In 1981, Dolly Parton topped the Billboard charts with “9 to 5.” That year, the National Association of REALTORS® created its first Profile of Home Buyers and Sellers, and the surprising finding was that single women outnumbered single men in the housing market. In fact, single women were second only to married people. Today, Dolly Parton and single female homebuyers are both powerful figures. Single women are against all odds in the housing market, purchasing homes with lower household incomes in an increasingly unaffordable housing market. Let's see how they stack up compared to single men.

What's surprising about single women homebuyers is that it wasn't until 1974 that women were legally protected from taking out a mortgage without a cosigner. Before the Fair Housing Act passed the ban on gender discrimination in housing transactions and the Equal Credit Opportunity Act's protections, it was common for widows to require a male relative to cosign. Under federal law, women had no legal recourse against this or other loan discrimination.

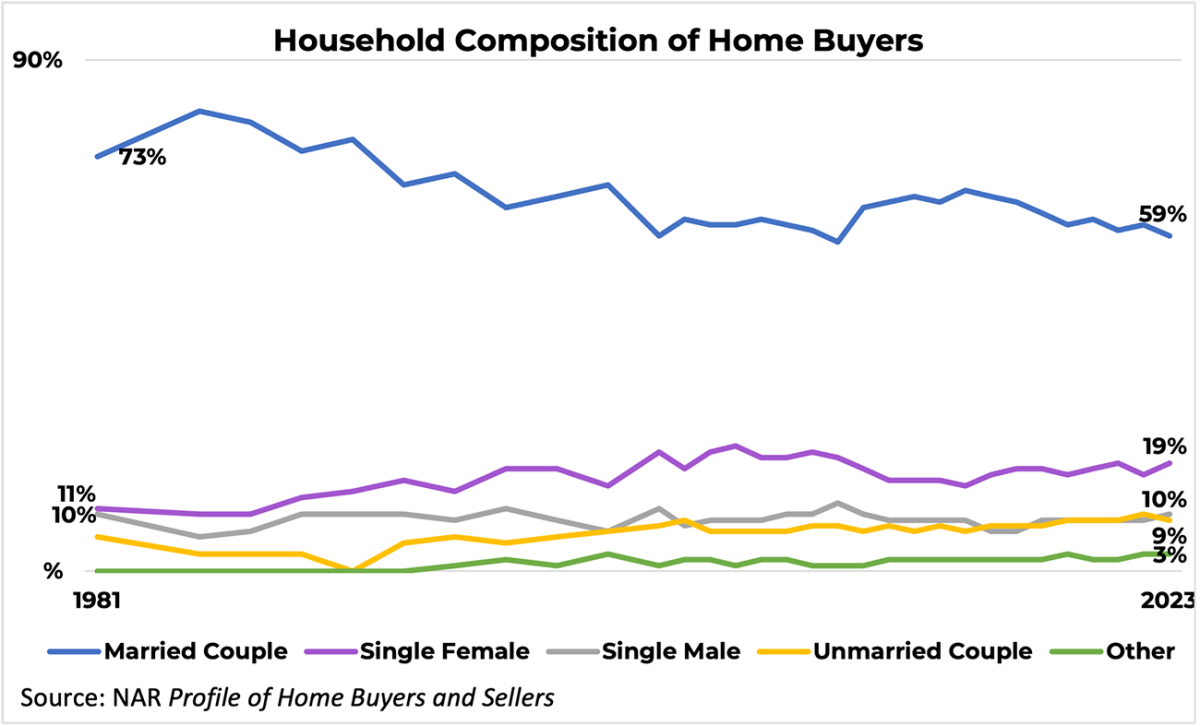

In 1981, 73% of homebuyers were married couples, 11% were single women, and 10% were single men. Currently, the percentage is 59% for married couples, 19% for single women, and 10% for single men. She had the highest percentage of single female buyers in 2006, at 22%. Between 2016 and 2022, the percentage of single women will go from 17% to 19%. In 2010, the percentage of single men rose to 12%, but in recent years it has remained between 7% and 9% of buyers.

