021.

-

Cash position: BETR ended 2023 with $554 million in cash, restricted cash and short-term investments.

Better Home & Finance Holding Co (NASDAQ:BETR) released its 8-K filing on March 28, 2024, disclosing financial results for the fourth quarter and full year ended December 31, 2023 . BETR is a digital-first homeownership company that offers: We provide mortgage, real estate, title and homeowners insurance services and aim to revolutionize the industry with our unique technology platform, Tinman.

In 2023, BETR faced a challenging market environment with high mortgage rates, but was still able to maintain its focus on digitalization and price transparency. The company continues to invest in technology and launch innovative products such as One Day Mortgage and One Day HELOC to improve the customer experience. Despite these efforts, BETR reported a significant net loss of $534 million for the year, but a 39% improvement year over year.

The company's cost-cutting efforts resulted in a 71% year-over-year decline in total expenses. BETR CEO Vishal Garg expressed optimism for 2024, with the expected growth driven by a shift to a new commercial operating model and an experienced loan officer base on a commission-based compensation plan. employment of people.

Despite the net loss, BETR's cash position remains strong, with $554 million in cash, restricted cash, and short-term investments at year-end. The company's focus on purchase loans, which account for 91% of its loans, demonstrates the company's commitment to adapting to the needs of consumers in the purchase market.

President and Chief Financial Officer Kevin Ryan highlighted the company's strategic investments and expansion of innovative products, which are expected to drive volume growth in 2024. BETR's partnership with Infosys and Beyond.com aims to extend the digital mortgage experience to a broader customer base.

While the company's net loss and adjusted EBITDA loss reflect the challenges it faces in 2023, significant expense reductions and a strategic shift in operating model support BETR's adaptability and recovery in a more favorable macro environment. It shows possibility.

For more detailed financial information and future updates, interested parties are encouraged to refer to BETR's Annual Report on Form 10-K filed with the SEC.

Investors and interested parties can access the webcast of the earnings conference call through the Investor Information section of BETR's website or via the registration link provided.

Please note that this summary does not contain forward-looking statements and should be considered historical data. For more information and investor relations inquiries, please email ir@better.com.

For more information, see Better Home & Finance Holding Co's full 8-K earnings release here.

This article first appeared on GuruFocus.