Ivana Star/E+ (via Getty Images)

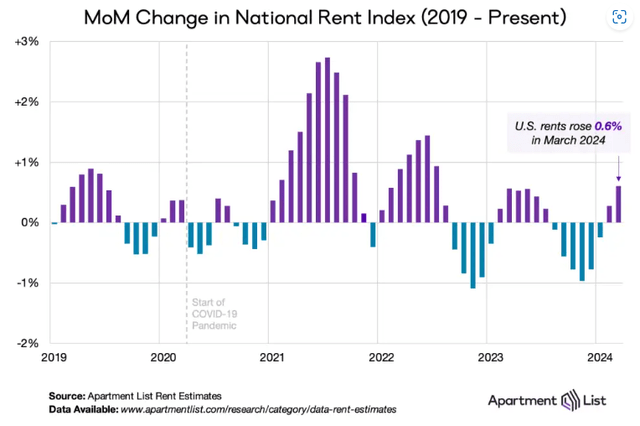

The outlook for multifamily REIT investing in early 2024 couldn't be bleaker. Apartment List said in his April report that rent growth is slowing as we head into peak apartment rental season.

Apartment list

Source: Apartment list

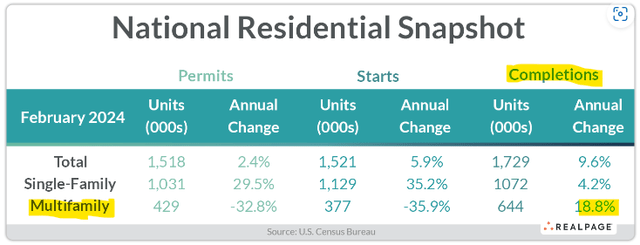

This may be due in part to a significant increase in new deliveries and construction starts of housing units across a broad range of markets.

Real page analysis

Source: RealPage Analytics

New supply temporarily exceeds demand, reducing occupancy and putting pressure on rents. The investment climate isn't too bad, but it just pales in comparison to the sky-high optimism of two years ago.

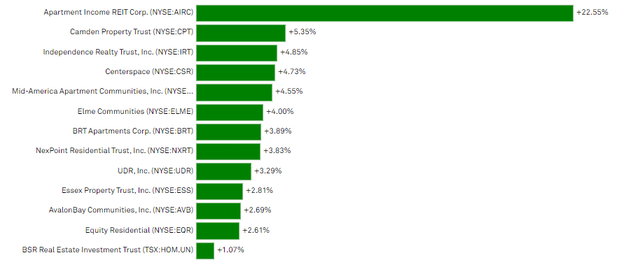

and before the market on Monday, April 8th.thblack stone (New York Stock Exchange:BX) announced its pending acquisition of an apartment income REIT (AIRC). The clouds lifted and everyone wanted to invest in apartments again. This chart shows the price movement of Multifamily REITs on the morning of April 8th. Nothing was left untouched.

Featured Sector: Multifamily REIT 04/08/2024

S&P Capital IQ

Source: S&P Capital IQ

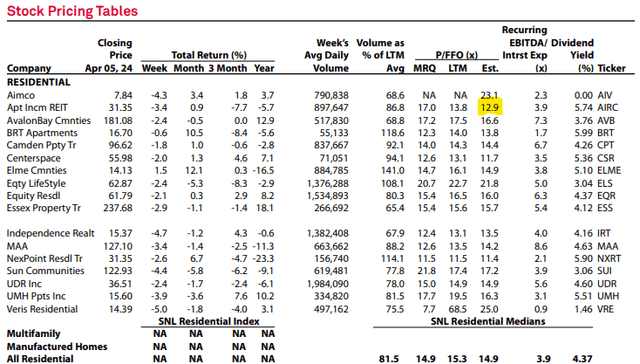

transaction

Prior to the announcement, Apartment Income REITs were trading at about 15x, the lower end of the expected price/FFO multiple for the multifamily sector. Additionally, the pre-announcement share price of $31.35 represented a discount of more than 25% to the consensus NAV median price of $42.29. These indicators, along with other factors, were attractive to 2.n.d. Market Capital is a value investor, so we were long stocks.

S&P Capital IQ

Source: S&P Capital IQ

Blackstone will take AIRC private through an all-cash acquisition for $39.12 per share. This price translates to 16.2x consensus estimates for the same index, $2.41 per share, and 92% of consensus/share NAV. What did BX gain and what do you think the market didn't gain?

Apartment income REIT

AIRC is a multifamily REIT that was spun out from Apartment Investment Management (AIV) several years ago. AIRC owns 76 apartment properties that are geographically concentrated in major cities such as Washington, DC, Boston, Philadelphia, Miami, and Los Angeles. The vintage of the properties ranges from the 1890s to new. Blackstone will assume debt and commit approximately $10 billion to complete the acquisition.

We reviewed Seeking Alpha's AIRC last March and rated the stock a Strong Buy based on the value metrics listed above. Additionally, we liked management's efforts to recycle capital and improve quality and performance across the portfolio. The AIR Communities team focuses on details and aims to satisfy high-quality tenants, increase NOI, and minimize G&A expenses. Their financial results offer a proud quarterly seminar on property management excellence, insight, and efficiency. You will no longer be able to receive phone calls.

BX is one of the world's largest asset management companies, focused on real estate investments.When several hundred people gather a billion Blackstone recognizes that its role only begins with raising money; the real work begins with investing the money. While retail and institutional investors alike have wasted much time on the sidelines pondering the direction of supply and demand, inflation, and interest rates, BX has been selling billions of dollars at a discount to NAV. took action to secure a portfolio of

In recent quarters, BX has expressed greater enthusiasm for investing in industrial and data center assets, but always seems to be returning to residential real estate. In January, Blackstone urged remorse from our sellers in the private transaction of Tricon Residential (TCN). Although absent from the multifamily sector in recent years, Blackstone's AIRC acquisitions include BlueRock Residential Growth (bought by BRG in 2021) and Preferred Apartment Communities (bought by APTS in 2022). , it is possible to achieve further economic benefits through consolidated operations with other multifamily housing companies. As always, BX has constructed a well-considered transaction that is likely to improve the realizable value of Apartment Income REIT.

Future transactions

Since it's an all-cash deal, we considered holding a position that would receive the full $39.12 per share. But April 10's all-too-hot CPI report took the wind out of everything real estate-related, and Monday's gains in multifamily REIT prices quickly disappeared. On Wednesday, the company sold its AIRC shares with the aim of reallocating capital to discounted multifamily opportunities.