The recent increase in the number of single female buyers is easily explained by the decline in the proportion of married Americans. According to Census data, in 1950 23% of Americans over the age of 15 were unmarried. In 2022, that percentage will be 34% of Americans. This currently equates to 37.9 million single-person households in the United States, or 29% of all households.

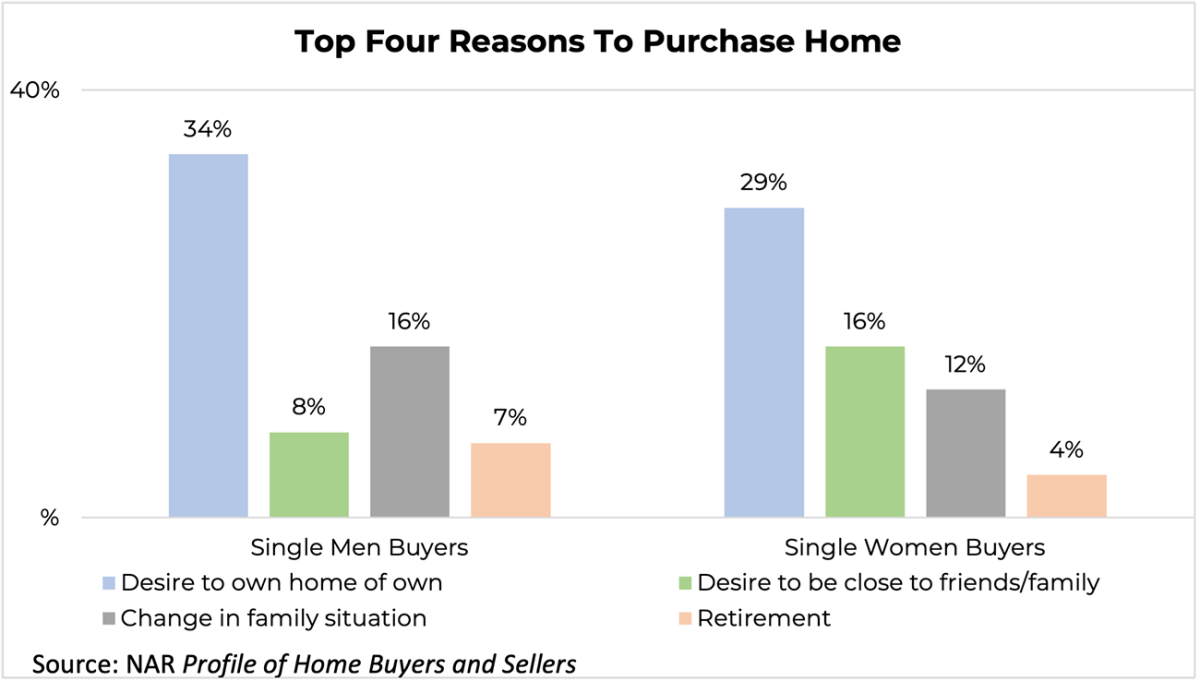

Why do women buy houses but men don't? To do this, it is best to look at who is buying and their family structure. Both men and women are most likely to say they buy because of the desire to own their own home, but women are far more likely to buy to be closer to friends and family. Men are more likely to report purchases due to changes in family circumstances, such as divorce, death, or the birth of a child. Data not collected if the buyer is currently single Her point is if the buyer was once married but is now widowed or divorced. Still, proximity to friends and family may be important for women in both scenarios. Interestingly, men were more likely to cite retirement as a reason for their purchase, at 7%, compared to just 4% of women.

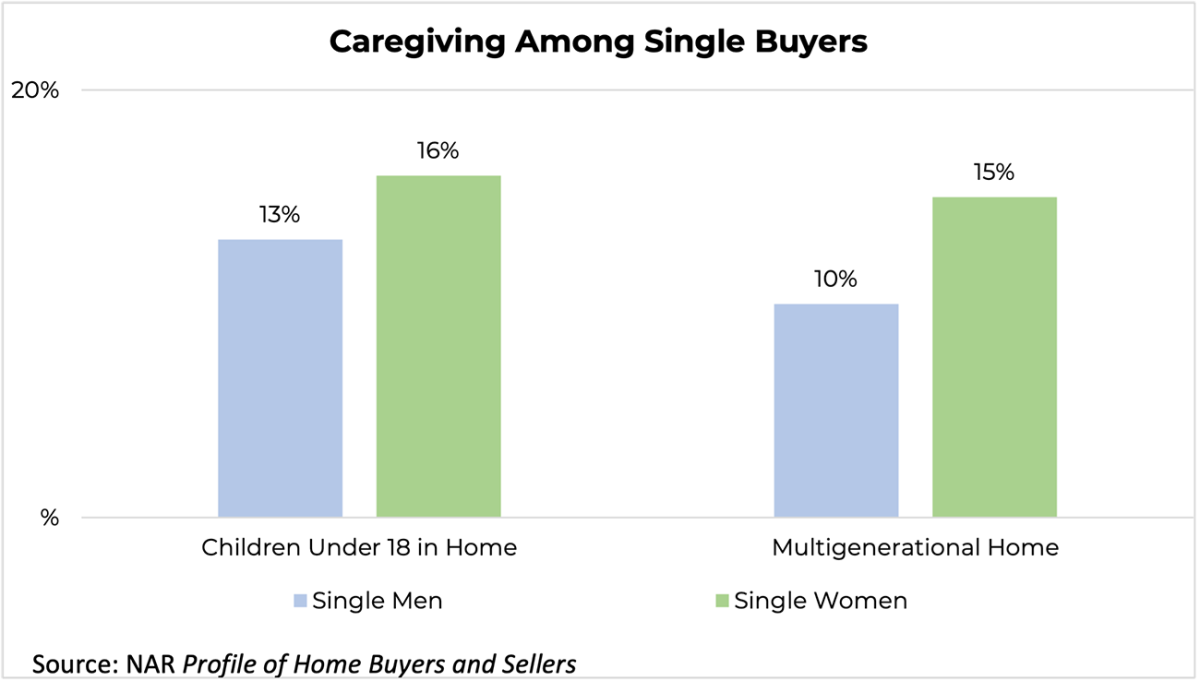

One potential reason why single women outperform single men in home buying is due to who lives in the home. A single woman is more likely to have children under her 18 years of age at home and more likely to purchase a multigenerational home. In both scenarios, women are likely to value the security of homeownership. For example, she knows where her children will go to school and doesn't have to risk moving house or relocating schools if the rent goes up. She also knows how much her home will cost, while there may be young people boomeranging back or older relatives in her home.

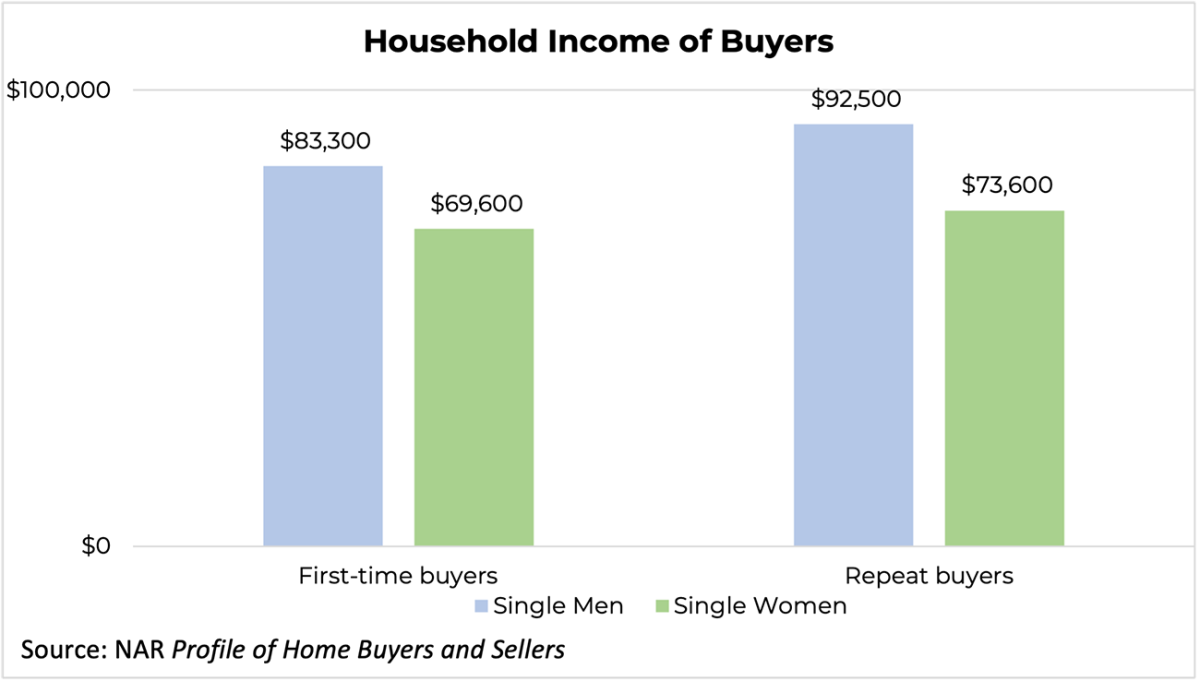

The second big issue raised is finance. Female homebuyers typically purchase a home as a first-time buyer with a household income of $69,600, compared to $83,800 for single men. Although men's incomes do not match those of married couples or unmarried couples, their higher incomes give them more purchasing power than single female buyers. This is especially important when considering housing affordability challenges. This is one reason why the median age of single women as first-time buyers is 38, while the median age of men as first-time buyers is 33. There is a possibility.

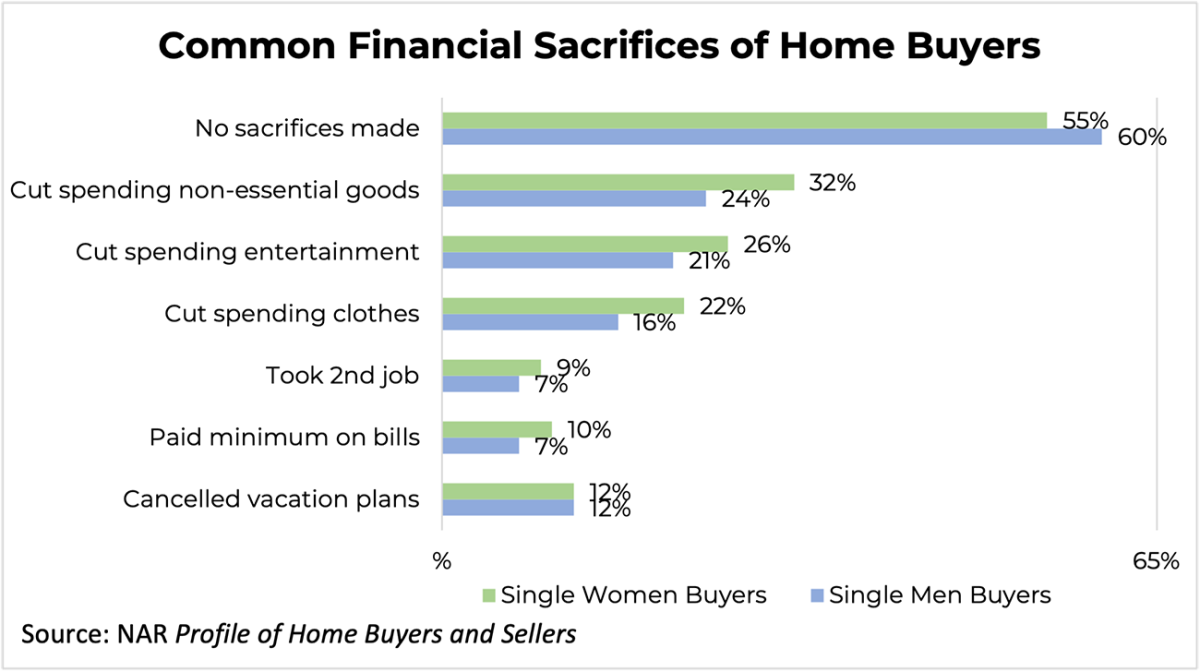

Given their lower household incomes, women make more financial sacrifices when making purchases. 45% of women make financial sacrifices compared to 40% of men buying a home. Common financial sacrifices include cutting back on spending on non-essentials, entertainment, clothing, and even taking up a side hustle. These sacrifices exceed those of male buyers, highlighting just how important homeownership is for women. As mentioned in a previous blog, women are more likely to live with friends or family before buying to avoid paying rent. These tolls can add up and occur over many years, which can also contribute to a slightly older age.

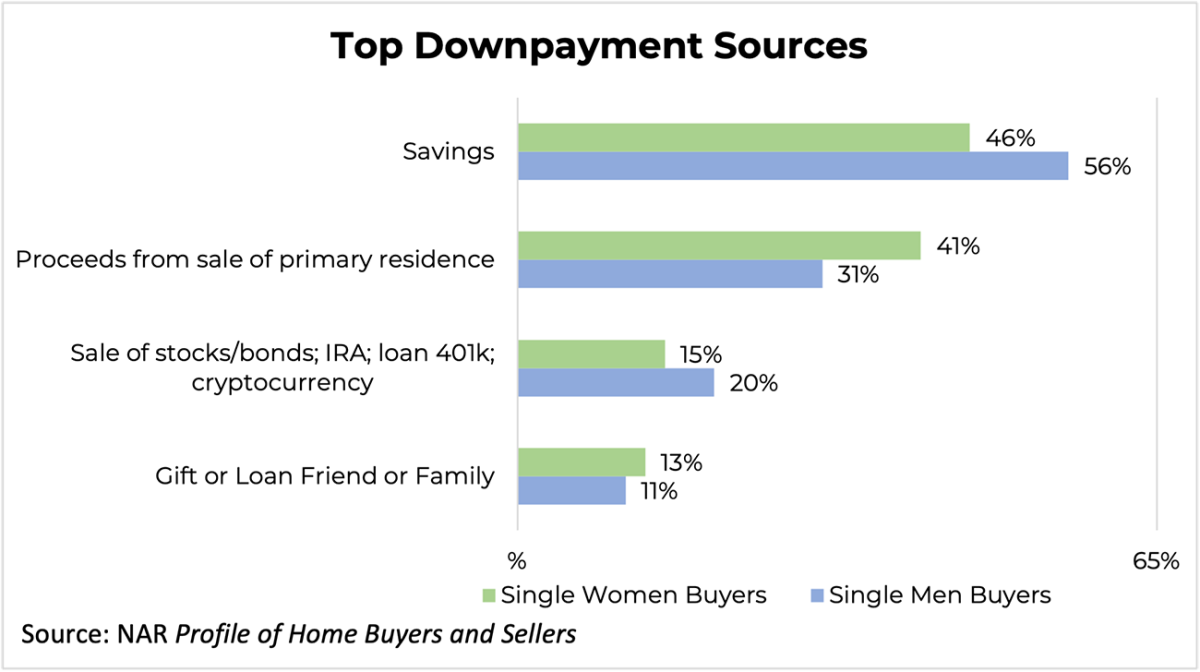

One notable difference is the source of the down payment. For both single men and women, savings and the sale of their last home are the most common sources of funding. However, he has two notable differences. Men have a higher utilization rate of savings, and women have a higher utilization rate of selling their last home. They are also more likely to sell stocks or bonds, use IRAs or cryptocurrencies, or take out loans from their 401k/retirement funds, compared to 20% of men and 15% of women. 13% of single women's girlfriends use gifts from friends and relatives as a down payment, compared to 11% of single men's girlfriends.

Regardless of how these single women enter homeownership, they've found a way and are doing it at a pretty fast pace. To learn more about these and other trends, check out our complete Home Buyer and Seller Profile report.